After almost 29 years, a TVS group company is heading for an initial public offering (IPO). On August 7, TVS Supply Chain Solutions announced that its IPO will be open for bidding from August 10 to August 14. The last TVS Group company to be listed was TVS Electronics in 1994.

TVS Supply Chain Solutions began operations as a part of the group under the name TVS Logistics before becoming a separate company in 2004.

Today, TVS Supply Chain Solutions, or TVS SCS, as a global supply chain company, provides end-to-end solutions to Fortune 500 companies across the world. The business is divided into two main components: Integrated Supply Chain Solutions and Network Solutions.

ALSO READ: TVS Supply Chain Solutions IPO records 36% booking on debut

Under Integrated Supply Chain Solutions, the company provides technology-based solutions for sourcing and procurement, integrated transportation, product management solutions, logistics operation centres and in-plant logistics such as finished goods and after-market fulfilment among others.

Under Network Solutions, it provides two types of services: Global Freight Solutions and Time Critical Final Mile Solutions, which include a variety of services such as spare parts logistics services, return, refurbishment and engineering support and courier services to B2B businesses, both large and small.

Translated, what this means is that, a manufacturing company, after having recognised its suppliers and customers, need not bother about how to get things “moving.” It can outsource the entire operations to TVS Supply Chain, which will pick up the raw material from anywhere in the world and get it to delivered to the company’s factories, and pick up finished good and deliver to its customers, be it in India or abroad. All the works along the way, be it warehousing or booking containers for transport, or taking care of custom clearances, the company will take care of everything.

Now, we know India is likely to grow exports big-time, thanks to government’s thrust and global companies’ push to diversify their sourcing base beyond China, widely termed as a China-plus-one strategy. This obviously means more business for a company like TVS Supply Chain.

On solid ground

Analysts believe the company has the competitive strength to provide end-to-end supply-chain solutions. So far, the company has grown largely through acquisitions, about 16 acquisitions over the past 17 years. Thus, it has both the domain expertise, and the global presence, which means it can replicate the know-how to future customers operating in a variety of geographies and industries.

Currently, TVS SCS has clientele in 26 countries across Europe, Asia (including India) and Australia.

According to a report by HDFC Securities, with the use of integrated, data-driven, end-to-end solutions, the company has been able deliver value to customer and gain their trust. This has mean high rate of repeat customers, which ensures a steady flow of business from existing customers, even as the company focusses on new customer additions.

“Our unit of measure is a project or a contract; how many contracts do we have, what is the longevity of these contracts, and what is our renewal ability…We have a renewal rate of around 99 percent, and it is our ability to win new contracts, which is the focus,” Ravi Viswanathan, Managing Director, TVS SCS, told Moneycontrol during a recent interaction. Recently, it added UK-based Centrica plc to its roster for “supply chain transformation”. Like most of its deals, TVS signed the Centrica deal for 7 years plus.

Diversified portfolio

While the business opportunity for TVS is huge, and it has a replicable model in place, by the very nature of its business, it won’t be immune to any headwinds in global trade, say analysts. This is what the Covid period showed. During Covid, the company’s revenue hardly grew and the business made losses. Only in FY23, it could get back in the green with a profit of Rs 10,311.01 crore.

What saves the day for the company in bad times though is the fact that it has a diversified portfolio. Any slump in one particular industry or country may be off-set by growth in the others. “The global supply chains were impacted and so were many of our customers like electronic components and auto manufacturers. Thankfully, our portfolio is fairly diverse. So we were able to manage the business effectively,” it said. Currently, about 50 percent of TVS SCS business comes from manufacturing; 30 percent comes from non-auto and 20 percent comes from auto. Non-auto businesses include electronics, mining, alternate power, technology and consumer goods while within auto it supports both production and the after-markets. “In many ways, our business model is a de-risked one. In spite of very strong economic headwinds in the western markets because of the war and inflation, last fiscal our business grew,” the management recently told Moneycontrol.

Capital intensity

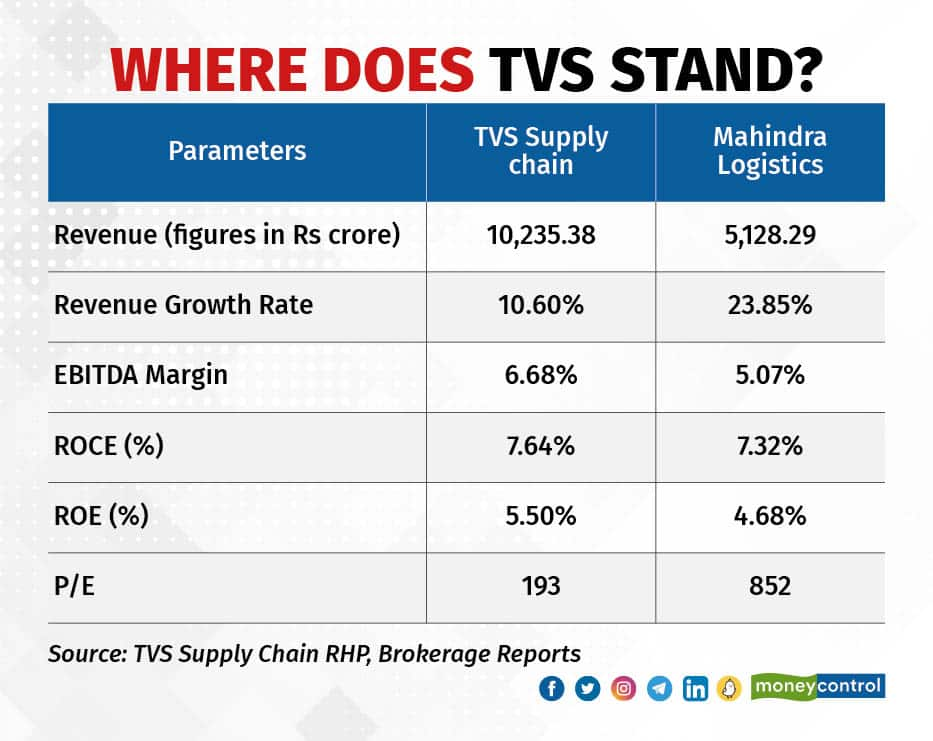

The past three fiscal years for which its financials are available, the company clocked losses in two years. Last fiscal, it recorded a net profit of Rs 41.7 crore as against a loss of Rs 73.9 crore in FY21. EBIDTA margin for FY23 stood at 6.68 percent. Return ratios were also unimpressive with ROE at 5.50 percent and ROCE at 7.64 percent.

.

.

The financial numbers at this point do not point to a very profitable business, although the management boasts of an ‘asset-light’ model and says that it is striving for a double digit EBIDTA by in the next few years. Being asset-light means that the company does not own any its fleet, containers or warehouse space, all of which is great because it means the capital requirement for the business is not too much. It leases warehouses and vehicles and has complete control over control over the capacity and fleet. The scheduling, routing, storing, and delivery of goods are managed by the company, which enables it to maintain control over operational quality metrics while keep things flexible to suit customer requirements.

Yet, the asset-light model is largely seen as a good model, a HDFC Securities report says that the company’s high dependency on third parties and network partners for warehousing and transformation, could impact operations, financials and cash flows. Besides, the company’s freight, clearing, forwarding and handling charges, and manpower expenses (comprising employee benefit expenses, sub-contracting costs and casual labour charges) constitute a significant portion of its operating expenses, which means any increase due to any internal or external factors may also adversely affect kits financials. While these are usually passed on to the clients, it may not always be possible, and depends on what the contracts provide for. Another challenge HDFC Securities points out is its exposure to foreign currency. Fluctuations in the foreign currency could impact both its revenue and borrowings.

India opportunities

While a lot of its presence is international, the growing supply chain market in India and the absence of a large-scale player of its size could be of advantage for TVS SCS in the domestic market, and most analysts believe that’s what makes the company stand out is its diverse set of services with no like-to-like peer in the market. Currently, a large portion of the third-party logistics market in India is highly disorganised.

Nirav Karkera, Head of Research at Fisdom, said, “TVS SCS has the edge of large institutional clients, scale and expanse and the ability to provide end-to-end solutions which no other company does. This definitely has its advantages, including ease in creating synergies across different points in the supply chain process.”

Indeed, the logistics industry in India is expected to grow to $385 billion by FY2027 at a CAGR of 13 percent from FY2022 driven by favourable macroeconomic factors, growth of outsourcing in the Indian logistics sector, and government policies encouraging manufacturing and consumption such as the PLI scheme. Over the last couple of years, on the back of the China Plus One strategy by global companies, the government has been encouraging domestic manufacturing. Analysts believe this could be an additional advantage for the segment.

IPO in focus

TVS SCS had initially announced its intention for an IPO last year but it was reported that this was postponed keeping market conditions and investor sentiments in mind. Through the IPO, the company, which is being valued at Rs 9,200 crore, plans to raise around Rs 600 crore from fresh issue as against Rs 2,000 crore decided earlier. The funds raised, according to the company, will play an important role in helping it overcome past challenges associated with debt. Similarly, it has cut its offer-for-sale to 14.23 million shares from 59 million shares planned earlier. The fixed price band for its initial public offering is Rs 187-197. At the higher end of the issue price, the company is valued at a market-cap of Rs 8,750 crore. The issue is priced at 10.5 times based on its net asset value of Rs 18.89 as of Mar 2023.

Considering the company’s pedigree with the TVS group, which is seen as a shareholder-friendly group, and the tremendous growth opportunity, the stock seems to have the potential to ride the growth wave and create wealth over the long haul. But in the short to medium term, this may not be a great bet. Karkera says he sees good potential for the stock, amongst larger institutional investors. “The sector warrants a lot of institutional interest and these investors are willing to take a longer-term risk on the sector which is in an expansion mode,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.