In order to generate alpha in the current market where most sectors are trading at high valuations, investors need to look at sector rotation and identify stocks that are neglected, according to experts. They picked stocks in chemicals, IT, mining and PSUs despite some of them having seen a rally recently.

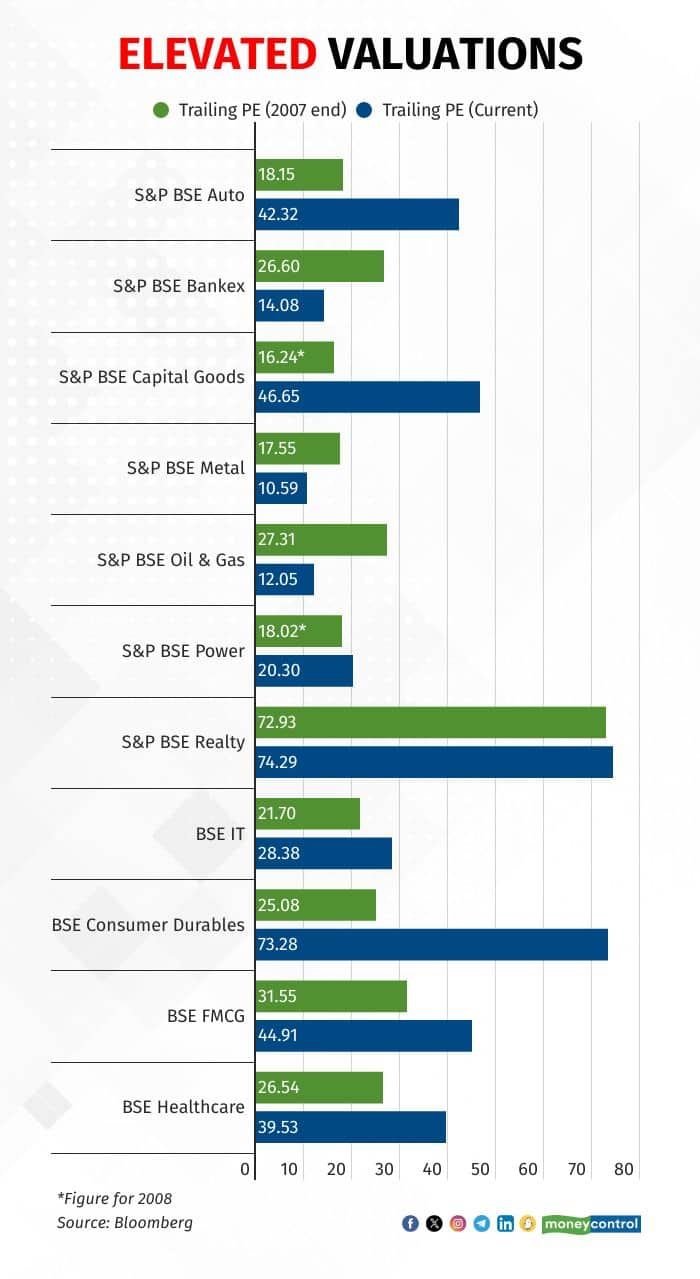

The market is near its peak with the Nifty hitting an all-time high of 20,156.45 points on September 15 before correcting 2 percent. Most segments in the current market are trading at valuations higher than their long-term averages. This is a different picture from the market highs of 2007, where only a few sectors were overvalued.

According to Bloomberg data, the BSE Realty Index was trading at a trailing price-earnings (PE) multiple of 72.93 at the end of 2007, significantly overvalued compared to other sectors. While the realty index in this market peak is trading at similar values (74.29), other segments of the market are also trading at high valuations, mainly Consumer Durables (73.28), Capital Goods (46.65) and FMCG (44.91).

Elevated Vaulations across different sectors

Elevated Vaulations across different sectors

Sandeep Tandon, CEO of Quant Mutual Fund, said investors need to combine other perspectives like macro data, liquidity and risk appetite to generate alpha. “Look at public sector enterprises. Most money managers still like to ignore it. But look at the returns. They are still trading in a very attractive zone. There are mining and metal companies. Mining in particular is very attractive,” he said at Moneycontrol’s Mutual Fund Summit in Mumbai on October 11.

Despite rallying 28 percent in the last six months, the PE of the BSE PSU Index is at 8.97. The BSE Metal Index is trading at 16.74 PE.

IV Subramaniam, CEO, Quantum Advisors, weighed on large-cap IT stocks despite their current underperformance. “If you look at the long-term business potential of those businesses (large-cap IT), they can generate a lot of cash. The large IT companies despite the possible slowdown look very attractive if you understand the business models and how they thrive even in bad times,” he said.

Prabhakar AK, head of research, IDBI Capital, pointed out the opportunities in chemical stocks. “Many chemical stocks have not performed recently. I find a lot of value there”, he said.

Chemical stocks have either been trading negatively between 2 and 12 percent year-to-date like Navine Fluorine, Deepak Fertilisers and SRF, or underperforming the Sensex, like Deepak Nitrite, which has risen 4 percent year to date compared to the BSE benchmark which has risen 7 percent. Chemical stocks have been under pressure due to weak demand and inventory dumping from China.

“Deepak Fertilisers is doing backward integration, where they are putting up an ammonium plant and that will come onstream very soon. SRF is forward integrating and backward integrating, so they have a lot of chemicals coming in,” Prabhakar added.

Backward integration is the process of taking over the supply chain of a company’s business. In forward integration, a company takes over its distribution processes.

All the analysts agreed that there are opportunities for growth in different sectors. “I think there are enough opportunities in the market as long as we are looking with an open mind and not with a very rigid approach and the sector rotation is the thesis to generate alpha even in the current scenario,” Tandon added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.