The Nifty 50 and Sensex lost around 3 percent each over last week as a result of heavy FII (Foreign Institutional Investor) selling. The markets are expected to consolidate during the coming week due to the Lok Sabha elections and commentary on US and India inflation.

During the week, volatility continued to remain at elevated levels with the India VIX at a 52 week high of 18.5 . "The fourth phase of ongoing Lok Sabha elections will be held on Monday 13th May, and may add to some volatility. Overall, we expect the market to consolidate in a broader range and take cues from Q4 results, global factors, and news flows around the general elections," said Siddhartha Khemka, Head, Retail Research, Motilal Oswal Financial Services.

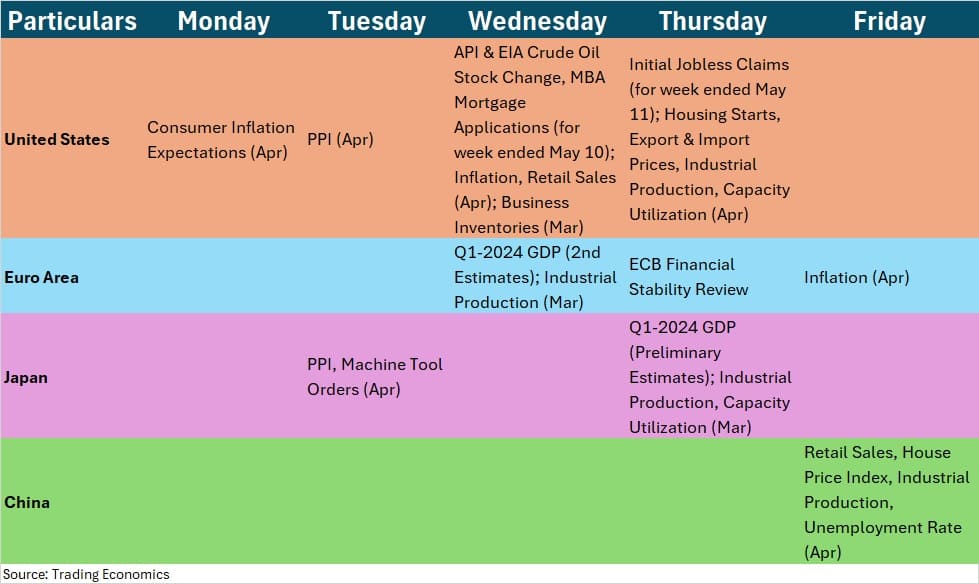

On Wednesday, participants would keep a keen eye on US inflation numbers.

Here are the key things to watch this week:

Corporate earnings

Over 200 companies will announce their results next week. Among the major ones are Zomato, Inox India, Varun Beverages, Bharti Airtel, PVR Inox, Radico Khaitan, Edelweiss Financial Services, Andhra Cement, Mankind Pharma, Power Finance Corporation, RVNL, Titagrah Rail Vikas Nigam, and Koukyo Camlin.

Primary market action

Among the mainboard IPOs, Go Digit General Insurance will open for subscription on May 15 and close on May 17. Aadhar Housing Finance Limited and TBO Tek Limited will list on the bourses on May 15. Indegene Limited will list on the exchanges on May 13.

On the SME side, Rulka Electricals Limited will open for subscription on May 16 and close on May 21. Quest Laboratories Limited will open for subscription on May 15 and close on May 17. Indian Emulsifier Limited will open for subscription on May 13 and close on May 16.

Crude oil

Brent crude prices rose to $82.79 per barrel primarily due to a decline in US crude stockpiles, which suggested tighter oil supply. "Additionally, expectations that the US Federal Reserve might cut interest rates later in the year also contributed to a more optimistic outlook for energy demand, further supporting the increase in oil prices," said Mahavir Lunawat, Managing Director of Pantomath Capital Advisors Private Limited.

FII / DII data

In the week gone by, FIIs sold stocks worth around Rs 82,800 crore in the cash segment, while DIIs sold equities worth around Rs 52,152 crore. On the other hand, FIIs purchased around Rs 61,264 crore worth of equities, and DIIs purchased around Rs 69,354 crore worth. Heavy FII selling, and concerns over the outcome of the ongoing general elections has added to the overall pressure in the markets, said Khemka.

Inflation

The street will pay attention to the consumer price index (CPI) numbers released by the National Statistical Office on May 13. In March, India’s CPI rose 4.9 percent year-on-year. "We believe the Reserve Bank of India (RBI) will be in a wait-and-watch mode until the inflation is in the targeted range of 4 percent, before considering any rate cuts," said Vikram Kasat, Head of Advisory, Prabhudas Lilladher.

US inflation

Traders will also turn their attention to the US CPI numbers for April, which are due on Wednesday. During last week’s meeting, the Fed indicated a less-hawkish-than-expected stance, with Chair Jerome Powell ruling out rate hikes and hinting that they are still leaning towards cuts.

Global cues

The European Central Bank (ECB) will conduct its financial stability review on Thursday, which is when Japan will also announce the preliminary estimates for its Q1 24 GDP.

Technical view

The Nifty 50 may extend last Friday's recovery in the coming session given the consistent sell-off in the previous few sessions and formation of the Inside Bar candlestick pattern on the daily charts. But considering the big bearish candlestick pattern with lower high formation on the weekly timeframe, the overall trend is expected to be in favour of bears in the coming week, unless the index sees a decisive close above 22,300 and sustains above the same for a few days, experts said. The immediate support may be at 21,900 and crucial support at 21,700.

"Thursday's low coinciding with the 89 EMA at 21,900 serves as immediate support, followed by previous swing lows in the 21,800 - 21,700 range," said Rajesh Bhosale, Technical Analyst at Angel One.

On the upside, he feels the zone between the 20 and 50 EMA, around 22,200 - 22,300, presents a formidable obstacle. Traders are urged to monitor these levels closely and adjust their trading strategies accordingly, he advised.

F&O cues

Options data indicated that 22,500 is expected to be the key resistance area for the Nifty 50 in the coming week, with key support at 21,500 levels.

On the weekly options front, the maximum Call open interest was seen at 23,000 strike, followed by 22,500 and 22,800 strikes, with maximum Call writing at 22,800 strike, then 22,500 and 22,900 strikes. On the Put side, the 21,000 strike saw the maximum open interest, followed by 22,000 and 21,500 strikes, with maximum writing at 21,000 strike, then 22,000 and 21,600 strikes.

The bulls are in an uncomfortable position now as the volatility continued its northward journey for 12 days in a row. India VIX, the fear index, jumped 26 percent during the past week, and has surged over 81 percent in the past 12 days.

Corporate action

Godrej Consumer Products has set the record date for its interim dividend of Rs 10 on May 14. Hindustan Zinc has set the record date for its interim dividend of Rs 10 on May 15. The record date for Tata Consultancy Services' final dividend of Rs 28 is set for May 16. Solara Active Pharma will do a rights issue of equity shares on May 15.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.