EMS Limited, Ghaziabad-based sewerage and water solutions company whose IPO got fully subscribed on the first day of bidding on September 8, expects its revenue growth to stabilise at about 25 percent in the current financial year 2023-24, Founder and Managing Director, Ashish Tomar, said.

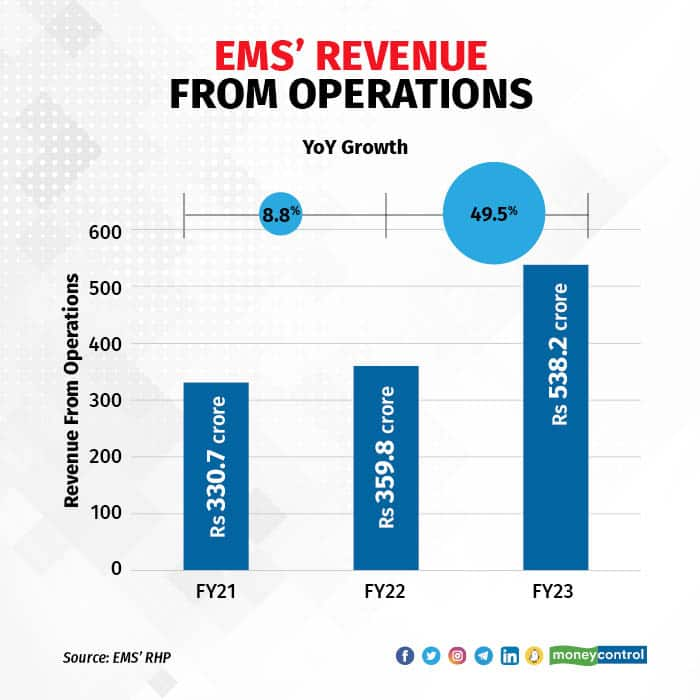

This is slower than the 50 percent revenue jump the company saw in the last fiscal year, 2022-23, due to removal of government restrictions.

"FY23 experienced higher growth due to the government lifting certain restrictions that facilitated the completion of pending projects.

Nevertheless, on a steady-state basis, the company anticipates a 25 percent growth in its turnover," Tomar said in an interview to Moneycontrol.

EMS’ Revenue From Operations

In the past, the company had faced government blacklisting for two reasons: Inadequate safety issues, and incorrect reporting of facts in bid documents.

According to the management, both these issues were addressed by the company. To provide further clarification, the CEO explained that the blacklisting by UP Jal Nigam occurred due to an incident at the Ghaziabad worksite. However, the company sought legal redress through the High Court, which retrospectively ruled that the blacklisting violated the law and subsequently lifted the blacklisting.

On the second issue concerning misreporting of facts too, the company pursued legal recourse through the High Court. This led to the dissolution of the evaluation committee of the Bihar Urban Infrastructure Development Corporation Ltd., (BUIDCo) by the High Court, which then entrusted the evaluation to a panel chosen by the High Court. Ultimately, this panel nullified the department's blacklisting order, allowing the company to secure the project.

Currently, the company has bid for projects worth Rs 2,000 crore, and it expects to bag orders worth Rs 300 crore-400 crore. The company’s current order book stands at Rs 1,750 crore and about 85 percent of the book comes from building and electrification works.

About EMS IPO

The initial public offering (IPO) of EMS commenced its subscription on September 8. EMS has set a price range of Rs 200-211 per share for the IPO.

The company aims to raise Rs 321.24 crore through this IPO, which includes a fresh issuance of shares valued at Rs 146.24 crore and an offer-for-sale of 82.94 lakh shares, totalling Rs 175 crore at the upper price band.

Ahead of the IPO opening, EMS successfully secured Rs 96.37 crore through the anchor book, with participation from six investors. The anchor book was fully subscribed on September 7.

EMS IPO valuation

EMS shares are valued at a P/E of 10.7 times based on FY2023 earnings. Key Indian participants in the water and wastewater treatment market which constitute the majority of their revenue are VA Tech Wabag and L&T (only water segment). VA Tech Wabag’s P/E valuation presently sits at 13.8 times.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.