Listed property developers had a rocking festive season in Q3FY22 thanks to low mortgage rates, stable residential prices, strong salary/hiring growth in the IT/ITeS sector, and continued work-from-home driving demand.

While the advent of the third wave is expected to eat into demand for residential properties in Q4FY22, developers are expected to garner sales through digital channels and the work-from-home norm, which is fuelling demand in big cities.

"The waning of the second Covid wave, record low mortgage rates and strong hiring/salary growth in the IT/ITes sector led to developers preponing many launches to August-September 2021, which saw strong buyer demand. As per our channel checks, this momentum has carried forward into Q3FY22 (the festivals of Dusshera and Diwali), and we expect developers to post record sales booking numbers in H2FY22 led by new launches,” said Adhidev Chattopadhyay, Vice President, Equity Research, at ICICI Securities.

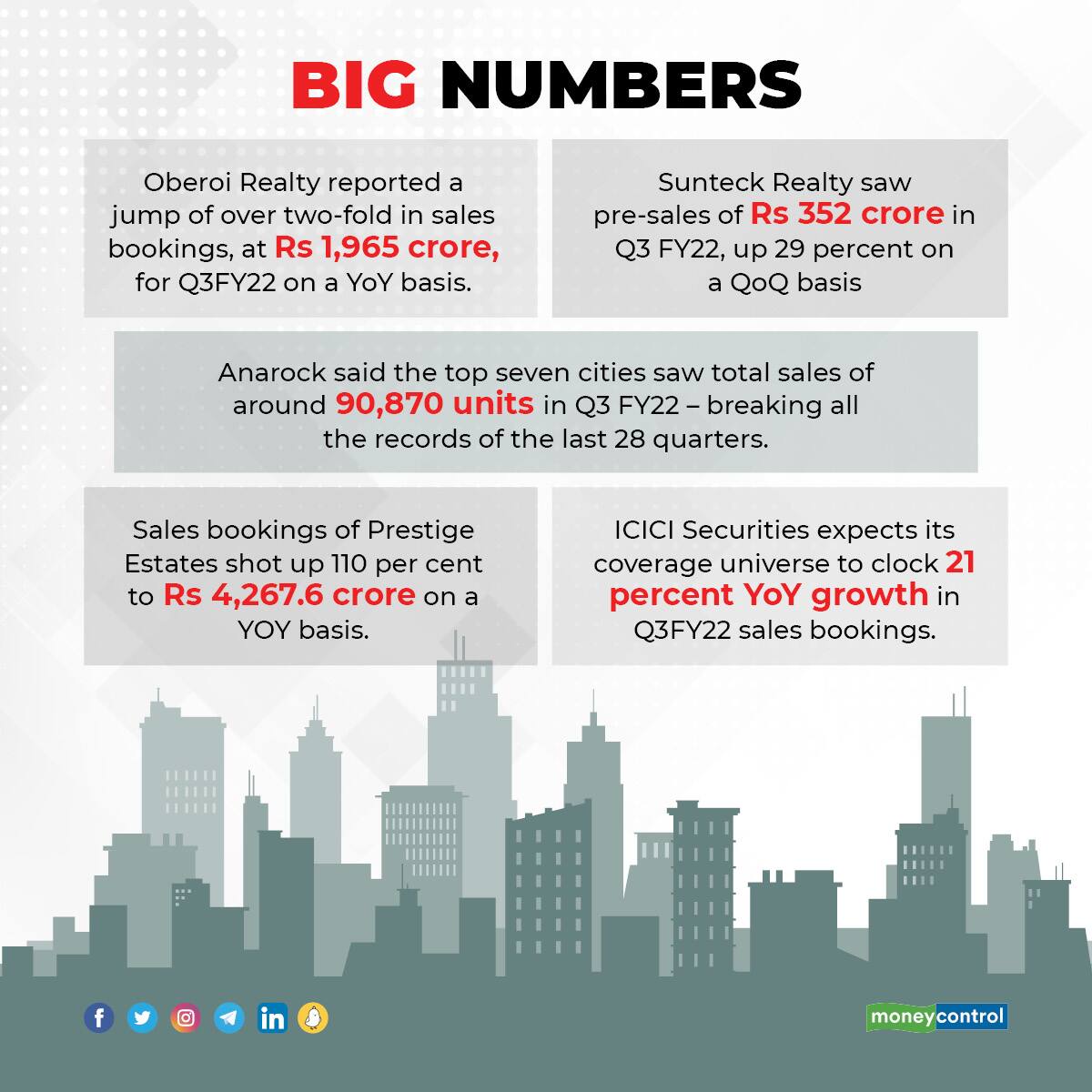

Chattopadhyay expects their coverage universe to clock 21 per cent YoY growth in Q3FY22 sales bookings. He expects sales to remain flat on a QoQ basis owing to the high base of the previous quarter.

A record-breaking quarter

As per property consultant Anarock, the top seven cities witnessed total sales of approximately 90,870 units in Q3 FY22 -- breaking all the records of the last 28 quarters (seven years). “A large part of overall housing sales was driven by leading listed developers, mainly because consumer preference has tilted towards branded developers, even if it comes at a premium. As seen last year, new supply by leading and listed developers went up significantly on the back of growing demand,” said Anuj Puri, Chairman of Anarock Property Consultants.

Anarock indicated that housing sales in Q3FY22 witnessed a 79 percent surge against the same quarter in Q3FY21, when housing sales stood at nearly 50,890 units in the top seven cities.

“Residential sales had already gained momentum in the second half of FY21 on the back of decade-low mortgage rates, pent-up demand, soaring emotional value on home-ownership,” said Sharad Mittal, Chief Executive Officer of Motilal Oswal Real Estate (MORE).

Mumbai-based Oberoi Realty reported an over two-fold jump in sales bookings, at Rs 1,965 crore, for the third quarter ended December 2021, on higher demand.

Another Mumbai based developer, Sunteck Realty, had pre-sales of Rs 352 crore in Q3 FY22, up 29 percent on a QoQ basis and flat on a YoY basis.

“As seen by the numbers, Sunteck has registered very healthy pre-sales numbers across segments -- luxury to aspirational luxury. In the coming quarters, we expect to sustain such a robust momentum in pre-sales numbers with many planned launches of projects, significantly increasing our market share,” said Kamal Khetan, Chairman and Managing Director of Sunteck Realty.

Sales bookings at Prestige Estate Projects shot up 110 percent to Rs 4,267.6 crore from Rs 2,026 crore in Q3 FY21. Prestige Estates also posted its highest-ever quarterly collections in Q3 FY22, at Rs 2431.6 crore, surging 70 percent on a yearly basis.

Shares of Oberoi Realty, Prestige Estates Projects and Sunteck Realty rose 14.47 percent, 18.22 percent and 33 percent, respectively, over the last month, indicating investor enthusiasm in these stocks post their strong performance. In comparison, the BSE Realty Index rose 9.29 per cent over the same period.

Sales set to sustain

Given the lower hospitalisation level and mild symptoms in the third wave of the pandemic, experts such as Anarock’s Puri anticipate a minimal impact on sales and new launches. “As long as the third wave remains less catastrophic and there are no major restrictions, residential real estate may be less impacted. In another advantage, the government has also reduced the quarantine period for covid patients, which, in turn, is good," Puri said.

Mittal of MORE believes that just like the second wave, the third wave will be a temporary hurdle as the Government is now better prepared, and the nationwide vaccination level is far higher.

“We believe that the fundamental factors all point towards rising residential demand in the future. We believe that residential demand will remain steady and will continue to increase over the next 24 to 36 months – as it enters a growth cycle that is mainly consumption driven," Mittal said.

Abhishek Shukla, Associate Director, India Ratings, believes the economic impact, too, might be limited as lockdowns have become much more nuanced and narrower in their scope. “Therefore, we think that the sales momentum will largely continue. There will be some dip in demand when lockdowns are imposed. But the impact will be only to postpone purchases by a few months and there should be little medium- or long-term impact," he said.

Chattopadhyay of ICICI Securities said a common theme is that while developers launched a few projects during the festive season, the bulk of the planned FY22 launches are expected to happen in Q4FY22 (January-March 2022), as developers have focused on selling inventory in projects launched in Q2FY22 and near-completion/completed inventory.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.