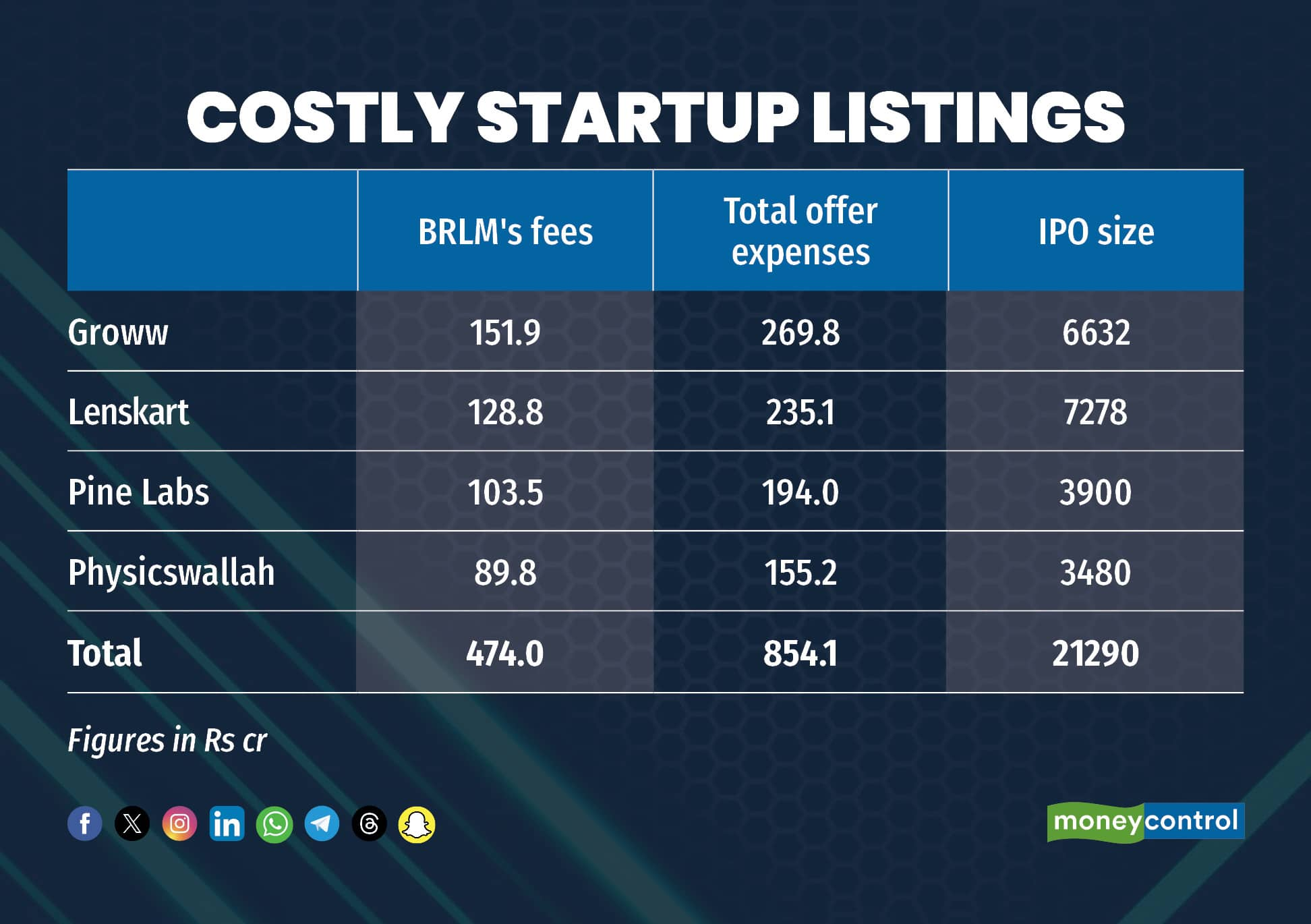

Four high-profile startups — eyewear retailer Lenskart Solutions, investment platform Groww’s parent Billionbrains Garage Ventures, edtech firm PhysicsWallah and fintech company Pine Labs — together shelled out Rs 474 crore in merchant banking fees for their recently launched initial public offerings, according to disclosures in their red herring prospectuses.

The four IPOs, which together mobilised Rs 21,290 crore last week, saw Groww emerge as the highest spender on banker fees at more than Rs 151 crore. Lenskart Solutions and Pine Labs followed with payments of around Rs 128 crore and Rs 104 crore respectively, while PhysicsWallah paid nearly Rs 89.8 crore to its issue managers.

In terms of overall IPO expenditure, Pine Labs’ outgo stood out, with total offer expenses amounting to 5 percent of its issue size, or Rs 194 crore. PhysicsWallah’s total spend came to 4.5 percent, or Rs 156 crore, while Groww set aside 4.1 percent of its IPO proceeds, translating to Rs 270 crore. Lenskart’s total expenditure was about 3.2 percent of the issue size, or Rs 235 crore.

Across the four offers, roughly 55 percent of all IPO expenses were directed towards merchant banking fees. The balance covered listing and regulatory charges, commissions to banks, processing fees of BSE and NSE, legal counsel costs, printing and stationery, and marketing and advertising outlays.

These payouts surpass those made in some of the year’s larger issues. LG Electronics India paid about Rs 226 crore to five banks for its $1.3 billion IPO, while Tata Capital disbursed Rs 159 crore to 10 arrangers for its $1.7 billion listing.

The year has proved exceptionally strong for merchant bankers as the primary market continues its record-setting run. Fundraising has already crossed Rs 1.5 lakh crore, with nearly 85 companies tapping the market.

Data also shows that digital-first companies and startups typically incur higher fee-to-issue ratios. Past listings by firms such as Nykaa, Ola, Yatra Online, Ixigo, EaseMyTrip and Go Digit have recorded total IPO expenses ranging from 4 percent to 11 percent of the issue size.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.