The March quarter earnings of speciality chemical companies may show a marginal impact of COVID-19, however, plant lockdowns, logistical challenges and consumption spillover would affect their profitability in FY21, said brokerages.

Brokerages highlight that the lockdown has resulted in supply chain disruptions despite stable order flows and even though major chemical and allied manufacturing companies in India are sitting with good order books from their customers across the globe, supplying the products remains a challenge.

"Unavailability of drivers in the domestic market and congestion across the global ports are delaying goods delivery. Vinati Organics, Advanced Enzyme Tech, SRF and Navin Fluorine have a high export dependency in their overall revenue profile," said brokerage firm Emkay Global.

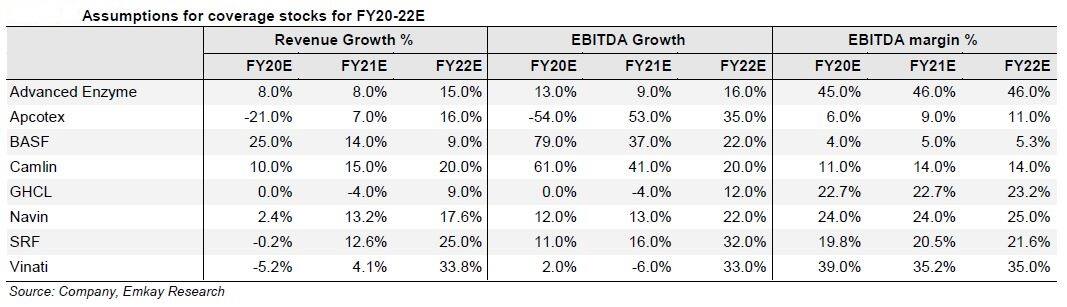

The shutdown will marginally hit Q4FY20 earnings as it was implemented in the last week of March but Q1FY21 would see a significant impact. Emkay Global expects its coverage universe to see a 3-23 percent earnings cut in FY21E and a 2.3-15 percent cut in FY22E.

COVID-19 has definitely hit the sector but brokerages believe these companies have the potential to scale up their production once economic activity resumes, in order to meet customers’ demand.

"The production shutdown will definitely give a blow to Q1FY21 numbers but they can manage to complete the annual orders in the remaining period of the year, provided the COVID-19 issue normalizes in the second half of FY21," said Emkay Global.

Brokerage firm Edelweiss Securities said that factoring in the risk to earnings in the current times is tricky, but the resilient demand from end user-industry would somewhat cushion the fallout.

"Agrochemical-based players such as PI Industries and SRF would suffer a limited impact on demand in our view. However, demand from other user industries such as auto, polymers, and fuel additives may succumb. Aarti Industries and Fine Organics face heightened risk," Edelweiss said.

Cushion for the sector lies in currency depreciation, crash in crude prices and global players cutting down their dependence on China post-COVID-19, Edelweiss highlighted.

Stocks that look attractive

Emkay Global believes that the COVID-19 issue will dampen short-term earnings. However, the brokerage is positive on SRF and Navin Fluorine due to their strong long-term positioning in the speciality chemicals segment, while Advanced Enzyme Tech looks attractive with cheap valuations, as per Emkay.

Edelweiss finds Galaxy Surfactants and SRF attractive given their resilient business models. The brokerage has upgraded them from ‘hold’ to ‘buy’.

Edelweiss has a 'buy' call on Aarti Industry, too, despite short-term pressure on user industries such as textiles, auto, polymers, etc and expected delays in the commissioning of its two large products.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.