The day of the union budget has always been chaotic and noisy. After all, we are talking of a $3.3 trillion economy with approximately 40 percent of the households in the low-income category, a growing middle class, and a small percent in the high-income bracket (22 percent of the national income goes to the top 1 percent). The country also has the fastest growing youth population.

It’s a complex situation.

The union budget has in many ways taken a step in the right direction, ensuring policy continuity. One hopes that will be maintained. Tax tweaks every now and then are avoidable.

Capex or effective capex?

Let’s dive into the capex. While the capex of Rs 11.1 trillion has been kept unchanged from the interim budget, there’s more within the effective capex. The Internal and Extra Budgetary Resources( IEBR) are available to Central Public Sector Enterprises (CPSEs) for capex, and include loans and equity. This also adds to capex in the economy. Thus, the combined capex growth rate is now 16 percent, with a mix that is more favourable than FY18.

In April-May 2024, we spent Rs 1.4 trillion in capex, which means budgetary support of Rs 9.7 trillion is expected between June 2024 to March 2025. The IEBR /GDP ratio, currently at 1.1 percent, is likely to increase slightly in the coming years amid investments in green energy-focussed PSUs.

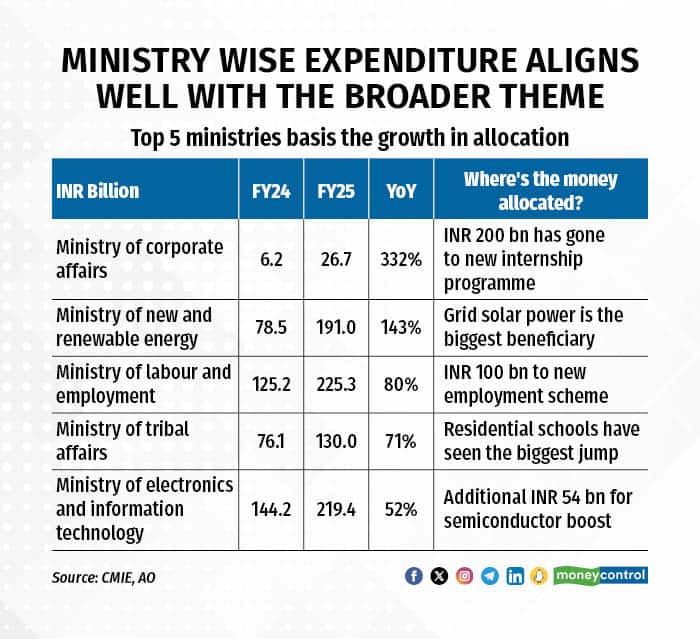

Looking at the ministries that have been the focus of this budget, it is evident that we are envisioning Viksit Bharat 2047 around nine themes.

Unprecedented outlays

Some of these allocations have been rather unprecedented and shows that new-age opportunities such as semiconductor fabs are a priority. Expenditure on research and innovation has a huge multiplier impact on the economy.

With such historic allocations, it is clear that India is trying to prepare itself for the future. For instance, the ‘Modified Programme for Development of Semiconductors and Display Manufacturing Ecosystem in India’ alone has seen its allocation go up from Rs 15 billion in FY24 to Rs 69 billion in FY25. This shows India’s commitment to expanding the value chain in this space.

Similarly, the Rs 100 billion allocation for employment schemes is a step in the right direction to address the country’s employment problem. For India to grow continuously at 8 percent, focus on employment is a must. We will see our demographic dividend only if we generate jobs. Also, job creation and skilling go hand-in-hand. Therefore, spending money on creating an infrastructure for skill development is complementary to job creation.

Further, India has a problem of a low income tax base, which means the few who pay taxes need to pay more. By incentivising the formalisation of the economy through the supply side, the stimulus has been aligned well for a progressive move to the organised sector.

Reducing customs duties on marine products, mobile phone parts, and precious metals helps reduce the cost of imports. India can then continue to add value to these items and export, which increases the competitiveness of the country globally. India is getting ready to seize the long-term opportunity today. It is good to have a budget that focusses on the big picture.

Growing FPI interest

India has had the problem of not being able to borrow enough as it never had enough ‘buyers of first resort.’ The inclusion of bonds in foreign indices has changed that, with a meaningful increase in FPI holdings. In FY25, the demand for government securities is estimated to be a strong Rs 18 trillion. If that continues, market borrowings are unlikely to be a problem

.

The reason the government’s borrowings haven’t shrunk despite the fall in the fiscal deficit is the reduced mobilisation of small savings, which in turn has led to pressure on bank deposits. However, debt markets have many tailwinds. The case for demand outstripping supply can be structurally positive.

India’s currency has been under pressure. FDI has fallen to a mere $9 billion last year. Reduction of tax on foreign companies from 40 to 35 percent is one way to fuel it. We exported agri goods worth $48 billion in FY24, and electronic goods worth $30 billion, which includes mobile phones worth ~$17 billion. Though India’s vast export potential is relatively untapped, the policy steps are designed to make India’s exports more competitive in the long run. Value-added exports are the future for India.

Finally, the gravity of the employment crisis is hard to measure. It’s innate and rising as fast as the youth population, if not faster. The government’s focus on skill and job creation is a good thing. We need an ecosystem that feeds people. Trickle-down economics will continue to favour India.

(The writer is a senior economist with a focus on Indian capital markets, macroeconomic investing and asset allocation.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!