This summer, offline diagnostic firms like Dr Lal PathLabs and Metropolis Healthcare are feeling the heat from online players, who are threatening incumbents by making inroads into offline channels.

Channel checks done by BNP Paribas suggests that online diagnostic players such as Tata 1mg and Healthians are venturing offline, initially in north India. Hospitals have also expanded their offline diagnostic outlets, albeit at a much slower pace.

Tausif Shaikh, Research Analyst, BNP Paribas Securities, believes this poses a challenge to incumbents as their FY24 revenue growth was in low double-digits , which too was largely driven by price-hikes, and not so much by volume growth.

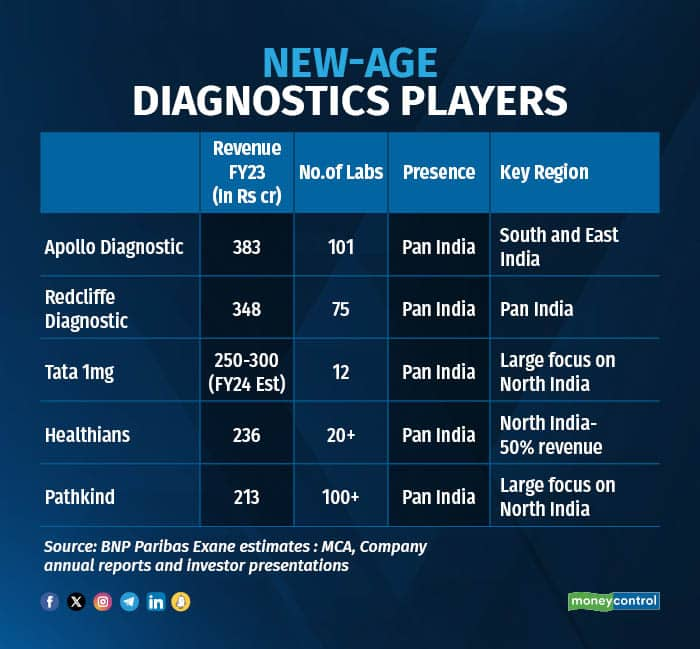

New-age players outpace incumbents

New-age players, in spite of cutting down on discounts, are seeing significantly higher revenue growth than the incumbents. Channel checks by Incred Equities also found that in Mumbai and Delhi, unlisted online and brick-and-mortar labs saw higher revenue growth than national B2C labs over the past year.

What's more worrisome for companies like Dr Lal PathLabs and Metropolis Healthcare is that these new-age players also expect their FY25 revenue growth to be higher than that of incumbents as they continue to invest in their network and lab expansion.

"With online players reducing their price discounts in FY24, it was

quite surprising that they were able to scale up their businesses well," said Shaikh.

Shaikh also shed light on the key insights he found from his interactions with new-age players. "New-age diagnostics players have been successful in building sizeable businesses, and their revenue contribution is largely from north India. Incred Equities also found that players like Tata 1MG and Redcliffe Labs have expanded their lab and collection centre network outside their core markets with minimal cash burn, helping them gain market share.

``We think this poses a threat to incumbents in the long term, if new age players and hospital-based labs continue to expand their offline channel for sample collection," Shaikh said.

Changing dynamics

New-age players are also entering segments that were ruled by incumbents. Traditionally, online-only players generated a higher chunk of their revenues from the wellness segment, which did not require doctor recommendations or a brand legacy. On the other hand, incumbents garnered a higher share of revenues from the illness segment, which required doctor recommendations, a trusted brand name, and the ability to perform complex diagnostics tests.

However, as new-age players go offline, they have also started targeting the illness segment. "New-age players were earlier focused on the wellness segment, but now they're also getting into the illness segment. Moreover, to build their channels, they are now interacting with doctors," Shaikh explained. Also, most new-age players have upped their game and are now offering complex tests, thus diluting the difference in terms of capabilities between new-age players and incumbents.

A rollercoaster ride

Shares of Dr Lal PathLabs and Metropolis Healthcare have witnessed a rollercoaster ride over the past four years. The spike in their stock prices following Covid has fizzled out subsequently.

Shares of Dr Lal PathLabs nearly doubled in value from 2020 to 2022, but post that, it witnessed a year of underperformance as the stock moved just 6 percent through 2023. Concerns over the CEO's exit and expensive valuations were the biggest reasons for the stock's underperformance.

Metropolis Healthcare also saw its stock price more than double from 2020 to 2021, however, since then, it has lost half its value as the bump in revenues due to Covid has not sustained. Like Dr Lal PathLabs, the stretched valuations of Metropolis, especially when its margins were moderating due to its expansion efforts, weighed on the stock price.

Going ahead, analysts expect some recovery in both the stocks, largely due to their prolonged underperformance. However, the upside is likely to be limited.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.