Bears maintained their control over Dalal Street, dragging the benchmark indices down for the third consecutive week ended January 24 with the continuation of sell-on rally sentiment given the persistent FII selling, and uncertainty surrounding Trump's economic policies. Further, the market participants are looking cautious ahead of major events - Union Budget 2025 and FOMC meeting. Falling oil prices, and in line with expected earnings season could not support the market.

The coming long week (January 27-February 1) will be super busy considering the several key events lined up. The market may continue to consolidate further, taking cues from the Union Budget, FOMC meeting, quarterly earnings, US GDP numbers for the December quarter, and ECB meeting, experts said.

The benchmark indices had a rangebound trading for another week. The Nifty 50 was down 111 points (0.5 percent) at 23,092, and the BSE Sensex declined 429 points (0.56 percent) to 76,190. The selling pressure was seen more in the broader markets with the Nifty Midcap 100 index falling 2.5 percent and Smallcap 100 index down 4 percent but both maintained the previous week's low.

Vinod Nair, Head of Research at Geojit Financial Services believes the market is now in the final phase of consolidation. "With the broad market having corrected by 14 percent, the downside appears limited, supported by strong long-term economic fundamentals," he said.

According to Siddhartha Khemka, Head - Research, Wealth Management at Motilal Oswal Financial Services, domestic equities are expected to trade within a broad range with some volatility amidst the Q3 result season, unfolding of US President Trump’s economic policies and the Union Budget.

The market will remain open on coming Saturday, February 1 for Union Budget, hence going to be a long trading week.

Here are 10 key factors to watch next week:Budget 2025All eyes will be on the much-awaited Budget 2025 given the weakening rupee, tariff threats from Donald Trump, and weak domestic demand. Finance Minister Nirmala Sitharaman is expected to focus on the measures to boost consumption and support economic growth while maintaining fiscal consolidation path. Experts see the fiscal deficit at 4.7-4.8 percent of GDP for FY25 against a budget estimate of 4.9 percent and the government forecasting it at 4.4-4.5 percent for FY26, with unlikely focus on cash-handout schemes, and likely increase in capex, agriculture investment, & modest rise in subsidy bill. "We expect some tweaks in tax slabs to support consumption. Customs duty announcements will be pivotal to understand the government’s response to tariffs under Trump 2.0," Barclays said.

Nomura expects the budget to adopt a balanced approach to boosting growth while retaining fiscal prudence. This should keep India’s fiscal risk premia low and provide greater leeway to the RBI to begin lowering its policy rate at the February MPC, it said. However, if markets expect the budget to choose growth over prudence, then there is a risk of disappointment, according to the global brokerage.

PSU and capex-themed stocks such as railway, defence, and capital goods will be in focus ahead of the Budget.

Corporate EarningsFurther, the quarterly earnings season will be in full swing with more than 500 companies announcing numbers next week including 15 names - Coal India, Oil and Natural Gas Corporation, Tata Steel, Bajaj Auto, Cipla, Bajaj Finance, Bajaj Finserv, Maruti Suzuki, Tata Motors, Larsen & Toubro, IndusInd Bank, Nestle India, Sun Pharmaceutical, Adani Enterprises, and Adani Ports, from Nifty 50.

In addition, several other key corporate firms like Hyundai Motor India, PB Fintech, Indian Oil Corporation, GAIL India, Canara Bank, Union Bank of India, Bank of Baroda, Indian Bank, Bandhan Bank, Shree Cement, ACC, Ambuja Cements, Aditya Birla Sun Life AMC, Adani Total Gas, Adani Wilmar, Bajaj Housing Finance, Emami, Federal Bank, Indraprastha Gas, BHEL, Bosch, Colgate Palmolive, Exide Industries, JSW Energy, JSW Infrastructure, Mahindra & Mahindra Financial Services, Mahanagar Gas, SBI Cards and Payment Services, Baazar Style Retail, Suzlon Energy, TVS Motor, Adani Power, Blue Star, Voltas, Bharat Electronics, Biocon, Dabur India, Jindal Steel & Power, Kalyan Jewellers, Dr Lal PathLabs, Waaree Energies, LIC Housing Finance, Marico, and Vishal Mega Mart will also be releasing their earnings scorecard next week.

Domestic Economic DataOn the economic data front, the fiscal deficit numbers and infrastructure output for December will be announced on January 31. Further, bank loan & deposit growth data for the fortnight ended January 17, and foreign exchange reserves for the week ended January 24 will also be released on the same day. India's forex reserves have been declining since September 2024, dropping further to $623.983 billion in the week ended January 17, down from $625.871 billion in the week ended January 10.

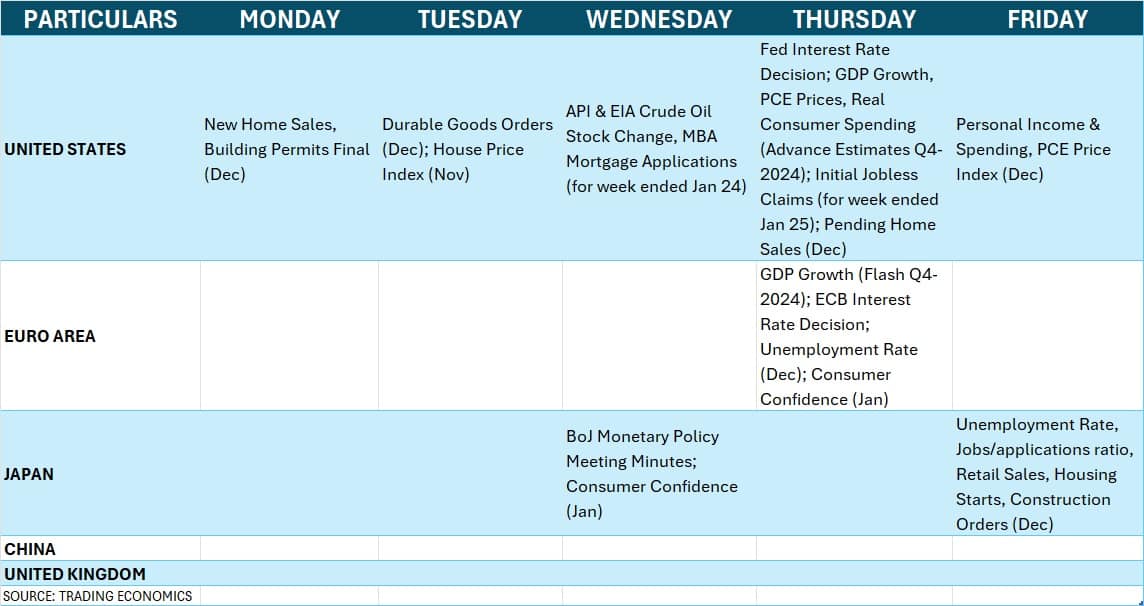

Fed Interest Rate Decision & US GDPGlobally, the market participants will keep an eye on the outcome of the first US Federal Reserve meeting in the new year 2025, and advance estimates for Q4-CY24 US GDP growth (against 3.1 percent in Q3-2024).

Most economists expect the central bank to hold the Fed funds rate at a range of 4.25-4.5 percent when the Federal Open Market Committee meets on January 28-29, with focus on the Donald Trump moves. In a speech at the World Economic Forum in Davos, US President Trump said he would demand that interest rates drop immediately, and likewise, they should be dropping all over the world.

Fed Chair Jerome Powell in the last meeting had signalled only two rate cuts in 2025. In addition, the focus will also be on new home sales, weekly jobs data, personal income & spending, PCE prices and real consumer spending data from the US will also be watched.

Global Economic DataFurther, the participants will closely monitor the European Central Bank's move and GDP growth flash data for Q4-CY24. Most experts see the ECB cutting interest rates by 25 bps in next week's meeting.

The Bank of Japan's monetary policy meeting minutes due on January 29 will also be watched.

The street will also monitor the activity at the foreign institutional investors' desk as they have persistently been selling in India despite cooling down US bond yields and the dollar index. Foreign institutional investors (FIIs) have net sold Rs 22,500 crore worth of shares last week, taking the total selling in January to Rs 69,080 crore. However, domestic institutional investors have managed to compensate the FII outflow to a major extent, net buying shares worth Rs 66,945 crore in the current month.

The US 10-year Treasury yield was down by 0.13 percent during the week to 4.617 percent, while the US dollar index declined by 1.77 percent to 107.465.

Further, the Indian rupee snapped an 11-week losing streak, appreciating 0.47 percent to finish the week at 86.14 against the US dollar.

IPOIn the primary market, investors will see one new IPO each from the mainboard as well as the SME segment. Dr Agarwal's Health Care will open its Rs 3,027-crore initial share sale for subscription on January 29.

In the SME space, the Rs 26-crore IPO by Malpani Pipes and Fittings will hit Dalal Street on the same day, while CLN Energy will close its IPO on January 27, followed by GB Logistics Commerce, and HM Electro Mech on January 28.

On the listing front, investors can start trading in shares of Denta Water and Infra Solutions, Capital Numbers Infotech, Rexpro Enterprises, CLN Energy, GB Logistics Commerce, and HM Electro Mech next week.

Technical ViewTechnically, the Nifty 50 has been in the range of 23,000-23,400 for the second consecutive week, forming bearish candlestick pattern on the weekly charts following Doji pattern formation in the previous week. The index managed to take a support at the downward sloping support trendline, but the overall sentiment remains in favour of bears with the index trading below 10, 20, and 50-week EMAs. The index is likely to remain in the same range next week too, as breaking below 23,000 can open doors for 22,800-22,600 levels and crossing decisively above 23,400 can take the index toward 23,600-24,000 zone, according to experts.

F&O CuesThe monthly expiry of F&O contracts due next week may bring some volatility in the market. According to the options data, the Nifty is likely to be in the broad range of 22,000-24,000 especially ahead of the Union Budget, with immediate resistance at 23,500 and support at 22,800.

On the Call side, the maximum open interest was seen at the 24,000 strikes, followed by the 23,500 and 23,800 strikes, with the maximum writing at the 24,000 strikes and then the 23,500 and 23,300 strikes. On the Put front,the 22,000 strike holds the maximum open interest, followed by the 23,000 and 22,500 strikes, with maximum writing at the 22,000 strikes, and then the 22,100 and 22,800 strikes.

The India VIX, the volatility index, extended its upward journey for the fourth consecutive week, rising 6.33 percent during the week to 16.75, the highest closing level since the first week of June 2024, making the bulls more cautious.

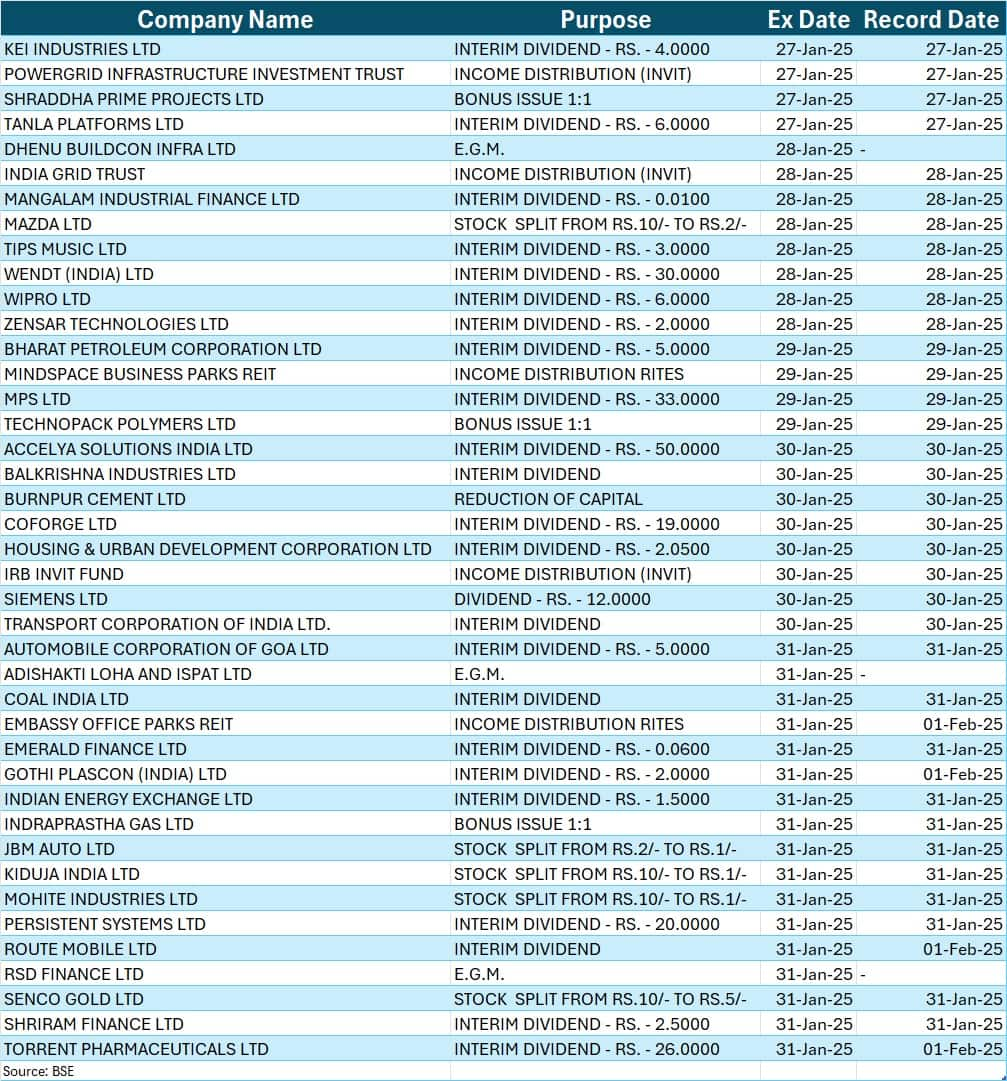

Corporate ActionHere are key corporate actions taking place next week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.