December 14, 2018 / 15:33 IST

Market at close:

Benchmark indices ended positive but remained flat throughout the day with Nifty close just above 10,800 mark.

At the end, Sensex was up 33.29 points at 35962.93, while Nifty was up 14 points at 10805.50. About 1249 shares have advanced, 1287 shares declined, and 145 shares are unchanged.

Bharti Airtel, Yes Bank, ONGC, NTPC and Asian Paints are the top gainers on the Sensex, while losers are HDFC, Wipro, L&T, Adani Ports and Bajaj Auto.

Among sectors, except pharma and metal all other sectoral indices ended in green, while midcap and smallcap stocks ended flat.

December 14, 2018 / 15:13 IST

Gujarat Ambuja Exports' Plant Expansion

Company has decided to put up a green field plant at Malda, West Bengal for 1000 TPD maize processing at an estimated cost of Rs 300 crore.

The plant will manufacture starch, liquid glucose and sorbitol to cater to the requirements of Eastern part of the country and export markets of Bangladesh and South East Asian countries, the company said, adding the project will be executed within a period of 2 years from now.

December 14, 2018 / 15:03 IST

Market Update

Benchmark indices continued to be volatile in afternoon after rising for previous third consecutive sessions.

TheSensex gained 4.86 points at 35,934.50 whilethe Nifty fell 1.80 points to 10,789.70 amid balanced market breadth.

About 1,135 shares advanced while1,271 shares declined on the BSE.

December 14, 2018 / 14:49 IST

Fund Raising

Satin Creditcare Network raised $30 millionnon-convertible debentures (NCD) from the Netherlands Development Finance Company (FMO) to accelerate its microfinance lending portfolio.

The investment will support Satin Creditcare in its planned expansion and portfolio growth, and its efforts in increasing financial inclusion, through its operations in more than 20 states, the company said.

December 14, 2018 / 14:44 IST

Gayatri Projects Bags Orders

Company has bagged a new order of Rs493 crore. This project is in JV, with Gayatri Projects being the lead partner with 74 percent stake.

The work includes construction of new 6 lane tunnel at Khambataki Ghat Section of NH-4 in Maharshtra under NHDP Phase - V on EPC Mode, the company said.

December 14, 2018 / 14:40 IST

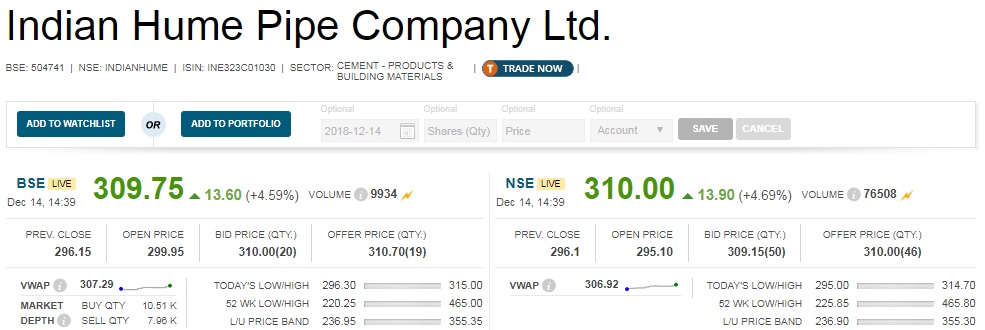

India Hume Pipe Company Wins Order

Thecompany has received twoLetters of Acceptance aggregating to Rs 234.11 crorefrom Madhya Pradesh Jal Nigam Maryadit, Bhopal.

December 14, 2018 / 14:33 IST

Anti-dumping Duty Likely On Chinese Chemical

The government may impose anti-dumping duty for five years on a Chinese chemical used in dye and photography industry in order to guard domestic players from cheap imports from the neighbouring country.

Imposition of the duty on 'Meta Phenylene Diamine' was recommended by the commerce ministry's investigation arm - Directorate General of Trade Remedies (DGTR) after conducting a probe in this regard.

In its probe, the directorate has concluded that there has been continued dumping of the chemical from China and it is likely to continue and increase if the current duty is allowed to cease. Source: PTI

December 14, 2018 / 14:19 IST

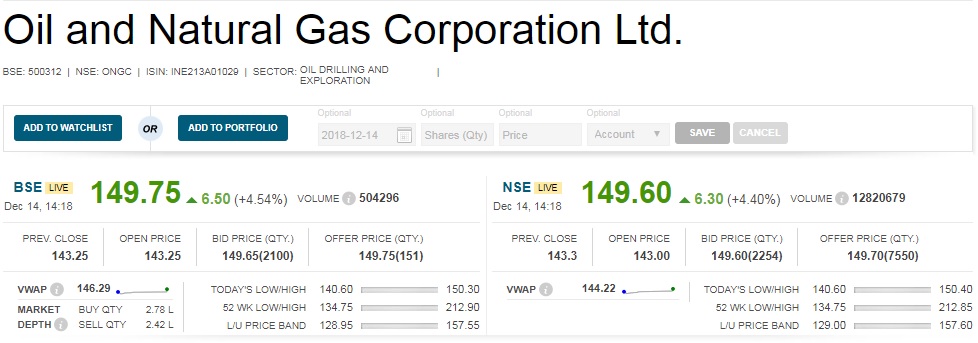

Just In - ONGC To Consider Buyback Proposal

Oil and Natural Gas Corporation said the board meeting is scheduled on December 20to consider the proposal for buyback of the fully paid-up equity shares of the company.

Hence, trading window' will remain closed for the designated persons fromDecember 17 to, 24, 2018.

December 14, 2018 / 14:17 IST

Alembic Pharma Raises Rs 350 Crore Via NCDs

Drug firm Alembic Pharmaceuticals said it has raised Rs 350 crore through allotment of non-convertible debentures (NCDs) on private placement basis.

"The NCD committee of Alembic Pharmaceuticals Ltd...has allotted 1,500, 9 percent rated unsecured listed redeemable non-convertible debentures (NCDs)... aggregating to Rs 150 crore under tranche I," Alembic Pharmaceuticals said in a regulatory filing.

The company said it has also allotted 2,000, 9 percent rated unsecured listed redeemable NCDs...aggregating to Rs 200 crore. Source: PTI

December 14, 2018 / 14:11 IST

Honda Cars to Increase Car Prices

Auto major Honda Cars India said it will increase prices of its entire model range from next month in order to partially offset the impact of rising input costs.

The company, which sells a range of models in the country, including sedans Amaze and City, is currently working on the quantum of the price increase.

"Our input costs are up by 4 percent already due to rise in input costs. In order to offset the impact we are looking to increase vehicle prices from January. We are currently in the process of working out the exact quantum of the hike," Honda Cars India Ltd (HCIL) Senior VP and Director (Sales and Marketing) Rajesh Goel told PTI.

December 14, 2018 / 14:08 IST

Europe Update

European stocks also traded lower, amid escalating concerns of a sharp slowdown in the world's second largest economy.

Germany's DAX, Britain's FTSE and France's CAC indices were down around a percent each.

December 14, 2018 / 14:01 IST

JUST IN

| Reserve Bank of India (RBI) board meeting concluded.