Toothpaste major Colgate Palmolive (India) shares gained three percent November 28, after the firm's annual analyst meet. However, despite management commentary on the staples player's growth strategy and new initiatives, brokerages remained mixed.

The firm's management focusing on pushing consumers to up-trade and driving per capita consumption. Colgate Palmolive (India)'s key focus is on urban markets, with the strategy of pushing brushing twice a day, and attempting to create awareness and improving usage in rural markets, especially with movements such as the 'Oral Health' in order to create recognition.

With growth slowing in urban and growth recovery plateauing in rural, Colgate is looking at a balanced mix of volume and price growth.

Colgate Palmolive's top brass also suggested that the firm will look towards balanced growth, which will be driven by equal emphasis on volume, mix and price. On the other hand, most brokerages and analysts expect mid to high single-digit volume growth.

At 9.30 am, shares of the firm were quoting Rs 3,098, higher by 2.67 percent compared to the previous session's closing price.

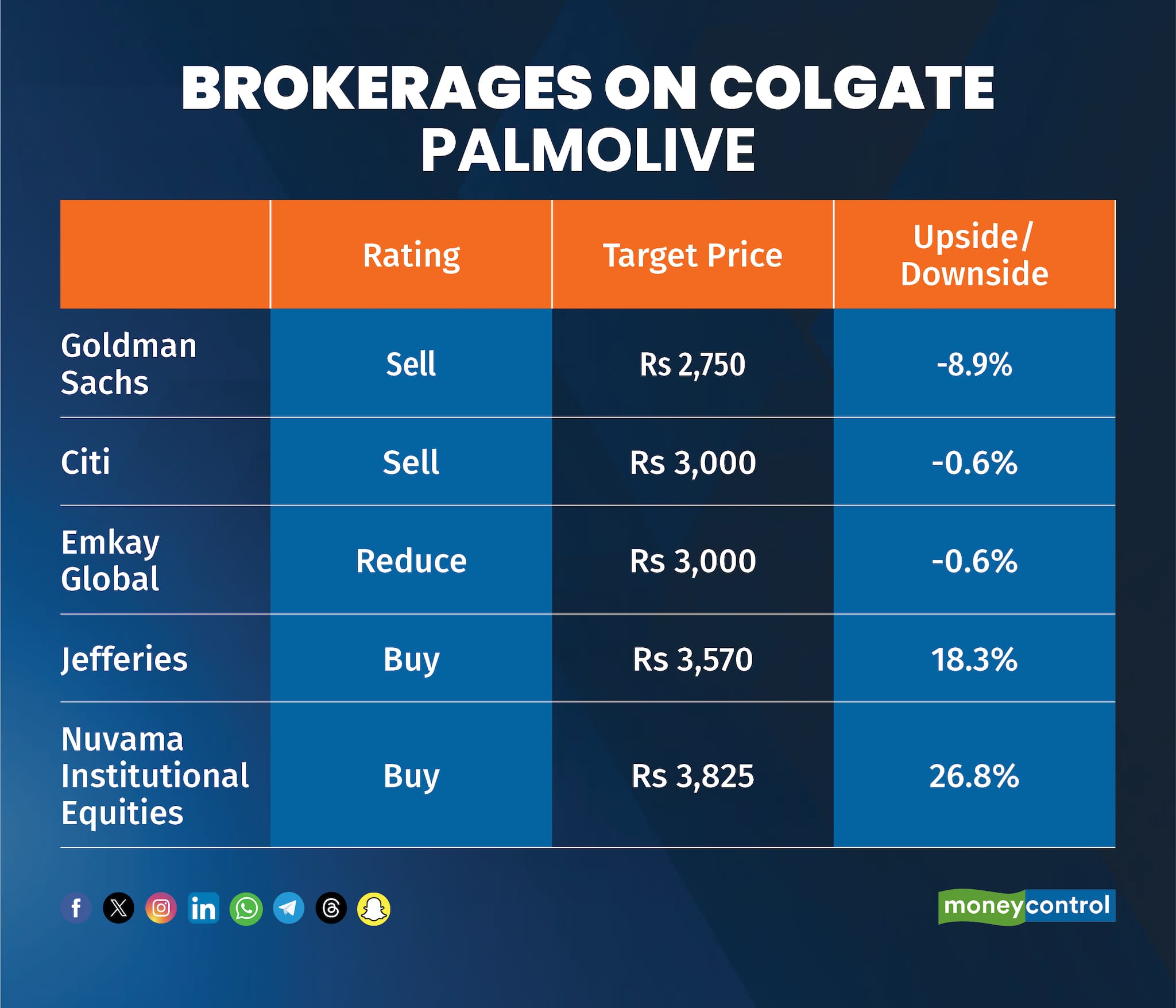

However, the commentary failed to enthuse some brokerages. International broking firms Goldman Sachs and Citi reiterated their 'sell' recommendation on the FMCG firm, as they expect earnings growth to moderate in the near-term.

The management's presentation alluded to softening category growth in urban markets, noted Citi. The commentary is in-line with larger trend seen emerging in the earnings season gone by, with urban consumption taking a backseat as consumers tighten their spending.

On the other hand, Jefferies and Nuvama Institutional Equities are bullish on the firm's strategic initiatives. The consumer player is also focusing on areas beyond oral care, with some plans to bring more products from its global parent company's stable, especially on the personal care front. The interventions taken by the firm to drive growth cover the entire value-chain, from product, packaging, advertisements, distribution and more.

Betting on premiumizationThe management sounded out its plan to drive salience of its high margin, premium products such as Colgate Total and Colgate Visible White. Oral care premium products currently comprise around 12-13 percent of the firm's total sales, while other premium, personal care categories contribute 25–30 percent.

Focus on toothbrushesBrokerages noted that over the past few years, Colgate had lost significant market share in toothbrush segment as a result of competitive intensity and the firm's management not giving the segment enough attention.

The company has started to offer toothbrushes at competitive prices, while boosting its availability to ensure it reaches a wider consumer base. It relaunched a key product, Colgate Zig Zag at price point of Rs 30 per toothbrush. This has helped the firm to grow faster than peers, noted the management.

Rural expansionThe firm noted around 55 percent of all rural households do not brush daily, while 20 percent of urban households do not brush twice daily. Around half the population uses a frayed toothbrush. While urban households replace their toothbrushes approximately once every six months, rural households replace their toothbrushes approximately once every 15 months.

Therefore, volume growth will likely be led by the rural segment. Already, volumes are recovering in the rural segment in the toothpaste and toothbrush categories. On the mass-side of the urban demand, hefty food inflation poses as a headwind.

What's next for the stock?Over the past year, shares of the toothpaste player have gained around 38 percent. However, from its 52-week high of Rs 3,890, shares of the firm have correct by a sharp 20 percent.

According to HDFC Securities, ColPal shares can warrant a re-rating on consistent mid to high single digit volume growth delivery in core portfolio and improvement in margin profile from already high base, which again will be a function of premiumization and cost optimization programme.

Emkay Global said, "We factor the company's enhanced execution in our target valuation multiple of 47x, and ascribe 10 percent execution premium to its historical average 5YF P/E. As we build in the margin improvement ahead, any re-rating in the stock would be contingent on its actions toward diversifying operations and accelerating topline growth."

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.