Several stocks and sectors across Dalal Street saw significant cheer in trade on August 18, as major GST rationalization could spur sales, boost revenue, and stimulate consumption. Brokerages were optimistic on auto, consumption, ACs and cement stocks, that were likely to see the highest benefit from lower GST rates.

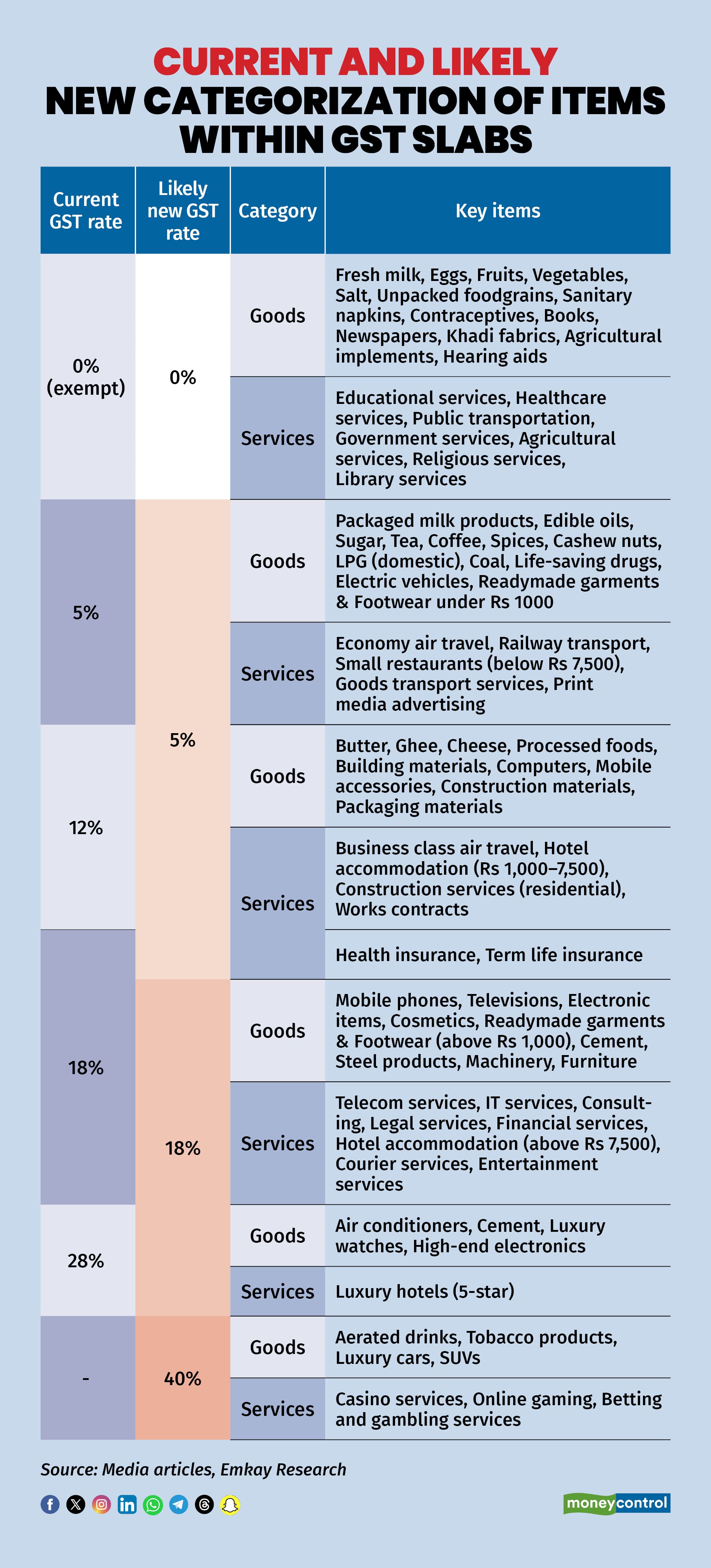

GST may be rationalised into two major slabs: five percent and 18 percent, according to most reports, with a sin tax rate of 40 percent.

Emkay Global noted that the development would be a massive positive for India as it is a consumption stimulus, will lead to ease of doing business with fewer rates, and result in greater formalization of the economy as cost-benefit of evasion turns adverse.

If implemented, key segments/sectors that stand to benefit include: Consumer Staples (through better demand, lower raw material costs), Automobiles, Cement, Hotels, Retail, Consumer Durables, Logistics, Quick Commerce, and EMS (likely better demand for ACs).

Food and beverages currently fall under 5 percent, 12 percent and 18 percent GST slabs. Several items in the 12 percent bracket, such as ghee, butter, cheese, paneer, bottled water, juices, instant noodles, pasta, wafers and Chyawanprash, could shift to 5 percent. This would benefit Bikaji (about 80 percent of revenue) and Gopal Snacks (about 85 percent), while Nestlé India may see relief in around 30 percent of its portfolio.

Dabur India could gain in beverages and Chyawanprash (about 23 percent of India revenue), ITC in its other FMCG segment (about 11 percent of revenue), and Britannia in dairy and wafers (less than 5 percent). Marico and HUL would also benefit, though to a smaller extent, noted Emkay Global.

Room Air Conditioners"We expect this change to strongly influence demand for air conditioners, particularly after recent signs of weakness," said CLSA. According to Motilal Oswal, Voltas and Havells are key beneficiaries of the move.

The government is reportedly considering lowering the Goods and Services Tax (GST) on passenger vehicles and two-wheelers. Both segments currently fall under the 28 percent slab and could benefit if rates are reduced to 18 percent, making them more affordable.

According to Emkay Global, the best way to play this would be through companies addressing mass-segment brands in each category, therefore the brokerage picked Hero Motocorp and Maruti Suzuki as its key picks. Motilal Oswal picked Maruti Suzuki, Tata Motors and Ashok Leyland as its top choices.

InsuranceThere is a possibility that GST on health insurance could be reduced to five percent or be completely exempted. In such an eventuality, health insurers and term life-heavy insurers can benefit. Further, even a cut in general insurance would directly benefit Star Health and Niva Bupa.

Indirectly, Go Digit and ICICI General could gain through margin improvement in motor insurance and higher motor premiums as two-wheeler and passenger vehicle sales pick up. In life insurance, the GST reduction on term plans from 18 percent to 5 percent would support Max Financial, stated Emkay.

FootwearThe GST cut on footwear that priced below Rs 1,000 from 12 percent to 5 percent is set to benefit

Relaxo, Bata, Khadim, Metro, and Campus by boosting affordability, narrowing the gap with unorganized players, and accelerating the shift to organized.

CementCement is taxed at 28 percent compared 18 percent for steel and other building materials, making India the highest taxed market globally compared to Australia at 10 percent, Singapore at 9 percent and EU VAT at 17-20 percent.

Motilal Oswal suggested the move would be a key sentiment boost for the cement sector, as reducing GST from 28 percent to 18 percent could lower prices by around 7.5-8 percent, though volumes may remain relatively inelastic.

Follow our market blog to catch all the live updatesDisclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.