The highly anticipated initial public offering (IPO) of Zomato opened for subscription today, July 14. The food aggregator closed its anchor book a day earlier.

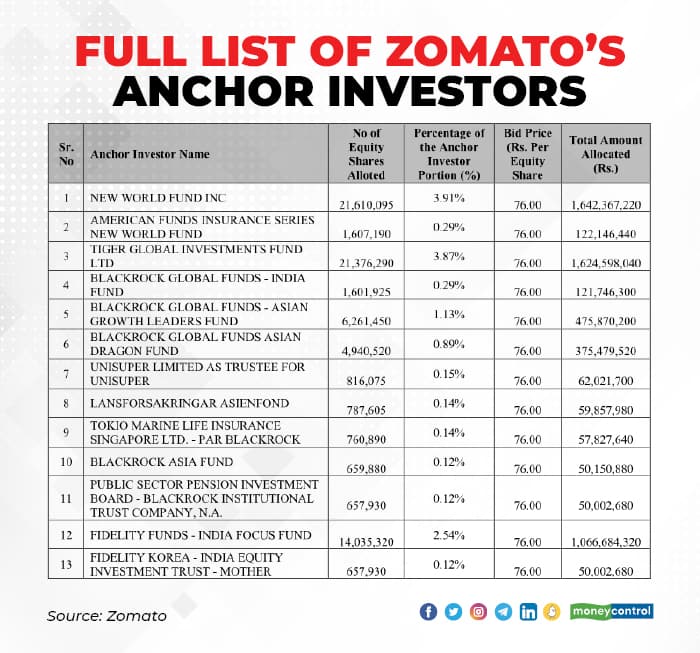

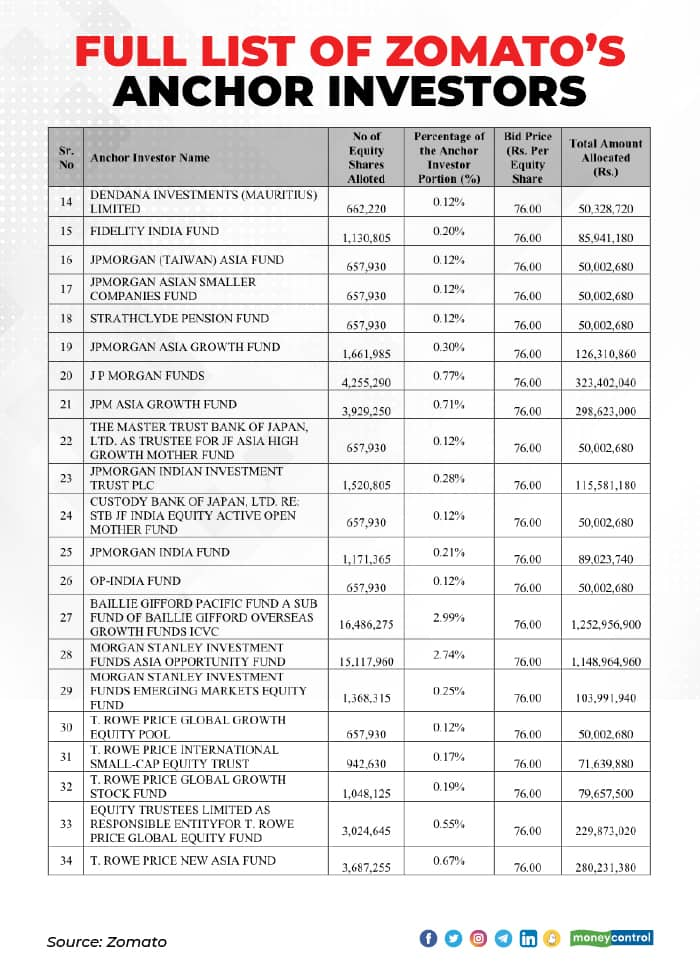

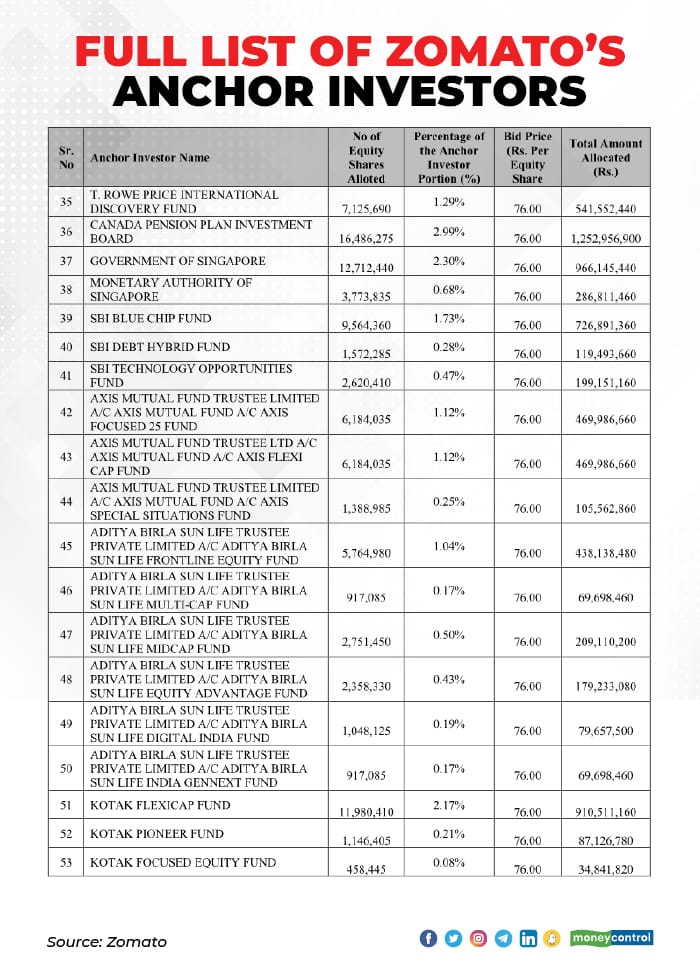

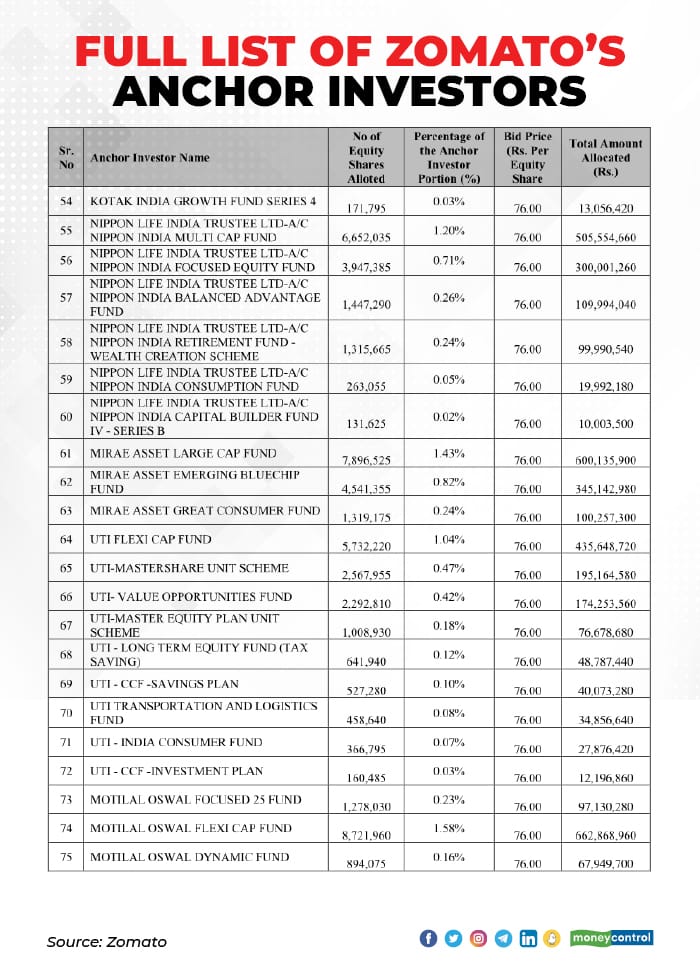

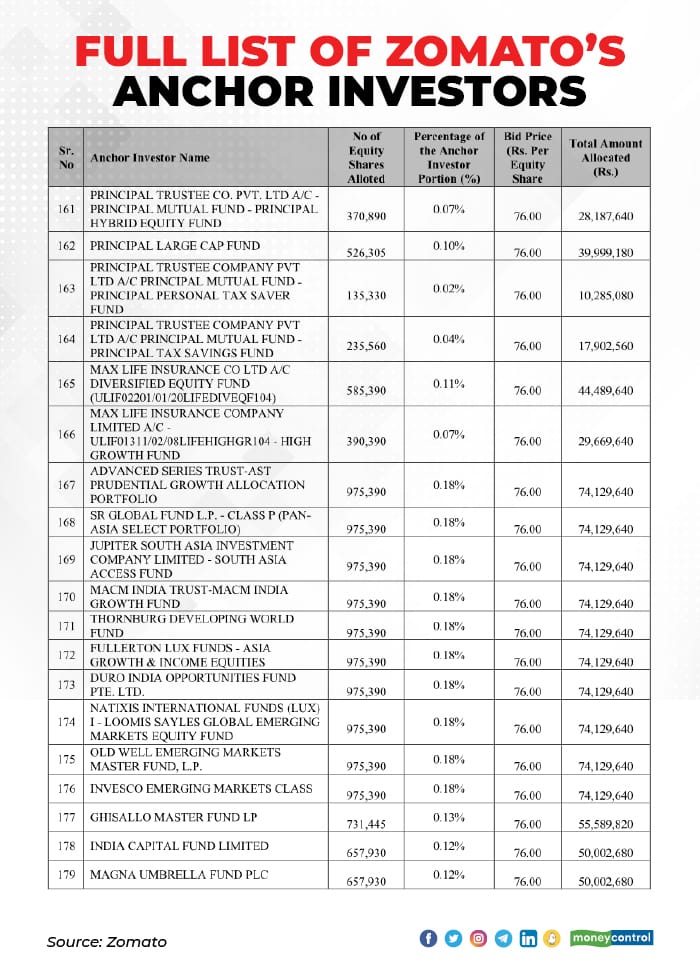

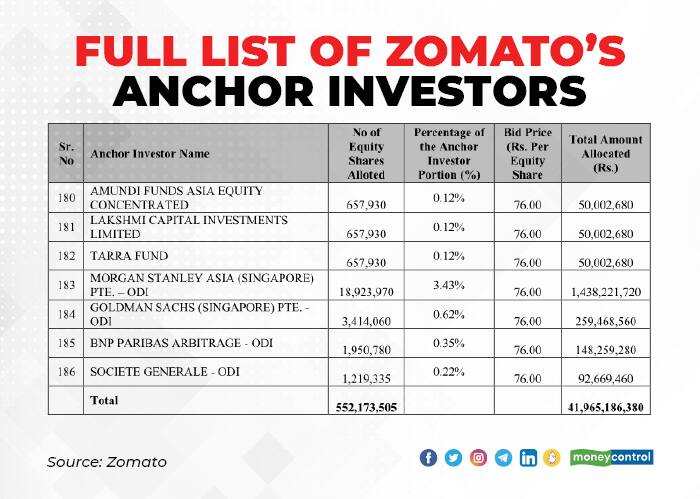

As expected, Zomato received a strong response from both global and domestic institutional investors for its anchor book. About 186 anchor investors were onboarded at Rs 76 per share, the higher end of the price IPO brand, Zomato said in a statement.

These include Government of Singapore, Monetary Authority of Singapore, WF Asian Smaller Companies Fund, Carmignac Portfolio, Steadview Capital Mauritius, Wellington Trust Company, Nomura, Aberdeen Global India Equity, Goldman Sachs, Schroder International, TKP Investments, Abu Dhabi Investment Authority, HSBC Global, UBS, Societe Generale, and Invesco Emerging Markets Class.

Also read - Zomato IPO: 10 key things to know about the issue and the company

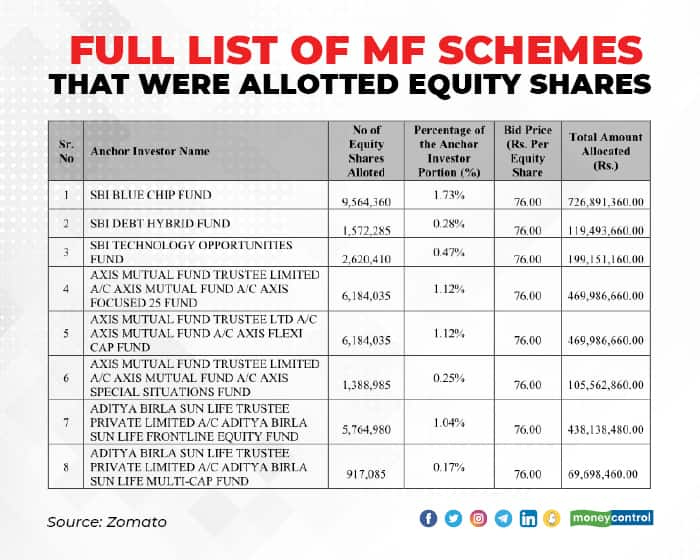

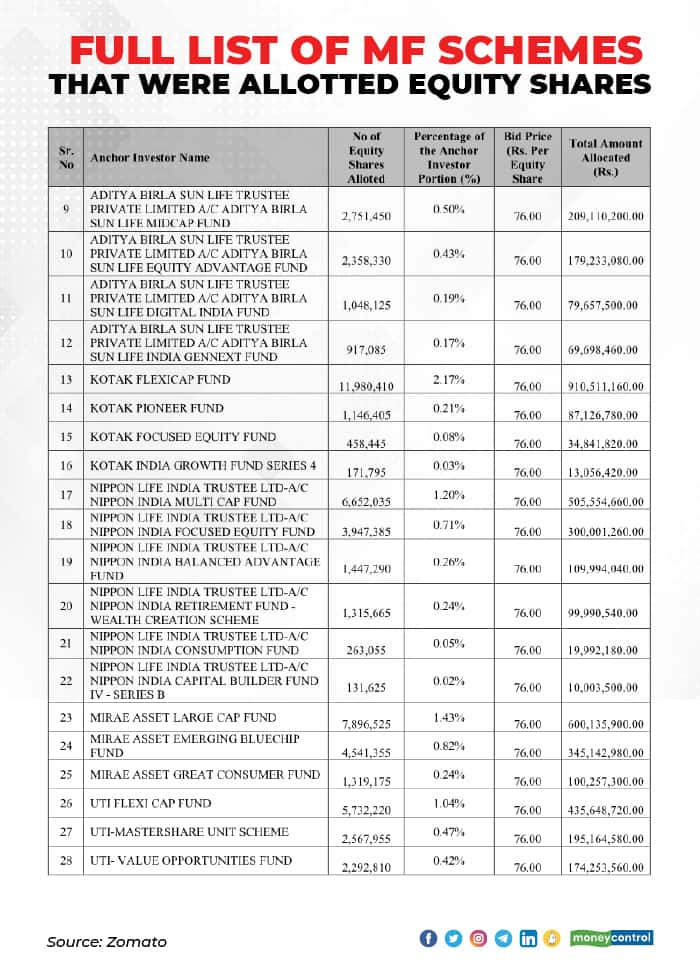

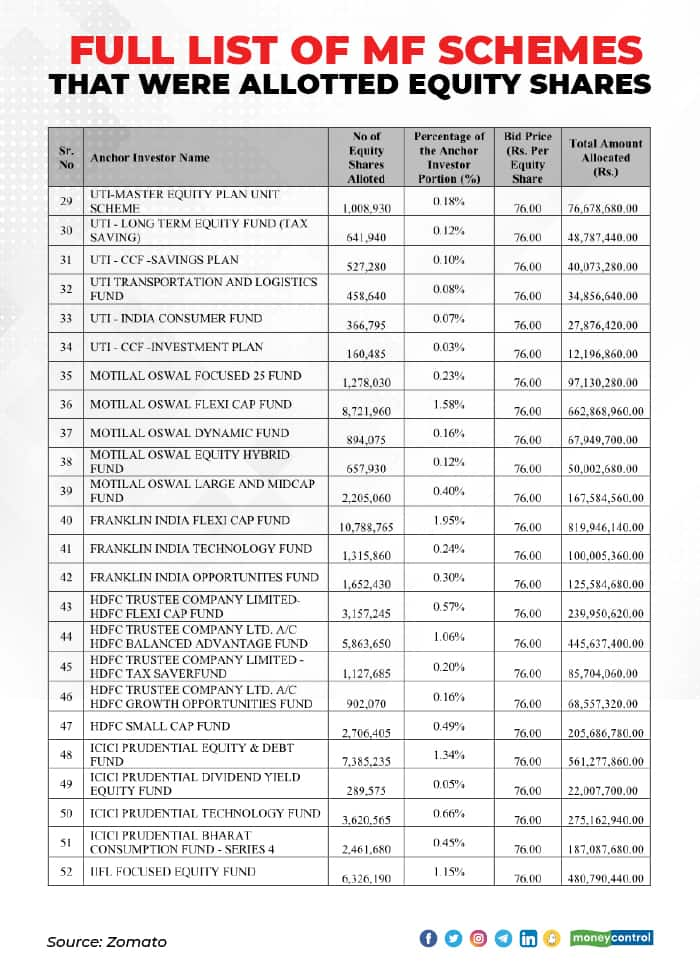

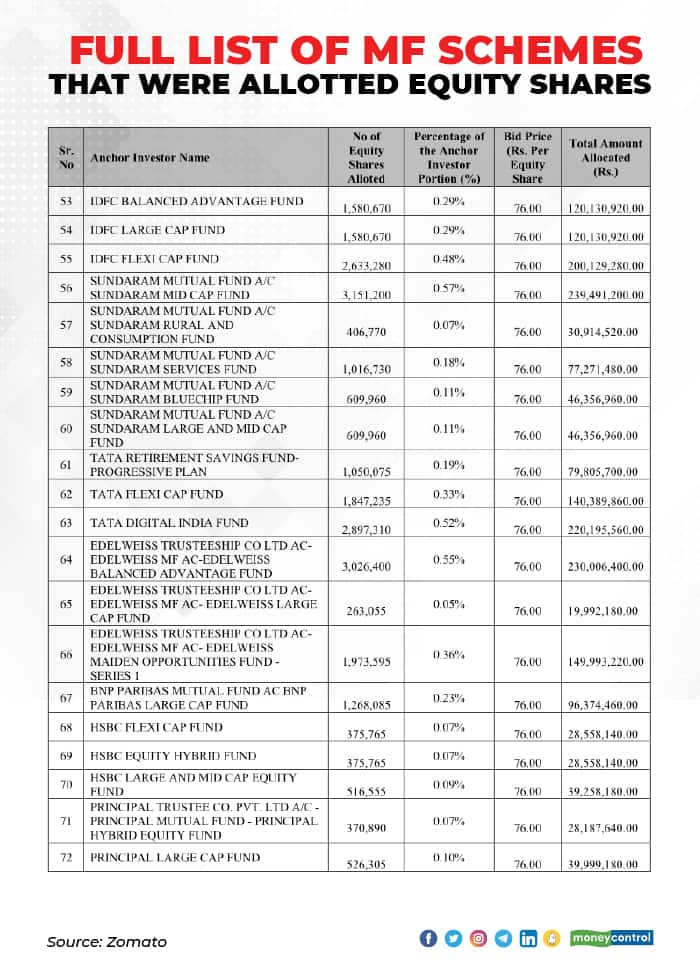

Zomato said 19 domestic mutual funds participated in the anchor book through 74 schemes. These include SBI Mutual Fund, Axis Mutual Fund, Aditya Birla Sun Life Insurance, Kotak MF, Nippon Life, UTI MF, Motilal Oswal MF, HDFC Trustee, Franklin India, HDFC MF, ICICI Prudential, IIFL MF, IDFC MF, Sundaram MF, Tata MF, Edelweiss Trusteeship, HDFC Life Insurance, and Max Life Insurance

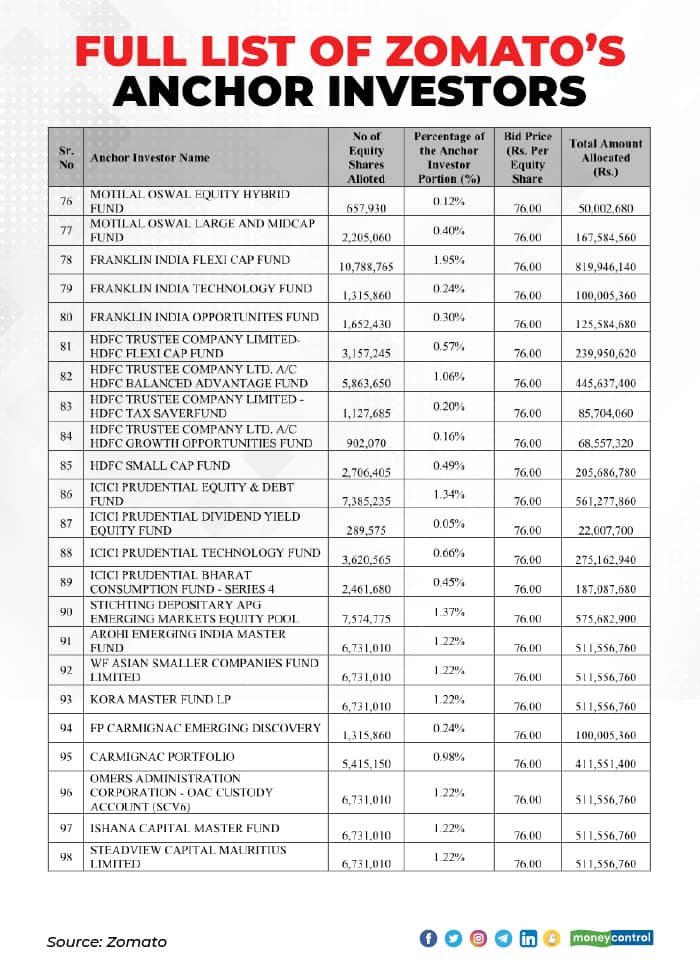

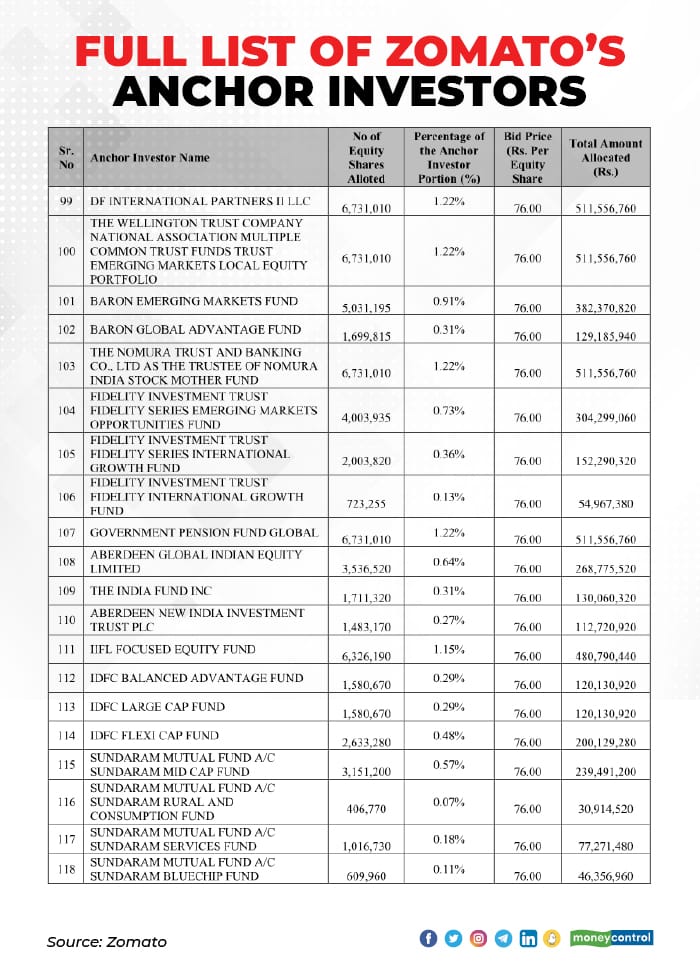

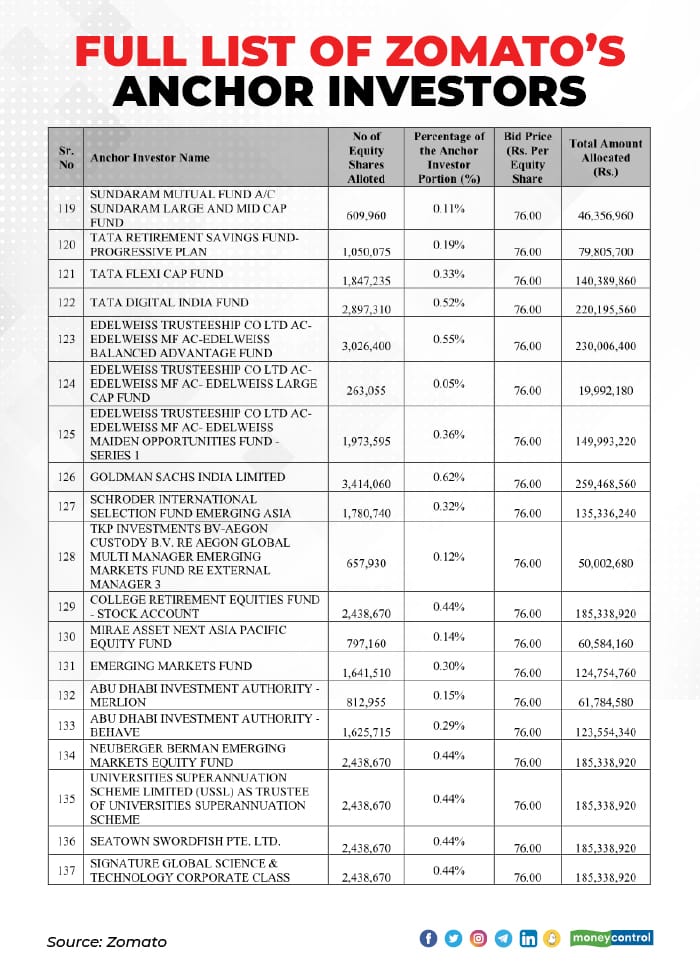

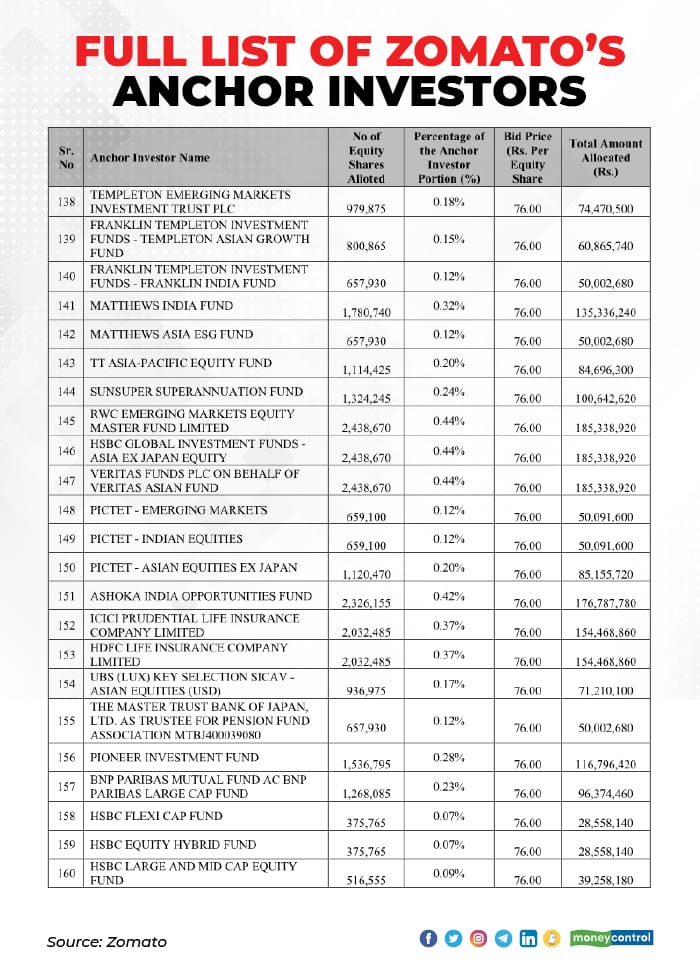

Check the complete list of anchor investors below:

The public issue will close on July 16. Zomato is eyeing Rs 64,365 crore or $8.7 billion post-money valuation.

At the time of writing this report, the issue was subscribed 29 percent, receiving bids for 20.94 crore equity shares against the IPO size of 71.92 crore equity shares.

At the forefront were retail investors, whose reserved portion was subscribed 1.54 times. Non-institutional investors put in bids for 5 percent against their reserved portion, while qualified institutional buyers put in bids for 2.69 lakh equity shares against their reserved portion of 38.88 crore equity shares. The portion set aside for employees was subscribed 4 percent.

To Know All IPO Related News, Click Here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.