The coming week could see a slight positive movement in the markets due to a series of events, ranging from TCS' (Tata Consultancy Services) Q4FY24 results, the US Fed minutes, Indian and US inflation figures, and more.

Markets were volatile in the first week of April but ended on a positive note. The Nifty 50 touched an all-time high of 22,619, and ended the week above the 22,500 mark with a gain of 0.84 percent. The 30-share BSE Sensex rose 596.87, or 0.81 percent, to finish at 74,248.22.

On the inflation front, the Monetary Policy Committee (MPC) kept the repo rate unchanged but voiced caution about climate shocks, both domestic and global, which could instigate food price rises.

Vinod Nair, Head of Research at Geojit Financial Services, said, "There is a subtle positivity in the Indian market, bucking the weak global trend, aided by positive manufacturing PMI (purchase manager's index) data and optimism about the upcoming Q4 results. Buoyancy of the broad market indicates the strength will continue in the short term. Meanwhile, strong US economic data has cast doubts on the Fed rate cut in June that the market was expecting. "

Here are the key events to watch for next week:

Q4 earnings

Six companies will be announcing their Q4FY24 results this week. They are Tata Consultancy Services, Cupid, Anand Rathi Wealth, Krystal Integrated Services, Popular Vehicles and Services, and Teamo Productions HQ.

CPI

India's consumer price index (CPI) data will be released on March 12. CPI inflation is expected to ease to 4.7 percent in March, owing to a decline in food and fuel prices, and a slight easing of momentum in core inflation, said Shreya Sodhani, Regional Economist at Barclays.

"The disinflation is broadly attributed to easing in momentum across food, fuel, and core items, though some base effects also helped. Headline CPI likely fell 0.12 percent month-on-month (MoM), driven by sequentially lower vegetable, LPG, and gasoline prices," said Sodhani. Along with CPI data, data on industrial production in February and foreign exchange reserves for the week ended April 5 will also be released on April 12.

US inflation and FOMC minutes

The US will announce its inflation data on April 10. At the last meeting, the Federal Open Market Committee (FOMC) had opted to maintain the federal funds interest rate at the current target range of 5.25 to 5.5 percent. The US Federal Reserve (the Fed) has not changed its interest rate target since July 2023, keeping rates at a 22-year high in its ongoing fight against inflation.

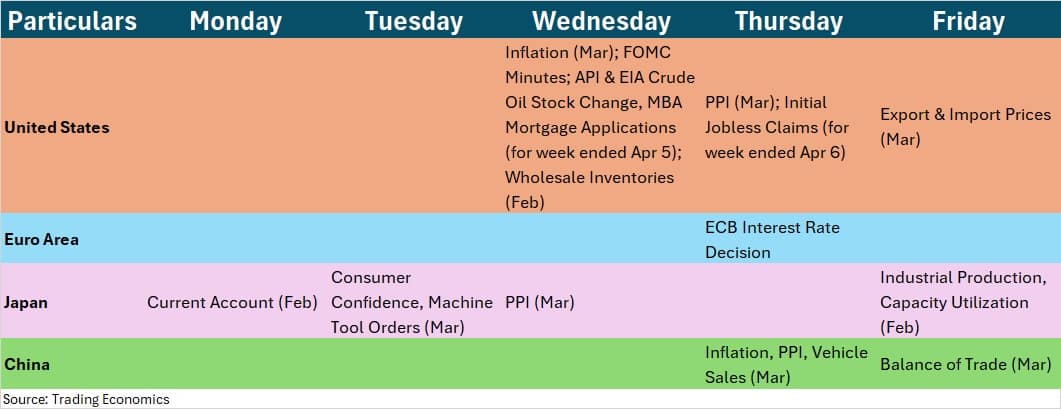

Global economic data

Market participants will also keep an eye on the European Central Bank interest rate, which will be announced next week. China inflation numbers, US jobs data, and producer price index numbers from US, China, and Japan will also keep the street busy.

Oil prices

Brent and US West Texas Intermediate (WTI) crude oil benchmarks rose more than $1 per barrel, with Brent settling at $91.17 per barrel. US WTI crude closed at $86.91 a barrel. Both benchmarks gained more than four percent last week after Iran vowed revenge against Israel for an attack. The prevalent geopolitical tensions may disrupt global supply chains, leading to commodity price spikes, especially in crude oil, said Vikram Kasat, Head, Advisory, at Prabhudas Lilladher.

Primary market

Bharti Hexacom will list on bourses on April 12. The company plans to raise Rs 4,275 crore and the price was set at Rs 570 per share. In the SME segment, the IPOs of DGG Wires and Cables and Teerth Gopicon will open on April 8 and close on April 10. Yash Optics and Lens, K2 Infragen, and Jay Kalash Namkeen will be listed on April 8.

Technical view

The Nifty 50 ended at a new closing high and formed a small-bodied bullish candlestick pattern with long upper and lower shadows on the weekly charts, where higher high, higher low formations continued for yet another week.

Technically, the Nifty is likely to be rangebound in the coming week, unless it decisively breaks 22,600 on the higher side, or 22,300-22,200 on the lower side. Either breach can give firm direction to the market, experts said.

"Traders should continue with a buy-on-dips approach until Nifty breaks 22,200," advised Ajit Mishra, SVP, Technical Research, at Religare Broking.

On the higher side, it can inch towards the 22,700-22,850 zone, he said.

F&O cues

Weekly options data continued to indicate that 22,500 is expected to be crucial for the Nifty 50, with 22,800 likely to be a key resistance on the higher side and 22,400 to be the immediate support for the index.

On the Call side, the maximum open interest was seen at 23,000 strikes, followed by 23,500 strikes, and 22,800 strikes, with meaningful Call writing at 22,800 strikes, then 23,000 strikes, and 23,500 strikes. On the Put side, the 22,500 strikes saw the maximum open interest, followed by 21,500 strikes, and 22,400 strikes, with the maximum writing at 22,400 strikes, then 22,500 and 21,500 strikes.

India VIX

Volatility tested the lows of November 2023, putting the bulls in a comfortable position. India VIX, the fear gauge, dropped 11.65 percent for the week, to the 11.34 mark.

Corporate action

Here are some of the corporate actions next week.

Indian Metals and Ferro Alloys Limited will announce a special dividend of Rs 15, while Prima Plastics and Sun TV will announce an interim dividend of Rs 2. The ex-dividend date for all three is April 8. Sprayking Limited will see a stock split from Rs 10 to Rs 2 in the next week.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.