The increasing bond yields and fear of rising inflation in the US made the investors and traders cautious globally. As a result, the Indian markets witnessed intense selling pressure, falling more than 3 percent in the week ended February 26. Also, the concerns over a second wave of COVID cases weakened the sentiment. But the rally post Budget FY22 and RBI's accommodative stance helped the market close with over 6 percent gains for the month of February.

The BSE Sensex tanked 1,789.77 points or 3.52 percent to 49,099.99, and the Nifty50 corrected 452.60 points or 3.02 percent to 14,529.15 during the week. With this, now both benchmark indices fell around 6 percent from record high levels.

But the broader markets outpaced frontline indices last week as the Nifty Midcap 100 index and Smallcap 100 index gained 0.65 percent and 0.87 percent respectively.

On Monday, the market will first react to encouraging Q3 GDP data, but overall, experts feel bears may continue to have the upper hand along with volatility at Dalal Street given the apprehensions over rising bond yields and FII outflow, though likely fresh stimulus in the US can act as a support in between.

"Going ahead, equity markets could remain under pressure as the normal course of correction continues to take shape. Now with expectations of a fresh stimulus in the US, there could be more helicopter money in the system. However, how many more liquidity infusions will be needed for the economy to stand on its own only time will tell," Nirali Shah, Head of Equity Research at Samco Securities told Moneycontrol.

Meanwhile, market participants should keep an eye on bond yields and the movement of USD/INR which could undergo some depreciation, she said, adding investors in need of liquidity could book profits from certain stock pockets but long term investors should continue to remain invested.

Here are 10 key factors that will keep traders busy next week:

Bond Yields

The key thing to watch out for in the coming weeks would be the US bond yields because any rise in yields can take out the FII money from developing countries like India to western markets and could also be a risk for emerging markets currencies.

The Indian rupee already depreciated to 73.46 on Friday, from 72.40 against the US dollar on Wednesday last week. Indian equities on February 26 already witnessed the biggest single-day FII outflow (of Rs 8,295 crore) since November 3, 2017. India has received more than Rs 2.3 lakh crore from 2020, so any outflow henceforth can pressurise equity markets.

The rising commodity prices also raised inflation worries. The US 10-year bond yields increased to 1.6 percent last week despite Federal Reserve Chairman Jerome Powell assurance to maintain official interest rates low with enough liquidity since the economy is still well below the pre-COVID level. But experts feel bond yields are still not at an alarming stage but if it shows consistent rise in coming weeks then that could be a cause of concern.

Coronavirus

After feeling the sigh of relief following declining path of COVID-19 infections, there has been some increase in cases again in last few days which also acted as a risk to the market and would be key thing to watch out for though the vaccination programme is going on smoothly. Maharashtra and Kerala showed the maximum increase in cases among states.

As a result the recovery rate slipped to 97.14 percent from 97.27 percent last week, though the mortality rate remained steady at 1.42 percent. India reported 1.10 crore confirmed COVID-19 infections with deaths at 1.57 lakh, whereas the recoveries stood at 1.07 crore and the total active cases were at 1.59 lakh.

The single-day vaccination tally rose above 8 lakh for the second time on Friday and so far the total vaccination count was 1.42 crore.

Auto Sales

Auto stocks will be in focus as sales data for the month of February will be released on Monday. Experts feel the passenger vehicle and tractors sales could remain strong, but the two-wheeler numbers could be muted, while there could be a rise in commercial vehicle sales YoY given the improving demand and gradual recovery in replacement demand.

Hence, Tata Motors, Maruti Suzuki, Eicher Motors, Bajaj Auto, Ashok Leyland, M&M, Hero MotoCorp, TVS Motor Company and Escorts amongst others could be in action.

OPEC Meeting

Crude oil prices were back to pre-COVID levels amid hope that demand could improve with vaccination rollouts in most affected countries. International benchmark Brent crude futures climbed up to $67 a barrel during the week but later corrected to close the week at $64.4 a barrel. However, the prices still gained 20 percent in February which is a big headwind for oil importers like India which already raised fuel prices to a record high levels.

Looking ahead, "the existing bullish appeal in prices may continue due to demand-supply dynamics. A surge in demand is likely due to a rebound in the global economy and hopes of more fiscal stimulus measures from top economies. A possible end of the pandemic due to vaccination is likely to boost industrial and economic activities and thus the demand for fuel. Existing production policies of OPEC and US may also bring down the global supply glut and balance the market," Hareesh V of Geojit Financial Services said.

Oil prices will get fresh direction in the coming week as the Organization of the Petroleum Exporting Countries and its allies including Russia are scheduled to meet on March 4. "The group will discuss a modest easing of oil supply curbs from April given a recovery in prices," said Abhishek Bansal, Founder Chairman at Abans Group.

Economic Data Points

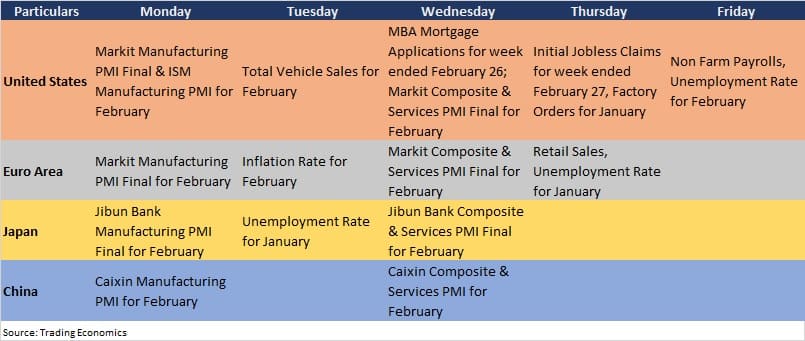

On the economic front, Markit Manufacturing and Services PMI data for the month of February will releaed on Monday and Wednesday respectively.

India's manufacturing sector activity turned stronger further as factories continued to ramp-up production in response to rising sales and new export orders. The IHS Markit India Manufacturing Purchasing Managers’ Index rose from 56.4 in December to 57.7 in January, while the Services PMI rose to 52.8 in January from 52.3 in previous month.

Foreign exchange reserves for the week ended February 26 will be released on Friday.

IPO

MTAR Technologies, a Hyderabad-based precision engineering solutions company engaged in the manufacturing and development of mission critical precision components and critical assemblies catering to clean energy, nuclear and space and defence sectors, will open its around Rs 597-crore initial public offering for subscription on March 3. The same will close on March 5.

The price band for the issue has been fixed at Rs 574-575 per share. The IPO comprises a fresh issue of around Rs 124 crore and an offer for sale of around Rs 473 crore by promoters and investors.

Technical View

The Nifty50 plunged 3.8 percent on Friday and fell 3 percent for the week, forming Long Black Day kind of candle on the daily charts and bearish candle on the weekly scale, which indicated further weakness along with volatility in the coming sessions.

"The market has established a series of 'lower top and lower bottom' that would be negative for the medium-term trend of the market," said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

Ajit Mishra, VP - Research at Religare Broking feels indications are pointing towards further slide in the Nifty and the next support at 14,400 and 14,200 levels.

"We expect volatility to remain high so traders should maintain extra caution in risk management aspects. The prudent strategy would be to use rebound to create shorts using options instead of naked futures," he said.

F&O Cues

Option data indicated that the Nifty could see a wider trading range of 14,000 to 15,000 levels in coming sessions, while the sharp increase in volatility is likely to put pressure on the market.

On the monthly options data, the maximum Call open interest was seen at 15,000 strike, which will act as a crucial resistance level in the March series, followed by 15,500 and 15,200 strikes, while the maximum Put open interest was seen at 14,000 strike, which will act as a crucial support level in the March series, followed by 14,500 strike.

Call writing was seen at 15,000, 15,500 and 15,200 strikes with Call unwinding at 14,000, while Put writing was seen at 14,500 and 14,100 strikes with Put unwinding at 15,100 strike.

India VIX rose sharply by 26.5 percent from 22.25 to 28.14 levels on a week-on-week basis.

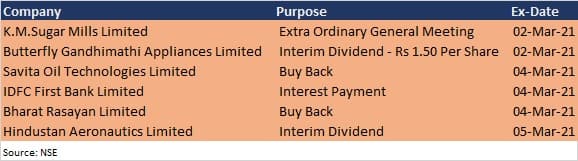

Corporate Action

Here are key corporate actions taking place in the coming week:

Global Cues

Here are key global data points to watch out for next week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.