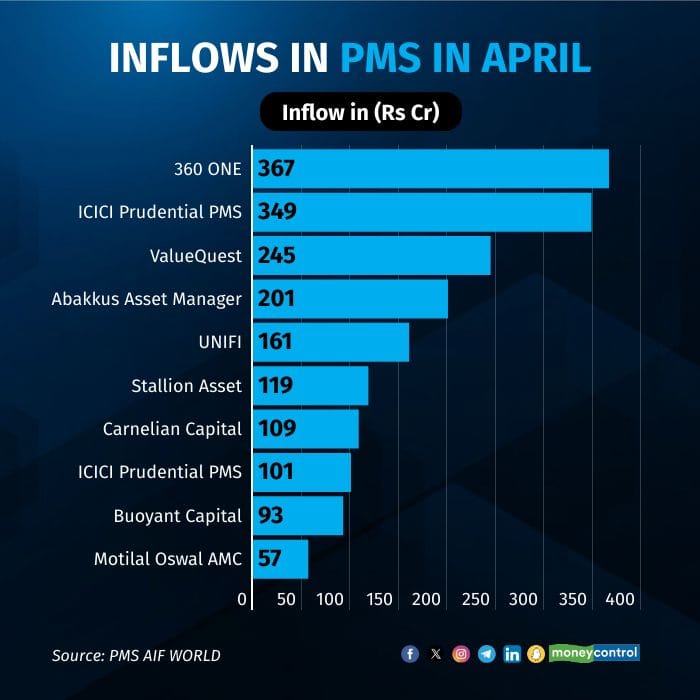

360 One, ICICI Prudential PMS, ValueQuest, Abakkus Asset Management, and UNIFI have received the highest month-on-month (MoM) inflows in their respective portfolio management services (PMS) strategies in April, as per data by PMS AIF WORLD. The rankings pertain to portfolios with assets under management of over Rs 1,000 crore.

360 One's Multicap strategy has seen the highest MoM inflows of Rs 367 crore in April. As of April 30, its AUM stands at Rs 4,380 crore. This is followed by ICICI Prudential PMS' Contra Strategy with inflows of Rs 349 crore in April. As of April 30, its AUM was at Rs 6,164 crore.

ValueQuest's Platinum Scheme stands third in terms of highest inflows in April. It received Rs 245 crore worth inflows in the same period and has given returns of 7.25 percent in April. As of April 30, it manages Rs 1,885 crore.

"The surge in PMS activity this April can be explained by the start of a new financial year. Wealth management firms and private banks have likely revamped their product offerings, and since PMS products are primarily sold through these channels, many products could fit their product team’s requirements. Additionally, the rigorous stock selection processes employed by most PMS approaches, and their investment philosophy, combined with their track records of performance, would have made them more attractive options for distribution by wealth managers and private bankers," said Pallav Rajan, founder at PMS Bazaar.

After ValueQuest, Abakkus Asset Management's All-cap Approach received inflows worth Rs 200 crore, taking the total AUM to Rs 5,706 crore as of April 30. It has given returns of 4.6 percent in April.

UNIFI's Blended Rangoli Portfolio is fifth in terms of inflows received during the month. It has received MoM inflows of Rs 161 crore, taking the total AUM of Rs 14,853 crore in April.

Stallion Asset's Core Fund received inflows of Rs 119 crore with an AUM of Rs 1,635 crore in April. The portfolio has given returns of Rs 7.81 percent in April. Carnelian Capital's Shift Strategy has received inflows worth Rs 109 crore in April, giving returns of 8.5 percent in the same period.

On the eighth number, ICICI Prudential PMS' PIPE Strategy saw inflows of Rs 100 crore in the same month, taking the total AUM to Rs 5,329 crore. It has given 9.1 percent returns in April.

After that, Bouyant Capital's Opportunities Strategy saw Rs 93 crore worth inflows in the same month. Currently its AUM is at Rs 3,000 crore and has given 6.55 percent returns in April. Motilal Oswal's Founders Portfolio saw inflows worth Rs 57 crore and has given returns of 5.37 percent in April.

Kamal Manocha, founder and CEO of PMS AIF WORLD said, "Over past 5 years, PMS product structure has seen increasing demand from HNIs and UHNIs, because unlike Mutual funds where investors inherit model portfolio and net asset value, in PMS a new portfolio is created for each client. And, at high market levels, these investors find better comfort in the 2nd approach."

Redemptions

ASK's Indian Entrepreneurship Portfolio saw the highest redemptions totaling to Rs 617 crore in April. Its AUM reduced to 18,197 crore in the same period.

Marcellus Investment Managers' Consistent Compounders Portfolio saw outflows worth Rs 345 crore in April, reducing the portfolio size to Rs 4,818 crore in the same period.

ASK's India Select Portfolio witnessed the third highest redemptions worth Rs 99 crore in April. Its AUM reduced to Rs 2,892 crore in the same period.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.