Apollo Hospitals Enterprise (APHS) will announce its Q1FY26 results on August XX. The quarter is expected to deliver healthy double-digit growth in revenue and profitability, supported by capacity expansion, increased inpatient volumes, and a richer case mix. Margins are likely to improve modestly, aided by operational efficiencies and a leaner cost structure in its digital health business.

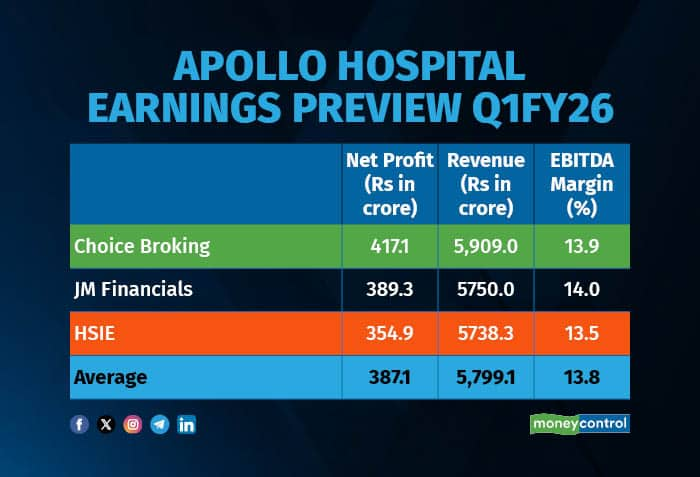

A Moneycontrol poll of brokerages pegs APHS’ Q1FY26 consolidated revenue between Rs 59,000 crore and Rs 59,600 crore, implying growth of 13 to 17 percent year-on-year (YoY). Net profit is seen in the range of Rs 3,550 crore to Rs 4,210 crore, a 16 to 37 percent YoY rise. EBITDA is estimated between Rs 7,760 crore and Rs 8,404 crore, up 15 to 24 percent YoY, with margins expanding by 26 to 80 basis points YoY.

Earnings estimates are in a relatively narrow range, indicating that any deviation could prompt a sharp stock reaction.

Key drivers for the quarter

Brokerages expect four broad factors to have shaped the quarter’s performance:

1. Hospital segment strength

Hospital revenue growth is projected at 15 to 20 percent YoY. BNP Paribas expects occupancy at 68 percent and ARPOB growth of 6 percent, while Choice Institutional Equities forecasts 66 percent occupancy and 1 percent ARPOB growth. The commencement of a 200-bed leased facility in Sarjapur, Bengaluru, in Q1 is seen adding to patient volumes.

2. Specialty mix and case complexity

A higher share of high-end specialties such as oncology and complex surgeries is expected to have lifted revenue quality. Choice notes that while ARPOB growth in Q1 is modest, the richer case mix supports long-term revenue momentum.

3. Pharmacy and digital health

Offline retail pharmacy is expected to maintain double-digit growth, driven by store expansion and operational optimisation. Apollo HealthCo’s digital platform, Apollo 24/7, is expected to post flat sequential growth but improved margins. BNP Paribas sees this aiding consolidated EBITDA margin expansion.

4. Cost controls and operating leverage

Reduced spending on Apollo 24/7, better operating leverage from higher patient volumes, and integration benefits from recent acquisitions are likely to have supported margins. HSIE projects a 26bps YoY improvement to 13.5 percent, while BNP Paribas forecasts an 80bps expansion to 14.1 percent.

Segment-wise expectations

Hospitals: Primary growth driver, aided by increased capacity and a higher proportion of high-end procedures.

Pharmacy: Continued expansion in offline stores; stable margins expected.

Diagnostics: Steady patient and test volume growth; margins likely stable.

Digital Health: Margin improvement from lower operating expenses and efficiency gains.

What to track in Q1FY26 earnings

EBITDA Margin Guidance: Whether management maintains its expansion outlook for FY26 amid new capacity additions.

Pharmacy Business Demerger: Status of the planned separation and its impact on group profitability and cost structure.

Occupancy and ARPOB Trends: Clarity on demand in new facilities and whether ARPOB growth accelerates beyond the low-single-digit range.

Digital Health Performance: Updates on Apollo 24/7 monetisation and integration with physical infrastructure.

Capex and Expansion: Progress on the plan to add over 2,500 beds in the next two years, with timelines and capital deployment details.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.