Indian market ended this week on a strong note as every sector participated in the bull run, lifting equity benchmarks Sensex and Nifty by 3 percent each. The rally was supported by positive cues from global counterparts, easing oil and commodities prices.

The benchmark share indices hit one-month high during the week ended July 8. The BSE Sensex rallied 1,574 points to 54,482, while the Nifty50 climbed 468 points to 16,221, the highest closing level since June 9, continuing uptrend for third consecutive week.

The broader markets also joined the rally with the Nifty Midcap 100 and Smallcap 100 indices gaining 4 percent and 3 percent respectively.

In the coming week, the market may first react to the quarterly numbers of TCS and Avenue Supermarts announced over the the weekend. Overall the market is expected to remain positive but the profit booking at higher levels to some extent can't be ruled out, with likely more stock specific action due to ongoing corporate earnings season and with focus on June inflation numbers by India & US, experts feel.

"The last three weeks of the rebound have certainly eased some pressure but cues are still mixed, which continue to trigger erratic swings in between. Apart from the US recession worries, participants should brace themselves for volatility owing to the earnings," Ajit Mishra, VP - Research at Religare Broking said.

Indications are favourable for a further rebound in the index and the Nifty could test the 16,500 zone, Mishra believes.

Here are 10 key factors that will keep traders busy next week:

The June 2022 quarter earnings season will be in full swing in the coming week with around 70 companies releasing their numbers including prominent ones like HCL Technologies, HDFC Bank, ACC, Mindtree, Larsen & Toubro Infotech, Jindal Steel & Power, Tata Elxsi and Tata Metaliks.

Among other numbers to watch out for would be Federal Bank, L&T Technology Services, 5paisa Capital, Spandana Sphoorty Financial, Anand Rathi Wealth, Delta Corp, Sterling and Wilson Renewable Energy, Angel One, Butterfly Gandhimathi Appliances, GTPL Hathway, Shakti Pumps (India), Tata Steel Long Products, Den Networks, Bharat Electronics, and ICICI Prudential Life Insurance Company.

Hence, "the management commentary on future earnings growth trajectory will be of interest to D-street," Apurva Sheth, Head of Market Perspectives at Samco Securities said.

2) CPI Inflation and Industrial Output

Another key event to watch out for will be CPI inflation numbers for June month scheduled to be released on coming Tuesday, along with industrial output data for the month of May.

Inflation remains at the centerstage for discussion on the RBI table as it is above the central bank's threshold limit of 4 percent (+/-2 percent). Most of experts are expected to come inflation print above 7 percent in June, similar to May 2022, though there could be some cap on the upside due to measures taken by the government, while the RBI itself in its earlier meeting increased its inflation forecast for FY23 by 100 bps to 6.7 percent.

"We expect CPI inflation to remain elevated, at 7.0 percent YoY, in June 2022, as several factors offset each other. Imported inflation remains the key driver of higher prices, but we expect tax cuts, RBI rate hikes and signs of stabilising food prices to anchor inflation in coming months," Rahul Bajoria, MD & Chief India Economist at Barclays said.

Industrial production in April climbed to 7.1 percent YoY, which was better than the economists' expectations of around 5 percent.

Apart from that, WPI inflation data for the month of June will be released on coming Thursday, while deposit & bank loan growth for the fortnight ended July 1, foreign exchange reserves for the week ended July 8, and balance of trade data for June will be announced on coming Friday.

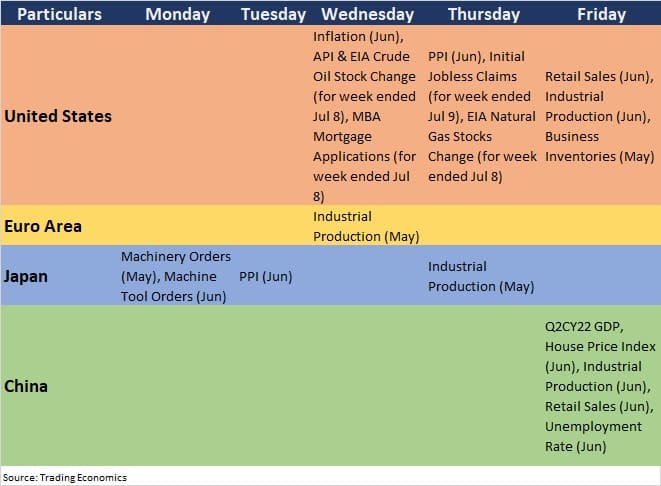

3) US inflation

US inflation is the most important data point that can be closely watch globally and can bring volatility in the global markets next week. The numbers will be released on coming Wednesday, followed by PPI and jobless claims data on Thursday.

Inflation in May was at 8.6 percent, the highest since December 1981, while for June, experts expect the print either at similar levels or tad above previous month's numbers.

US Federal Reserve will closely watch this data before taking interest rate decision in its July policy meeting. Most of experts as well as Fed officials indicated that there could be 50-75 bps hike in interest rates in the policy meeting.

4) Other Global Data Points

Here are other global data points to watch out for next week:

5) Oil Price

The falling oil prices was one of reasons for positive momentum in the markets last week. The reason behind correction in prices is the fear of recession in the US, the world's largest economy, while experts feel the tight supply and ongoing geopolitical tensions could support the prices. Most of experts are seeing recession in the US but it could be a shallow and short-lived.

Hence, all eyes are on the crude oil price movement in coming days, but any further fall in price is always welcome by oil importing countries like India as that could reduce pressure on current account deficit of the country.

International benchmark Brent crude futures closed at $107 a barrel, falling compared to $111.63 a barrel on week-on-week basis. The prices dropped below $100 a barrel during the week.

6) FII Selling

FIIs turned net buyers for a single day during the week, but overall they remained net sellers for the week ended July 8, offloading more than Rs 2,200 crore worth shares.

However, the pressure of outflow has been reduced compared to previous weeks, which was another supporting factors for the market. Hence whether the outflow pressure reduces further or not going forward will be closely watch, though the DIIs have offset the FII outflow pressure to major extent by consistent buying. DIIs have net bought shares worth Rs 3,910 crore during the passing week.

Most of experts are saying the FII outflow is expected to continue till the significant improvement in global situation.

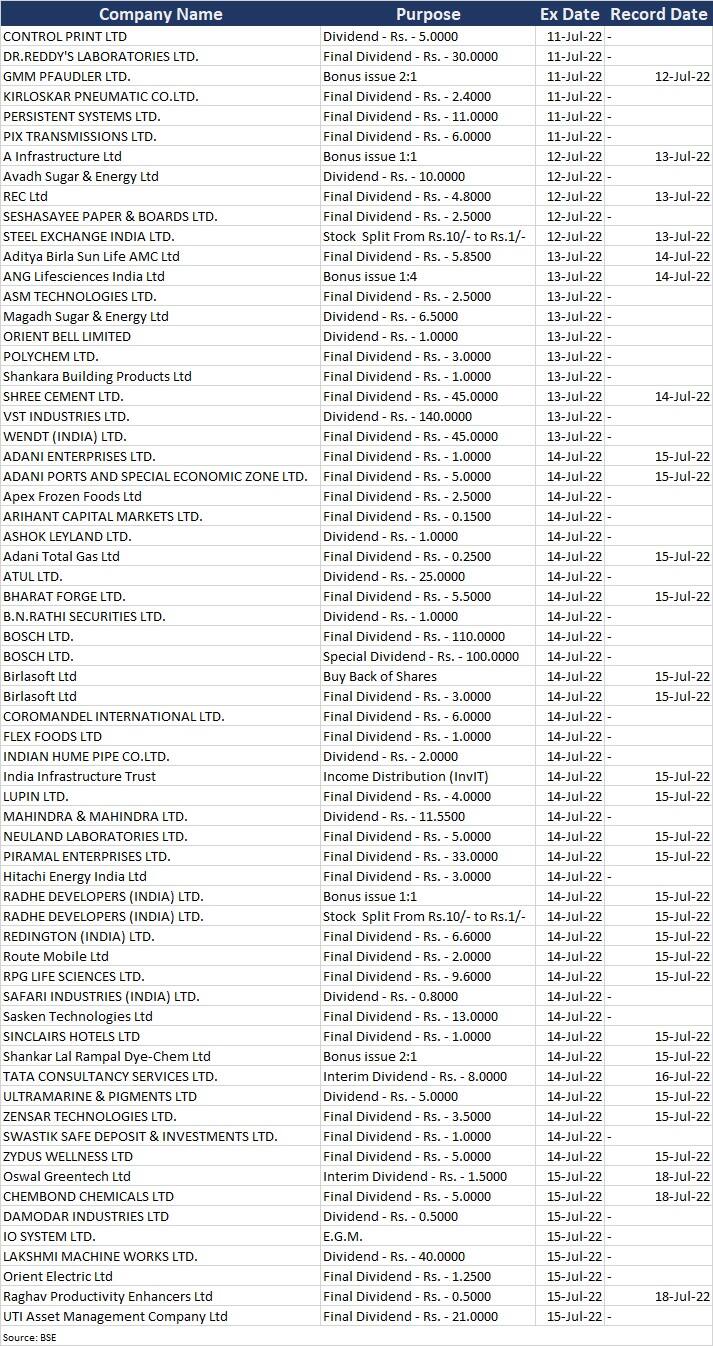

7) Corporate Action

Here are key corporate actions taking place in the coming week:

8) Technical View

The Nifty50 has seen a formation of bearish candlestick pattern which resembles somewhat Hanging Man kind of pattern on the daily charts, while on the weekly scale, there was a strong bullish candlestick formation, which resembles somewhat Bullish Engulf kind of pattern formation, raising hope for the further uptrend in coming sessions.

Experts largely expect the next hurdle for the index at 16,300 followed by 16,500 if it sustains above 16,200, with major support at 16,000 mark. Even oscillators RSI (relative strength index) and Stochastic indicated that the sentiments are positive.

"If Nifty manages to stay above 16,200 levels and moves up in the next 1-2 sessions, then that could mean an important trend reversal on the upside for Nifty as per smaller and larger timeframe chart. There is a possibility of Nifty moving towards the next upside resistance of 16,500 levels by next week," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Immediate support is placed around 16,150-16,100 levels, he added.

9) F&O Cues

On the option front, we have seen a maximum Call open interest at 16,200 strike followed by 16,900 & 16,500 strike, with Call writing at 16,900 strike then 16,700 & 16,600 strikes and Call unwinding at 16,100 strike then 16,000 & 15,900 strikes.

The maximum Put open interest was seen at 16,000 strike, followed by 16,200 & 15,900 strikes, with Put writing at 16,200 strike, then 16,000 & 15,300 strikes, and Put unwinding at 15,100 strike.

The above weekly option data indicated that the Nifty50 could be in a trading range of 15,900-16,500 strikes for coming sessions.

"From the derivative front, Call writers were seen unwinding their short positions held at 16,000 strike and 16,100 strike while on the other hand Put writers added hefty open interest at 16,200 strike. Overall we advise traders to adapt buy on dips strategy keeping 16,000 levels as strong support for Nifty," said SMC Global, while ICICI Direct expects the current recovery to continue towards 16,500 levels in coming sessions.

10) India VIX

The volatility index India VIX fell by 13.4 percent during the week to close well below crucial 20 mark, at 18.4 levels, which made bulls more comfortable at Dalal Street. If it sustains below these levels then there could be more stability in the market, experts said.

"Volatility has been cooling off from the last six sessions paving way for the bulls and cheer the index above at higher crucial levels. Now it needs to sustain at lower zones for market stability," Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.