Some pre-IPO investors in Ola Electric could be staring at potential losses because the price band for the public issue is set lower than their average acquisition price—a rare scenario for tech IPOs in recent years. Meanwhile, early investors like Tiger Global, and Matrix Partners stand to enjoy multi-bagger gains.

The Bhavish Aggarwal-led firm has set a price band at Rs 72-76 per share for its IPO.

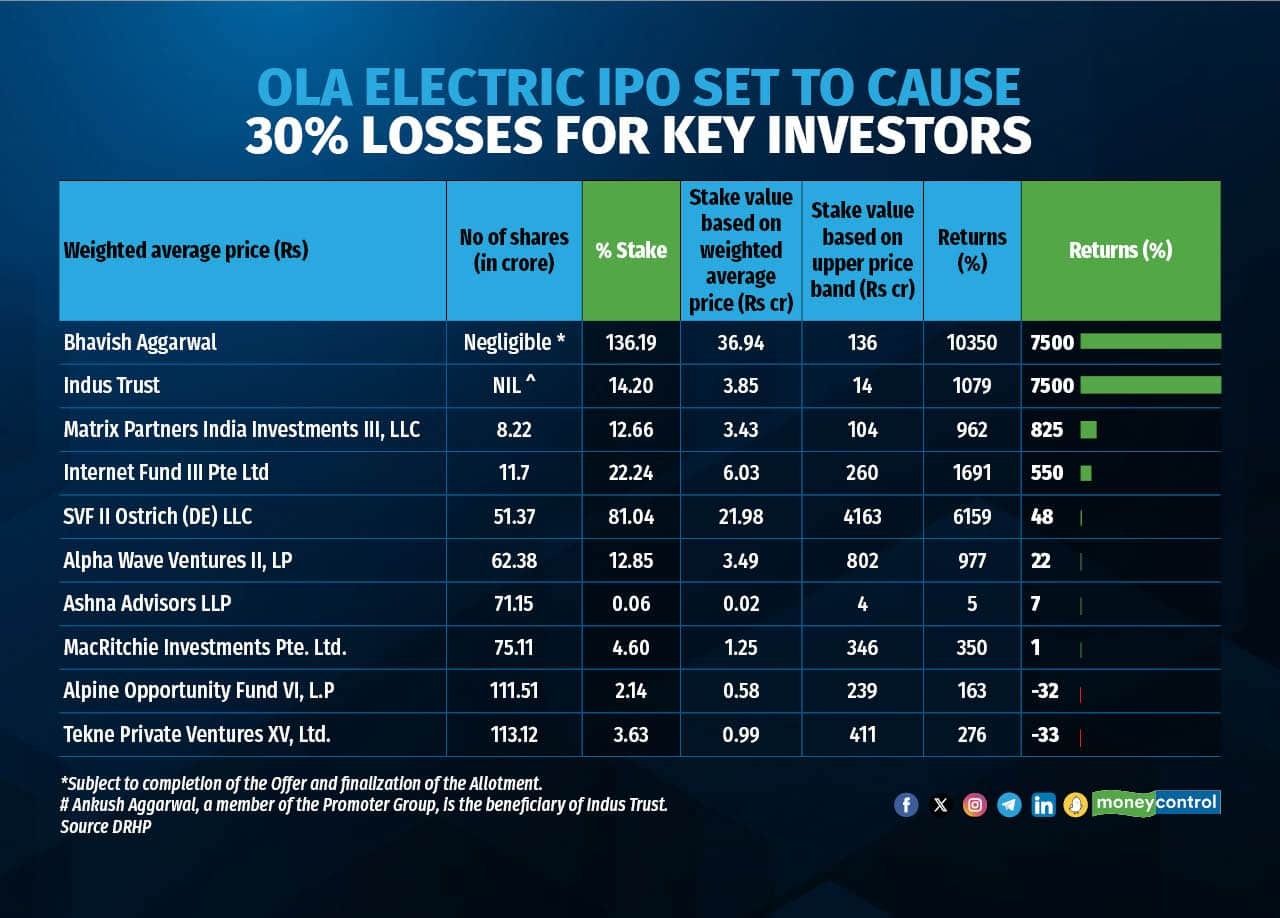

Investors like Alpine Opportunity Fund VI LP, which bought shares at an average price of Rs 111.51, and Tekne Private Ventures XV Ltd, which bought at Rs 113.12 per share, are likely to see over 30 percent losses from upper price band of Rs 76 a share.

Currently, Alpine Opportunity Fund’s 21.42 million shares are valued at Rs 238 crore based on their average price, but drop to Rs 163 crore at the upper price band. Tekne Private Ventures XV’s 36.32 million shares are worth Rs 410 crore based on the average price, but only Rs 276 crore at the upper price band. Both funds will sell part of their stake in OFS.

MacRitchie Investments Pte, backed by Temasek , which bought Ola Electric's shares at an average price of Rs 75.11, will see flat returns. It holds 46.03 million shares, or 1.25% of the company, valued at Rs 350 crore based on the current price band.

Ashna Advisors LLP purchased shares at an average price of Rs 71.15. With 6.01 lakh shares, or 0.02% stake, the fund will realise a 7% return, valuing its stake at Rs 4.58 crore at the upper price band.

Alpha Wave Ventures II LP and SVF II Ostrich DE LLC will see gains of approximately 22% and 48%, respectively. Alpha Wave Ventures acquired shares at an average of Rs 62.38, holding 128.50 million shares (3.49% stake), valued at Rs 976 crore. SoftBank arm SVF II Ostrich DE LLC bought shares at Rs 51.37 each and holds 810.43 million shares (21.98% stake), valued at Rs 6,159 crore.

Internet Fund III Pte Ltd, backed by Tiger Global, and Matrix Partners India Investments III will achieve staggering gains of 550% and 824%, respectively. Internet Fund purchased shares at Rs 11.7 each, holding 222.44 million shares (6.03% stake), valued at Rs 1,690 crore. Matrix Partners acquired shares at Rs 8.22 each, holding 126.62 million shares (3.43% stake), valued at Rs 962 crore.

Bhavish Aggarwal, the firm's promoter, holds 1.36 billion shares (36.94% stake), valued at Rs 10,350 crore based on the price band. He acquired this stake for a negligible amount, according to the DRHP.

At the upper price band, Ola Electric's market cap is about $4 billion, down 25.8% from its $5.4-billion valuation in September 2023, led by Temasek. The lower IPO valuation is due to a global tech valuation correction and Ola's strategy to boost participation, analysts said. The IPO comes as Indian stock markets are trading at record highs.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.