Somaiyaa joined in 2020 as a CEO at White Oak Capital which currently manages over $2.2 billion in AUM for domestic HNI investors, Sovereign Wealth Funds, institutions, family offices, and high net worth investors from all over the world investing into India.

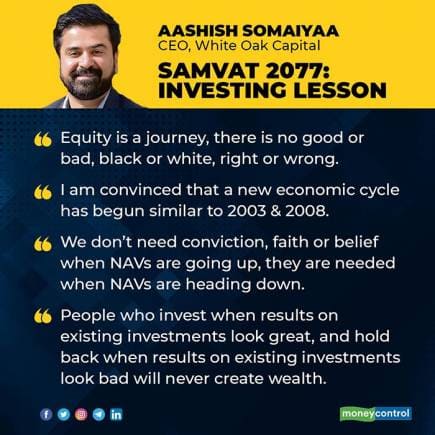

Equity is a journey, there is no good or bad, black or white, right or wrong. There is only context and perspective and one needs to stay put instead of demanding conclusions and judgments at frequent intervals, he said in an interview with Moneycontrol’s Kshitij Anand.

Edited excerpts:

Q) Many congratulations once again to you on joining White Oak Capital Management as CEO. How was your stint at Motilal Oswal and plans for White Oak?

A) Motilal Oswal has a strong belief in equity and working with Raamdeo Agrawal, Motilal Oswal, Navin Agarwal, and my team was an honour. It’s the first AMC of scale that is 100% equity and made consistent efforts to enunciate that in the equity investing outcomes are probabilistic and uncertain.

Hence, one doesn’t control outcomes but one can control the consistency and quality of inputs. Motilal Oswal AMC in 2013 was the first AMC to communicate philosophy and process instead of products and performance.

Talking and explaining positions basis investing beliefs and philosophy now seems to have become a norm; it wasn’t so before Motilal Oswal focused heavily on this area.

WhiteOak will probably have the distinction of being the first full service AMC and investment firm launched by a professional and managed by professionals.

It was founded in 2017 by Prashant Khemka, former CIO of Goldman Sachs Asset Management’s India Equity and Global Emerging Markets Strategies. WhiteOak, with its founder leading 13 seasoned equity investment professionals having India as well as global investing experience, currently manages over $2.2bn in AuM which is invested in listed Indian equity.

The performance for the last 3 years has been a standout. About Rs 3000 crs or $400 mn is managed by way of AIF and PMS for domestic HNI investors and over $1.7bn is managed for global investors like Sovereign Wealth Funds, institutions, family offices, and high net worth investors from all over the world investing into India.

Q) Tell us briefly how did you fell in love with equities, and at what time you realized that managing money is your calling?

A) I think the answers lie in my childhood and adolescent experiences. For the most part of my childhood, we lived in a large joint family.

My father being the oldest had to fend for his younger siblings through their education and early careers and marriages until they created their own homes in the 1980s.

I don’t think he had much to spare for investing until very late, maybe the last 4-5 years of his life before he passed away in 1989 in a car accident.

My mother who was a homemaker took up a job on compassionate grounds at the State Bank of India as a clerk. My sister couldn’t pursue any post-graduate studies and for the most part, my graduate and post-graduate education were paid for by my sister even as my mother struggled to run our household on a clerk’s salary.

Suffice it to say that for the most part of my mother’s life and my sister and my youth, we had a lower-middle-class existence full of financial constraints and in my case a serious inferiority complex.

Sometime in the early 2000s almost 20 years to the day he passed, my mother finally looked through a bunch of papers that existed but lay unattended; turns out they were share certificates.

What we never really knew consciously or had active cognizance of was that my father was an avid investor. He had applied for IPOs of companies like Nestle, Siemens, State Bank of India, Hero Honda, and of course Reliance Industries among others.

These were not big amounts, they were all like a Rs 1000 application fetching 100 shares because back then all issues were at Rs 10 in an IPO.

As we rummaged through the papers, it slowly dawned on us that my mother was fairly "wealthy". The amount was easily multiples of what my mother would earn in a year and maybe atleast a 100 times of what my father would have invested to buy those modest lots of 100 shares. I have seen the power of equity first hand, I know it works.

But unless some such slow cooking delicious story plays out in the background unbeknownst to protagonists of the plot, usually we human beings love closure after every minor market event – we love to judge and pronounce and act on good or bad, black or white, right or wrong.

Equity is a journey, there is no good or bad, black or white, right or wrong. There is only context and perspective and one needs to stay put instead of demanding conclusions and judgments at frequent intervals.

Q) What is your call on markets & earnings which are on the verge of hitting fresh record highs?

A) I am convinced that a new economic cycle has begun, it always happens with very high liquidity, low inflation, and low-interest rates – same as what was witnessed in early 2003, end 2008, and now again since mid-2020.

Everyone seems to be watching for stimulus from the Government without realising that there are no stimulus bigger than high liquidity, historically low rates and the need for banks to lend.

Q) Your message to investors for this Diwali and your outlook for the next SAMVAT 2077?

A) The most disheartening phenomenon of the last 6 months has been the decline in the monthly SIP input from investors. It reflects very poorly on the communication as well as an understanding of the SIP concept.

Data shows that investors were so gung-ho about their investments and about adding SIPs right through 2016-17-18 with higher and higher market levels as all the trailing installments showed appreciation in value.

But, the key benefit of SIP is rupee cost averaging which means that while you buy at higher levels eventually you will average by buying at lower levels and add more units if markets and NAVs fall.

In March this year, the index was back to its 2014 levels – instead of doubling down the data shows investors actually stopped their installments. This is no recipe for wealth creation.

We don’t need conviction, faith or belief when NAVs are going up, they are needed when NAVs are heading down.

What’s even worse is that as NAVs have recovered almost the entire damage investors who were scared in March and April, not only didn’t take advantage of lower NAVs, they now seem to exiting even as a new economic and market cycle is set to begin.

I am sure that investors are highly concerned about the NAVs of their equity mutual funds. But, equities and equity mutual funds will go down from time to time in a cycle and stay there; it’s a feature, not a bug.

We can have long debates and discussions about how ugly the rear view mirror looks book the following rules about investing in equities are eternal:

1. When the rear view mirror looks disastrous, that’s when the windscreen starts to look bright and sunny

2. People who invest when results on existing investments look great, and hold back when results on existing investments look bad will never create wealth

3. Wealth is not created in bull markets. Wealth is created by investing in bad times which shows up as appreciation in the account statements in the good times.

Q) What is the importance of asset allocation and why is it more relevant when Gold and probably global investing might have delivered better returns than domestic equities?

A) We know this in hindsight and also we know when the relative trends across asset classes take a turn only in hindsight. It’s not always possible to predict and time these trends changes hence asset allocation is crucial.

Instead of thinking till when will gold prices go up even as equities struggle, its better to have a balance that suits our risk profile and return expectations.

A) I know there are huge concerns on USA elections, I am no expert but I can’t help thinking that in 2016 the market tanked because Mr Trump won the election and now everyone is fearing market will tank if he loses the election.

This tells you a lot of about what the market and by implication investors know about what they should fear.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.