Fort Lauderdale-based asset management firm GQG Partners has picked 2.6 percent equity stake in IDFC First Bank, the private sector lender, via open market transactions on September 1.

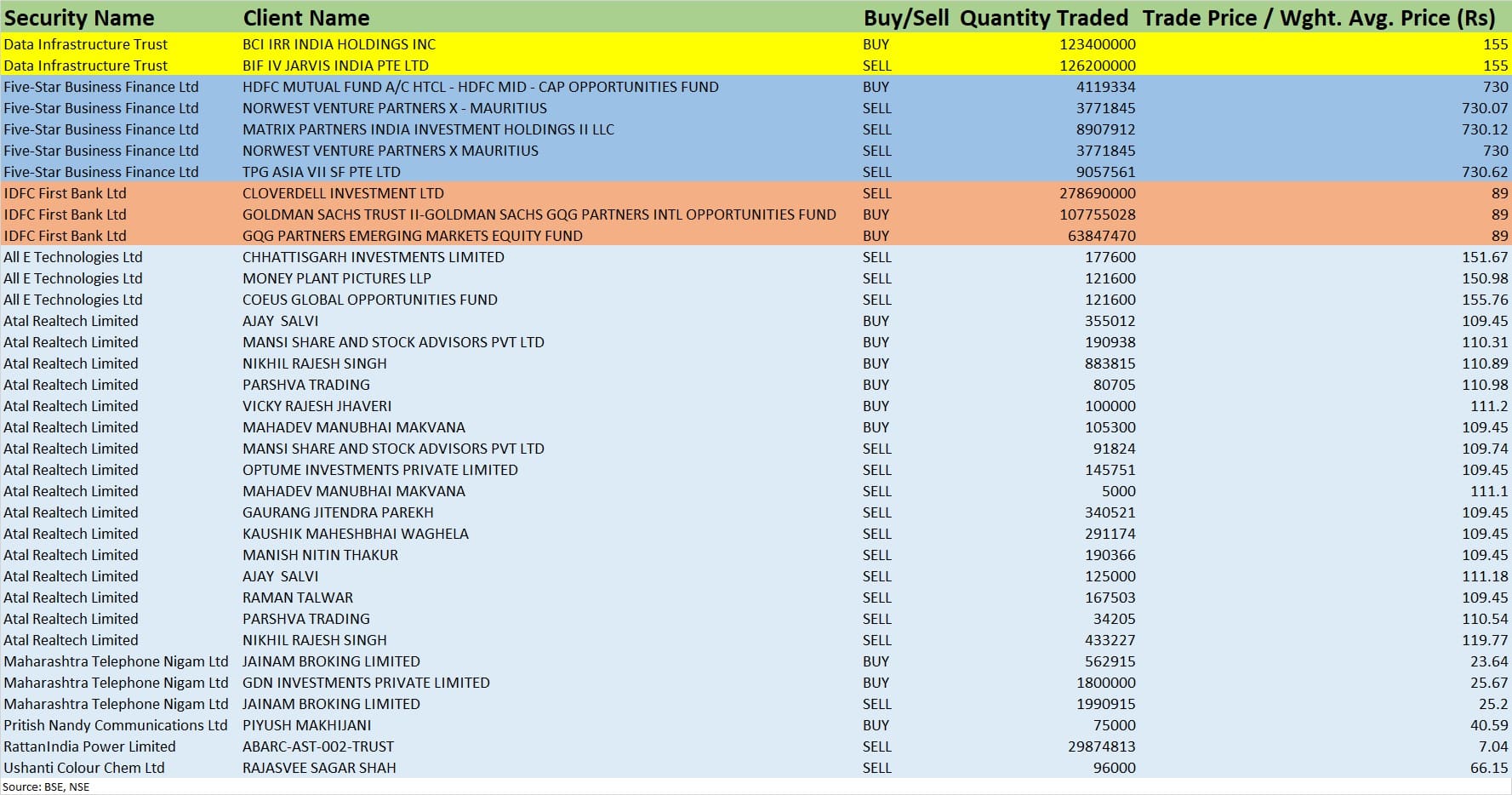

Rajiv Jain-founded GQG Partners bought the stake in the bank via two funds. While GQG Partners Emerging Markets Equity Fund bought 6.38 crore equity shares, Goldman Sachs Trust II-Goldman Sachs GQG Partners International Opportunities Fund purchased 10.77 crore shares, as per the bulk deals data available on the BSE.

These shares, constituting 2.6 percent of total paid-up equity of the private lender, were bought at an average price of Rs 89 per share, and were worth Rs 1,527.26 crore.

However, global private equity firm Warburg Pincus-owned Cloverdell Investment was the seller in the deal, offloading 27.87 crore shares or 4.2 percent shareholding in the bank at same average price. The stake sale was worth Rs 2,480.34 crore.

Cloverdell held 7.12 percent stake or 47.17 crore shares in IDFC First Bank as of June 2023. The stock, which settled Friday's trade with just 0.11 percent gains at Rs 93.44 on the BSE, clocked uptrend in last 18 out of 20 weeks and registered 73 percent gains in the same period.

Five-Star Business Finance was also in focus on Friday, falling 5.89 percent to Rs 727.80 after a significant stake sale by foreign investors.

Foreign investors Norwest Venture Partners X - Mauritius, Matrix Partners India Investment Holdings II LLC, and TPG Asia VII SF Pte Ltd sold 2.55 crore shares, which is equivalent to 8.75 percent of total paid-up equity, of the mortgage lender. The stake sale was worth Rs 1,862.86 crore.

HDFC Mutual Fund was the buyer for some of the above shares. HTCL - HDFC Mid - Cap Opportunities Fund bought 41.19 lakh shares in Five-Star Business at an avearge price of Rs 730 per share, amounting to Rs 300.7 crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.