The market extended its upward journey for the second consecutive week ending November 21, despite selling pressure seen on Friday due to weak global cues, including an unlikely Fed funds rate cut in the December meeting, and rising concerns over potential delays in the India–US trade talks. Better-than-expected Q2 earnings, easing inflation, and a slowdown in FII selling supported equity market sentiment, while the rupee hit an all-time low during the week.

The market, in the current week starting November 24, is expected to be rangebound with a positive bias and will focus on the further progress in India-US trade negotiations, Ukraine peace deal, Q2FY26 GDP data, and FII activity, according to experts.

The Nifty 50 rallied 158 points (0.61 percent) during the last week to 26,068, and the BSE Sensex jumped 669 points (0.79 percent) to 85,232, but the broader markets were under pressure with the Nifty Midcap and Smallcap 100 indices falling 0.76 percent and 2.2 percent, respectively.

Siddhartha Khemka, Head of Research, Wealth Management at Motilal Oswal Financial Services, expects markets to remain firm this week, supported by buying on dips, improving demand outlook in Q3, and resilient flows.

Any progress on the India-US trade talks would be a key short-term catalyst for the markets, he believes.

However, Vinod Nair, Head of Research at Geojit Investments, feels the market may witness some profit booking in the near term if the pressure on INR persists.

Here are 10 key factors to watch next week:

India-US Trade Deal Update, Russia-Ukraine Peace Deal Progress

The development with respect to India-US trade negotiations will remain a key factor to watch by the market participants in the coming weeks, as any confirmation on the deal is expected to not only act as a trigger but also provide support for the equity markets and the rupee that is under pressure, though experts feel it is not going to change fundamentals materially.

"While any timeline forecasts can be tricky with the current US administration and its predilections, there is a high probability that the deal will be struck before end of 2025," P Krishnan, the Managing Director & Chief Investment Officer – Equity Asset Management at Spark Asia Impact Managers, said.

Meanwhile, all eyes will also be on the progress toward the Russia-Ukraine peace deal. As per the latest BBC News reports, US Secretary of State Marco Rubio said a "tremendous amount of progress" has been made in talks to finalise a Ukraine peace deal. Talks in Geneva - between delegations from the US, Ukraine, and its European allies - are focusing on a 28-point draft plan and will continue on Monday.

Global Economic Data

The market participants will focus on a series of economic releases, including retail sales, PPI, pending home sales, durable goods orders, and weekly jobs data from the United States, to gauge the potential interest rate decision.

Tokyo's CPI numbers for November, along with unemployment rate, retail sales, housing starts, and construction orders for October, will also be watched this week.

Q2FY26 GDP Data

Back home, the market will keep an eye on the quarterly economic growth numbers scheduled for November 28. SBI Research in its latest report expects the real GDP growth of around 7.5 percent in Q2FY26, with the possibility of an upside surprise, against 7.8 percent growth seen in Q1. "Growth is being supported by a pick up in investment activities, recovery in rural consumption, and buoyancy in services and manufacturing, underpinned by structural reforms like GST rationalization that also helped unleash a festive spirit that decisively showcased triumph of hope over hype," the research house said.

Apart from GDP, industrial production, and fiscal deficit numbers for October month along with foreign exchange reserves for the week ended November 21, and bank loan & deposit growth for the fortnight ended November 14 will also be disclosed on the same day.

Indian Rupee

The focus will also be on the currency movement as the Indian rupee hit an all-time low of 89.7 against the US dollar, weakening 1.07 percent during the week, the biggest depreciation since February this year, and traded near the upper Bollinger bands, considering the delay in the India-US trade deal and fading expectations of a Fed rate reduction.

"With no visibility on tariff rollback or trade-related assurances, sentiment remained weak, leading to a broad risk-off move in the rupee. Near-term weakness can extend further, with the rupee likely to trade in the 89.20–90.00 range," Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities said.

Meanwhile, the US Dollar index closed above the 100 mark for the first time since May this year, rising 0.93 percent for the week to finish at 100.196 and trading above short-term moving averages and approaching the medium-term moving average, possibly amid better-than-expected US non-farm employment data for September and a heavy sell-off in cryptocurrencies. "However, inflation worries and uncertainty over AI investments could limit gains of the dollar index," Manoj Kumar Jain of Prithvifinmart Commodity Research said. He expects the dollar index to remain volatile this week amid volatility in the global financial markets and ahead of the meeting for the Russia-Ukraine peace deal.

The market participants will continue to monitor the activity at the Foreign Institutional Investors (FIIs) desk, as there is no directional trend in their activity. Their selling reduced and they turned buyers for some days last week. FIIs have net sold Rs 188 crore worth of shares last week against Rs 12,020 crore worth of selling in the previous week, taking the total current month's outflow to Rs 13,841 crore.

"Going forward, FII selling is likely to decline due to the fading of the AI trade and the improving prospects for Indian equities," VK Vijayakumar, Chief Investment Strategist at Geojit Investments, said. Expectations of Nifty touching new highs soon and an imminent trade deal between the US and India can bring the FIIs back into the Indian market, according to him.

On the contrary, Domestic Institutional investors (DIIs) remained net buyers throughout last week, buying nearly Rs 13,000 crore worth shares, taking total net purchases to Rs 54,321 crore for current month.

The SME segment will remain in action mode with five companies launching their public issues worth Rs 171 crore next week, while there will be no new IPO from the mainboard segment.

SSMD Agrotech India will open its Rs 34-crore IPO on November 25, followed by Mother Nutri Foods' Rs 39.6-crore public issue and K K Silk Mills' Rs 28.5-crore offer on November 26. Purple Wave Infocom and Exato Technologies will be the last IPOs amongst them in the SME segment, opening both on November 28.

Meanwhile, from the mainboard segment, Sudeep Pharma will close its IPO on November 25, which was subscribed 1.42 times till November 21.

On the listing front, Excelsoft Technologies will make its market debut on the BSE and NSE on November 26, followed by Sudeep Pharma on November 28, while from the SME segment, Gallard Steel will list shares on the BSE SME on November 26.

Technical View

Technically, the Nifty 50 is expected to be range-bound until it decisively surpasses the previous week's high of 26,250, as sustaining above it can open the door for 26,500, while overall, the trend is still favourable for bulls with the index trading well above all key moving averages with continuation of broader higher high-higher low formation. However, falling below the psychological 26,000 level can bring the index down toward the 25,850-25,750 zone.

F&O Cues

The monthly options data suggested that the Nifty 50 is expected to be in the 26,000-26,500 range in the near term, with a broader range being 25,500-27,000.

The maximum Call open interest was placed at the 26,500 strike, followed by the 26,200 and 26,100 strikes, with the maximum Call writing at the 26,100, 26,200 and 26,150 strikes, while the 26,000 strike holds the maximum Put open interest, followed by the 25,700 and 25,900 strikes, with maximum Put writing at the 25,700, 26,500 and 25,750 strikes.

India VIX

The further sharp spike, if any, in India VIX, also known as the fear gauge, to around the 15 zone may bring more discomfort for bulls as it already crossed all moving averages on the daily charts. It rallied 14.18 percent during the last week to 13.63, the highest level since June this year, surpassing short and medium-term moving averages.

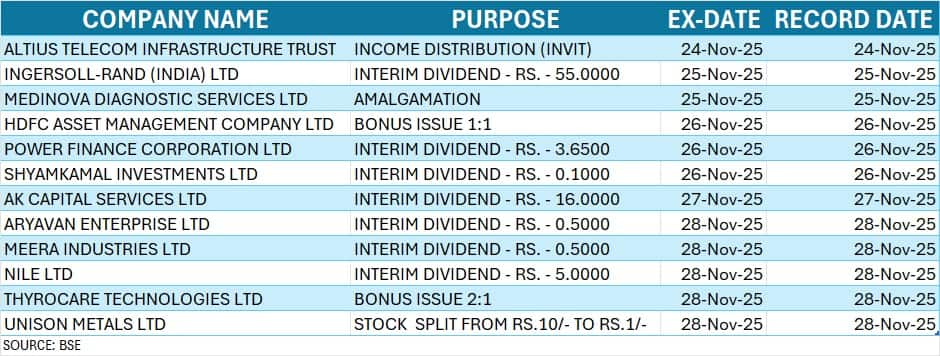

Corporate Action

Here are key corporate actions taking place next week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.