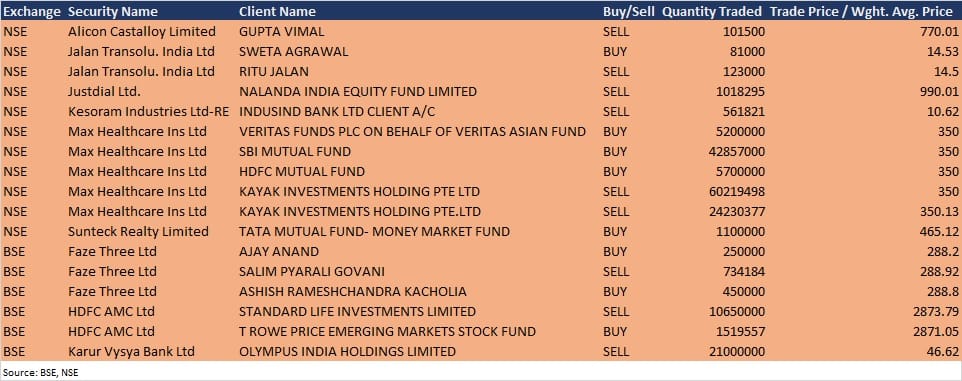

Foreign promoter Standard Life Investments has sold 1,06,50,000 equity shares in leading asset management company HDFC AMC at Rs 2,873.79 per share on the BSE, the bulk deal data showed on September 29. As a result, the stock corrected 5.55 percent to close at Rs 2,905.05.

Moneycontrol quoting CNBC-TV18 had reported yesterday that Standard Life would be selling 1.06 crore equity shares in HDFC AMC. Standard Life held a 21.23 percent stake in the asset management company as of June 2021. With this stake sale, its shareholding reduced to 16.23 percent now.

On the other side, T Rowe Price Emerging Markets Stock Fund, owned by global investment firm T Rowe Group, acquired 15,19,557 equity shares in HDFC AMC at Rs 2,871.05 per share.

Among other deals, ace investor Ashish Rameshchandra Kacholia bought 4.5 lakh equity shares in Faze Three, the home textile and automotive fabric manufacturer, at Rs 288.80 per share on the BSE.

Promoter Ajay Anand also acquired 2.5 lakh shares in Faze Three at Rs 288.20 per share. However, investor Salim Pyarali Govani was the seller, offloading 7,34,184 equity shares in the company at Rs 288.92 per share, who as of June 2021 held a 14.29 percent stake in the company (34.76 lakh shares). The stock declined 2.74 percent to Rs 291.10.

Investor Olympus India Holdings sold 2.1 crore equity shares in Karur Vysya Bank at Rs 46.62 per share. Olympus held 2.92 percent shareholding in the bank (2,33,27,768 equity shares). But the stock rallied 5.10 percent to close at Rs 49.50.

Nalanda India Equity Fund sold 10,18,295 equity shares in Just Dial at Rs 990.01 per share on the NSE.

Veritas Funds Plc on behalf of Veritas Asian Fund acquired 52 lakh shares in Max Healthcare Institute at Rs 350 per share, SBI Mutual Fund bought 4,28,57,000 shares at same price, and HDFC Mutual Fund purchased 57 lakh shares at same price on the NSE.

However, promoter Kayak Investments Holding Pte Ltd was the seller in the above deal, offloading 6,02,19,498 equity shares in Max Healthcare Institute at Rs 350 per share, and 2,42,30,377 equity shares at Rs 350.13 per share on the NSE.

Tata Mutual Fund - Money Market Fund bought 11 lakh shares in Sunteck Realty at Rs 465.12 per share on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.