The value of pledged shares for the July-September quarter of the companies tracked by Edelweiss Alternative Research stood at around Rs 2 trillion, about 1.3 percent of the total market capitalisation of the firms.

The analysis is based on 4,062 companies the research firm tracks. It found that 16 percent or 642 promoters pledged a part of their holdings, which is in line with the average of the past four quarters, the research house said in a note.

Promoters often raise money against their holding in their companies from various financial institutions to meet working capital requirement, personal needs or to fund ventures. Their shares act as collateral, with promoters retaining ownership.

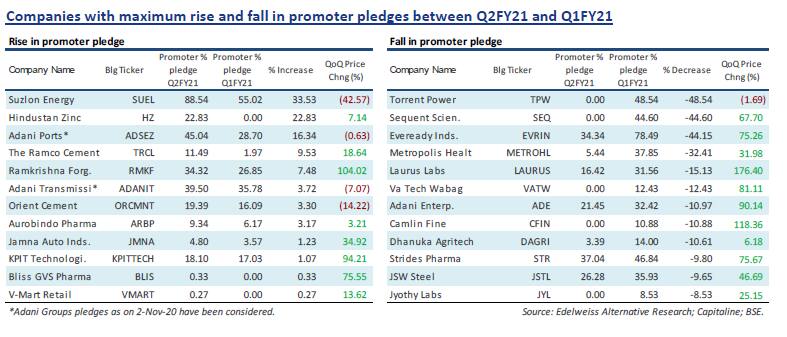

Ten companies with market-cap of more than Rs 100 billion had more than 25 percent of the promoter holdings pledged. Edelweiss has highlighted 12 companies that saw the most rise in pledges in the July-September quarter.

These include Suzlon Energy, Hindustan Zinc, Adani Ports, The Ramco Cement, Balkrishna Forging, Adani Transmission, Jamna Auto and V-Mart Retail.

Pledging of shares does not necessarily imply that a company or a promoter is under financial stress but experts still advise caution in case investors have one of these companies in their portfolio.

“Ideally promoters’ pledging shares is not considered a good sign as it directly exhibits their current liquidity situation. Currently, the market is upbeat and not at all in a bad shape, hence promoters intention matter the most,” Sacchitanand Uttekar, DVP – Technical (Equity), Tradebulls Securities told Moneycontrol.

“If he is trying to stabilise any of his other existing businesses or capitalising on any fresh opportunity makes a huge difference in the long term. But the overhang still remains, as with any drastic shift in markets, from good to ugly, generally forces the lenders to take action which, in turn, eventually impacts the price performance of the stock,” he said.

Uttekar added that it was ideal to remain cautious and refrain from adding such ideas to one's folio.

Drop in pledge

Stocks that have seen the maximum fall in promoter pledge include Torrent Power, Eveready Industries, Laurus Lab, Va Tech Wabag, Strides Pharma, JSW Steel, and Jyothy Labs, data from Edelweiss Alternative Research shows.

“While an increase in pledge is seen as a dangerous sign for the company’s shareholders, but a decreasing trend can be seen as a positive sign. A higher percentage of promoter pledge could lead to higher risk and volatility in the stock price,” Umesh Mehta, Head of Research, Samco Group told Moneycontrol.

Investors should ideally avoid companies that have a high promoter pledge or in fact stay away from any promoter pledged companies during such uncertain times, he said.

“This very same pledge can stab a shareholder’s back as we have seen in many instances in the past. Hence, it is advisable to pick companies which have zero pledged shares by promoters,” he said.

Stocks that have seen a reduction in pledging activity in the past three quarters (sorted by market cap) include Sun Pharma (Q2FY21- 9.09% vs. Q4FY20-13.22%), Motherson Sumi (Q2FY21- 10.69% vs. Q4FY20- 13.05%), Adani Enterprises (Q2FY21-21.45% vs. Q4FY20- 49.79%), Apollo Hospital (Q2FY21- 33.65% vs. Q4FY20- 36.66%), Max Financial (Q2FY21- 90.32% vs. Q4FY20-94.76%), etc among others.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.