It has been a stellar year so far for the primary market as India Inc has raised $9.7 billion through their initial public offerings (IPOs), the highest amount in a nine-month period over the last 20 years.

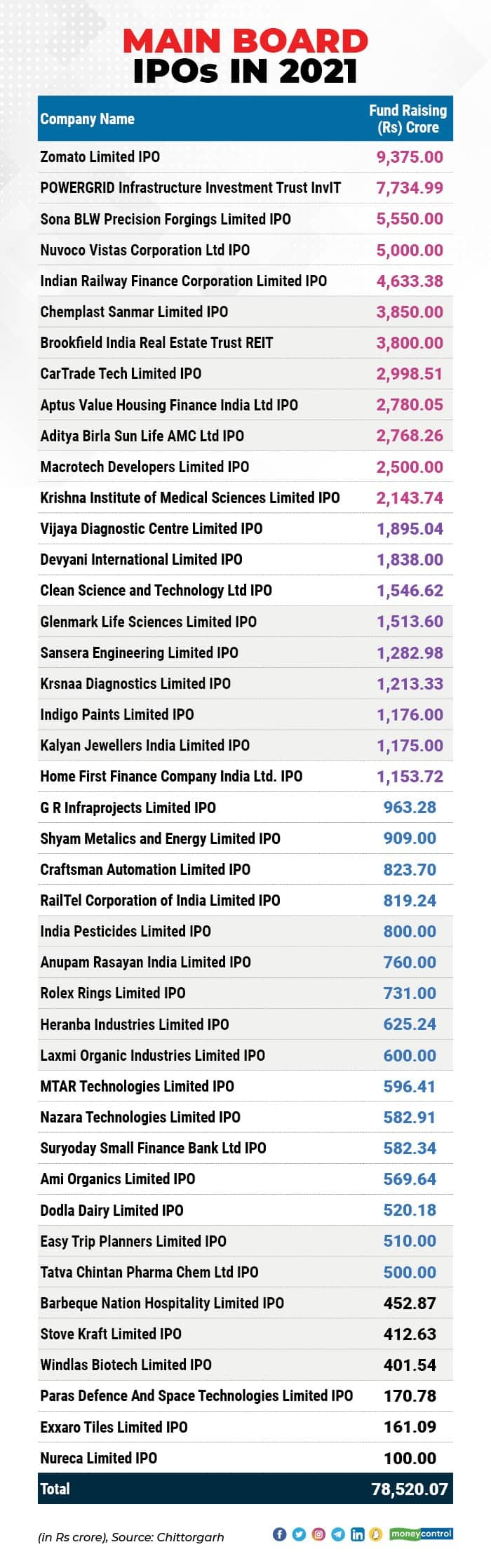

So far, 43 companies launched public issues in the mainboard and the same number of firms in the SME segment during January-September 2021. In rupee terms, the total fundraising via IPOs stood at Rs 78,520 crore in the mainboard segment and Rs 551 crore in the SME segment.

Fund Raising in Q3CY21

In the quarter gone by, i.e. July-September 2021, the fundraising of Rs 39,559 crore by 20 companies was higher than the previous two quarters in the mainboard segment. Strong sentiments in the secondary market with BSE Sensex and Nifty50 hitting record highs and surpassing new milestones (60,000 and 18,000 levels, respectively) following economic recovery and strong earnings growth especially after COVID-19 crisis are some of the key reasons for momentum seen in the primary market. Several companies also rushed to raise funds ahead of expected tapering by Federal Reserve.

The rising participation of retail investors with the increased digitalisation also provided major support to the equity market.

The same momentum was also seen across the globe.

"Globally, Q3 2021 saw 18 percent more deals than the previous third-quarter record set in 2007 and 11 percent higher proceeds than the last record-setting third quarter in 2020. In Q3 2021 alone, there have been 547 IPOs raising $106.3 billion," said EY - Global in its statement.

EY further said year-to-date (YTD), there have been a total of 1,635 IPOs raising $330.7 billion, an 87 percent and 99 percent increase year-on-year, respectively. "Overall, Q3 totals YTD have already surpassed 2020 by both deal numbers and proceeds."

In the July-September quarter, the highest fundraising of Rs 9,375 crore was by the food delivery company Zomato, (which was also the highest in the current year), followed by Nuvoco Vistas Corporation (Rs 5,000 crore), Chemplast Sanmar (Rs 3,850 crore), CarTrade Tech (Rs 2,998.5 crore), and Aptus Value Housing Finance (Rs 2,780 crore).

In India, "the most active sector was diversified industrial products with eight IPOs followed by the Technology sector with five IPOs. These sectors were also the largest in terms of Issue proceeds in Q3 2021," said EY.

EY further said the key driver of activity in the third quarter was the rebound of IPO markets in Europe, Middle East, India, and Africa (EMEIA), particularly Europe, India, and Tel Aviv exchanges, as well as IPO candidates racing to raise capital before expected tapering begins.

Experts are largely positive on the IPO market and feel the companies having niche business, robust business model, good corporate governance with fair valuations are expected to attract investors first, than others.

"The Indian IPO market has been on a bullish run and has witnessed one of the most active quarters since Q4 2017. The outlook for the next quarter remains positive with several new-economy and technology-driven IPOs expected," said Prashant Singhal, Emerging Markets, Technology, Media, Telecom (TMT) Leader at EY.

"Equity indices are at an all-time high giving a boost to the primary market. Similar to global markets, investors are willing to invest in companies with attractive business models, fair valuations, good corporate governance, and quality of management teams," he added.

Hemang Kapasi of Sanctum Wealth said for IPO investors, 2021 has been an exciting year thus far. "The long queue of IPOs and record amount of fund-raising (the highest in the last two decades) reflect investor confidence."

Several Amendments for Listing in India

Capital markets regulator Securities and Exchange Board of India (SEBI) also made several changes in the regulations for listing in India, which also triggered a rush for fundraising in the primary market.

"There have been several amendments in the regulations for listing in India viz. reduction in lock-in period, changes in the composition of committees, reduced disclosure for group companies, changes in roles and functions of Independent Directors, changes in ESOP regulations, etc. which have brought more relaxations in disclosures to be made by companies going for an IPO," EY said.

SEBI is also proposing a Special Purpose Acquisition Company (SPAC) like structure in India which will bring further momentum.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!