Market continued to hit fresh record highs in the week gone by on the back of positive global cues. Benchmark indices gained 2 percent each crossing major milestones in the sixth consecutive weekly gain.

BSE Sensex crossed 46,000 for the first time adding 1,019.46 points in the past week, while Nifty gained 255.35 points to end at 13,513.90.

"Market will react to the macroeconomic data viz. IIP and CPI inflation in early trade on December 14. We reiterate our positive yet cautious approach citing overbought conditions and suggest limiting leveraged positions. It’s prudent to stick with stock-specific trading approach and using dips to add quality stocks," said Ajit Mishra, VP - Research, Religare Broking.

Here are 10 key factors that will keep traders busy next week:

Vaccine Developments

Investors will keep an eye on the progress on the vaccine developments in India and Worldwide.

Saudi Arabia become the latest country to approve Pfizer Inc. and BioNTech SE’s Covid-19 vaccine, joining the United Kingdom, Canada and Bahrain.

The US Food and Drug Administration (FDA) on December 11 approved the Pfizer-BioNTech COVID-19 vaccine for emergency use, and a rollout could begin within days. This is the first COVID-19 vaccine candidate that has been given emergency use authorisation in the Unites States, the country most affected by the pandemic.

However, applications of the Serum Institute of India (SII) and Bharat Biotech seeking emergency use authorisation for their COVID-19 vaccine candidates were not considered due to "lack of safety" and inadequate data on efficacy.

The Drug Controller General of India on December 12 approved the Phase I and II human clinical trial initiation for indigenous mRNA vaccine candidate HGCO19. The vaccine has been developed by Pune-based firm Gennova Biopharmaceuticals, the Ministry of Science and Technology stated.

Coronavirus

The developments in corona vaccine and decreasing trend of the infections supported the market last week.

So far, India has recorded 97,67,371 confirmed COVID- 19 cases, including 1,41,772 deaths. A total of 92,53,306 patients have recovered, as per the latest data from the Union Health Ministry. However, there are 3,72,293 active cases in the country, which comprise 3.81 percent of the total caseload.

Maharashtra, Karnataka and Andhra Pradesh have reported the highest number of cases so far. However, infections continue to rise rapidly in states like Kerala and West Bengal. India's recovery rate continues to rise and now stands at 94.74 percent.

US Stimulus Talks

Global stock indexes eased and the dollar rose on Friday amid continued concerns over the timing of more US economic stimulus.

The S&P 500 and Nasdaq ended lower, while the Dow closed up slightly. All three indexes registered declines for the week.

Rising coronavirus deaths are causing fresh business restrictions in many US states and increasing layoffs, making investors anxious to hear whether more fiscal relief is coming.

House of Representatives Speaker Nancy Pelosi on Thursday raised the possibility of stimulus negotiations dragging on through Christmas.

IPOs

Quick restaurant chain Burger King is expected to have a strong debut on December 14 as shares are trading with a massive 75 percent premium in the grey market on December 11.

In absolute term, shares traded at a premium of Rs 44-45 in the grey market against the final issue price of Rs 60, as per the data available with the IPO Central and IPO Watch websites.

Also, the initial public offering (IPO) of Mrs Bectors Food Specialties, one of the leading companies in the premium bakery segment and a supplier to fast-food chains like Burger King, will open for subscription on December 15, with the price band fixed at Rs 286-288 per share.

The bakery products maker plans to raise Rs 540.54 crore the IPO, which comprises a fresh issue of Rs 40.54 crore and an offer for sale of Rs 500 crore by selling shareholders.

Linus Private Limited is going to sell Rs 245 crore worth of shares via offer for sale, Mabel Private Limited Rs 38.5 crore, GW Crown PTE Ltd Rs 186 crore and GW Confectionary PTE Ltd Rs 30.5 crore.

FII Flow

Foreign institutional investors (FIIs) continued the investments in the Indian market in the third consecutive month in December 2020 till now, however, domestic institutional investors (DIIs) remained net seller.

In the month till now FIIs purchased equities worth Rs 26,927.66 crore and DIIs sold equities worth of 18,625.86 crore.

In the last week, FIIs bought equities worth Rs 16,721.30 crore, while DIIs sold equities worth of Rs 12,535.34 crore.

Gold

Gold prices are likely to find support from an expansionary monetary policy by global central banks. The European Central Bank (ECB) boosted its pandemic-emergency purchase program (PEPP) by 500 billion Euros, which was precisely as per expectations, and extended the program by 9 months, to March 2022, longer than an expectation of 6 months.

Gold prices are likely to trade firm, while remaining above the key support levels of the 200-days EMA of $1,818 per ounce, while an immediate resistance is seen around the 50-days EMA at $1,873, said Abhishek Bansal, Founder Chairman, Abans Group.

F&O Cues:

On option front, Maximum Put OI is at 13000 followed by 12000 strike while maximum Call OI is at 13000 followed by 13500 strike.

Marginal Call writing is seen at 13700 then 13800 strike while Put writing is seen at 13200 then 13500 strike. Option data suggests an immediate trading range in between 13200 to 13750 zones.

India VIX was up by 0.45% from 18.71 to 18.79. Overall lower levels of volatility suggests that Bulls are holding the tight grip and any small decline could be bought in the market," said Chandan Taparia of Motiall Oswal.

Technical View

Nifty50 ended higher in the volatile session on December 11 after hitting fresh record highs during the day.

Nifty smartly recoiled from the intraday low of 13402 levels which resulted in a Doji kind of formation for second day in a row. However, on weekly charts a moderately bullish candle with the trading range of 378 points.

Bulls will be in need of a fresh breakout with a strong close above 13600 levels to confirm that they are still in a commanding position. In that scenario Nifty can initially extend its gains towards 13790 levels. Contrary to this a close below 13400 shall puncture the short term uptrend with initial trends about 13200 levels, said Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in.

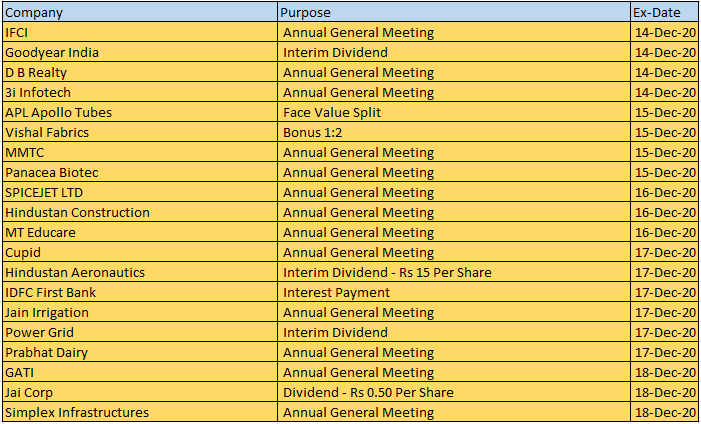

Corporate Action

Here are key corporate actions taking place in the coming week:

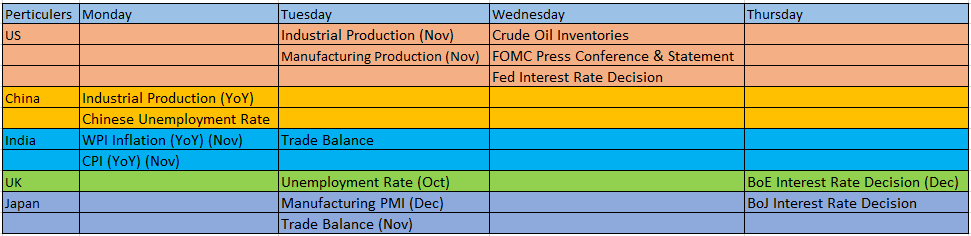

Global Cues

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.