Bharat Bond ETF, which has emerged as an attractive opportunity for investors to participate in the debt market, might not help you in achieving your crorepati dream but can certainly help you diversify.

The Bharat Bond ETF will make its entry into markets this week. The ETF, managed by Edelweiss Mutual Fund, would be open for investment soon. The new fund offer is expected to open on December 12 and will be open for subscription till December 20.

Bharat Bond ETF might not be able to replace equities to generate wealth for investors, but it is a good replacement to fixed deposits if someone is looking for stable returns, suggest experts.

According to experts, portfolio allocation towards Bharat Bond ETF could be in the range of 10-20 percent depending on the risk profile of investors.

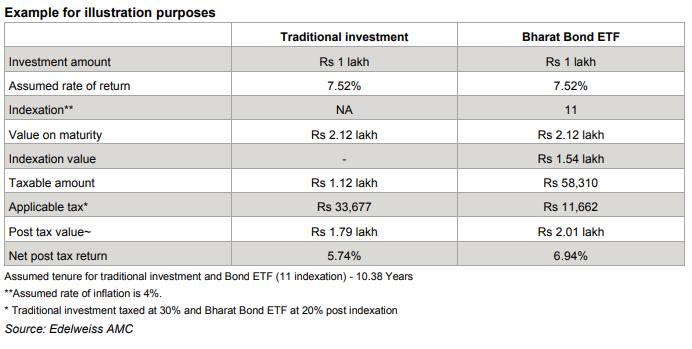

“If held for more than 3 years the taxation will be significantly lower compared to fixed deposits. Also, the ETF units can be leveraged just like fixed deposits,” Pawan Agarwal - Managing Director - Private Wealth, IndiaNivesh told Moneycontrol.

“Allocation depends on the risk profile of investors. However, conservative investors can look to allocate around 20% to 22% of the portfolio in Bharat Bond ETF as it offers returns in line with that of AAA oriented funds without any concerns of default,” he said.

Bharat Bond ETF will help in diversification of investors’ portfolios as the ETF will only invest in bonds issued by a select set of central government PSUs - which usually has a low exposure in debt mutual fund portfolios.

Bharat Bond ETF is ideal for investors having a conservative to moderate risk profile. The ETF is mandated to invest in PSU fixed income securities.

It is offered in two tenures, 3-Years and 10-Years. But, 10-Year options could be a good hedge, say experts.

“Only the 10-year tenure could be useful as a diversification tool and for investors who want to lock in the current yield and hold it for a long tenure. During down cycles, it can be a good hedge to equities which is another long duration asset,” Dinesh Rohira, Founder & CEO at 5nance.com told Moneycontrol.

“Investors should have some portion of their portfolio in long-duration fixed income instruments. Bharat Bond ETF has little credit risk at this point. The liquidity of this product cannot be ascertained yet and though the yield curve is steep, it might not be the best entry point even for the 10-Year bonds. An investor should allocate 10% of the fixed income portfolio to this product,” he said.

Can it help you achieve the ‘Crorepati dream’?

Most middle-class investors want to achieve Crorepati dream during their working career.

However, with Bharat Bond ETF, investors might not be able to achieve the dream by just investing in this instrument. It could be used for diversification or an alternative to fixed deposits.

“The kind of characteristics with which the Bharat ETF has been introduced will definitely get the sight of investors and retail participants but if someone is dreaming crorepati returns, he should switch to some other asset class,” Kaushlendra Singh Sengar, Founder, Advisorymandi.com told Moneycontrol.

It is ideal for investors who have an investment horizon in line with the maturity of the ETF and are comfortable with intermittent volatility because of interest rate movements and are looking to lock in the current yields. Investors would require an initial investment of over Rs 80 lakh to turn into a crore at the end of 3-years.

“Return expectations for this product will be in line with high-quality debt papers. In the current scenario, AAA PSU yields are trading at ~6.7% for 3-year horizon and if returns are in line of 6.7%, ~82.5 lakh will need to be invested to achieve 1 Cr target in 3 years,” Rajesh Cheruvu, Chief Investment Officer, Validus Wealth told Moneycontrol.

According to data from CRISIL for the past five fiscals suggest that yields on AAA-rated bonds for 3-5 year tenures have been higher than those on term deposits of similar tenures.

“These bonds delivered 30-170 basis points higher yields than term deposits. During this period, the average yield on the AAA segment was 8.09% whereas the average yield on term deposits was 7.01%,” it said.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.