After the coronavirus outbreak, it looked that the primary market was down in the dumps but with the smart recovery by Indian shares following the March crash and the gradual easing of the lockdown, the launch of Rossari Biotech public offer in July ushered the IPO season in earnest.

After the successful launch of SBI Card, Rossari Biotech launched an IPO in March but then cancelled it. It was also the first company to kick off the IPO season in July amid COVID-19 crisis. The overwhelming response to the Rossari Biotech IPO saw others take the plunge and the rest of the year was busy.

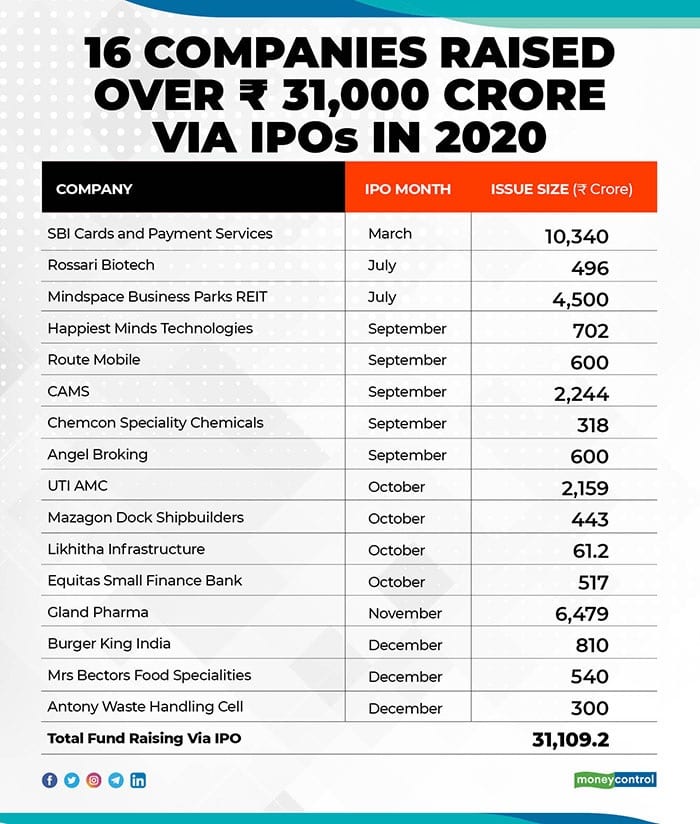

Mindspace Business Parks REIT came in July, then August was quiet. September and October were pretty busy months as Happiest Minds Technologies, Route Mobile, CAMS, Chemcon Speciality Chemicals, Angel Broking, UTI AMC, Mazagon Dock Shipbuilders, Likhitha Infrastructure and Equitas Small Finance Bank launched their IPOs.

Gland Pharma came in November and then Burger King India, Mrs Mrs Bectors Food Specialities and Antony Waste Handling Cell IPOs followed in December.

The majority of IPOs got a great response from investors, given the niche businesses, strong market share and expected economic recovery.

Sixteen companies came out with IPOs during 2020 against 17 the previous year but the fund-raising in 2020 was much higher at more than Rs 31,000 crore compared to Rs 17,433 crore in 2019.

If we include the Yes Bank FPO, then the fund-raising via public issues would be more than Rs 46,000 crore.

The success of IPO market attributed to a buoyant mood in the secondary market. The benchmark indices surged more than 79 percent from March 23's low to hit a new high. The broader markets also joined the party later with the Nifty midcap index rising 86 percent and smallcap up 103 percent.

Liquidity, especially after trillions of dollars were pumped in by global central banks, was one of the key reasons behind the success of the primary as well as the secondary market.

"Strong institutional flow has supported a record equity capital market year. The revival in the second half (H2) helped the IPO market to gain traction in CY20. Investors preferred to invest in sector leaders or dominant players anticipating that such companies would emerge stronger and as winners post-COVID," V Jayasankar, Senior ED & Head ECM at Kotak Mahindra Capital Company said after an investment banking meeting in December.

The year 2021 is also likely to be strong, given the big line up of IPOs and expected strong market conditions along with economic and earnings recovery, experts said.

"I believe the Indian stock market will continue its movement in 2021 and the primary market will also mirror the same story. Looking ahead, continued improvements in the global risk appetite and expected improvement in domestic economic activity reflecting a rise in GDP growth will further boost Indian equities to perform well," Prashanth Tapse, AVP Research at Mehta Equities told Moneycontrol.

"IPO pipeline will continue to remain strong as there are quality IPOs lined up including Kalyan Jewellers, Suryoday Small Finance Bank, ESAF Small Finance Bank, Nazara Technologies, RailTel Corporation, Indigo Paints, Stove Kraft, Samhi Hotels, Apeejay Surrendra Park Hotels, Zomato and nation's financial behemoth LIC," he said.

Jayasankar also said the outlook remains optimistic for the equity capital market business.

In CY21, "we may continue to see heightened IPO activity dominated by resilient sectors like new-age tech, healthcare and consumer. Given the robust IPO markets, we expect many unlisted corporates to list earlier than previously envisaged. The need for growth capital, deleveraging to support growth as well as building buffer capital to face challenges arising on account of COVID-19 will see a buoyant fundraising activity," he said.

"Recovering sectors like hospitality, commercial real estate (REITs) and BFSI will also tap the IPO market," he added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!