Adcounty Media Allotment Live Updates: Subscribed for 252x, the public offer likely to finalise allotment today - Know where to check

Adcounty Media IPO Latest News Today (July 2): The IPO of digital marketing firm Adcounty Media India witnessed overwhelming investor interest, getting subscribed 251.70 times overall. Investors placed bids for 107.64 crore equity shares against the IPO size of just 42.76 lakh shares, through over 3.06 lakh applications. The Non-Institutional Investors (NIIs) category led the surge, subscribing 397.93 times their allocated quota. Retail investors and Qualified Institutional Buyers (QIBs) followed with subscription levels of 229.37 times and 137.33 times, respectively. The company aimed to raise Rs 50.69 crore through the issue, priced at Rs 85 per share.

-330

July 02, 2025· 13:09 IST

India ready to welcome every satcom player as long as they check all the boxes: Scindia on Starlink's entry

India is ready to welcome every satellite communication player as long as they check all the boxes, Telecom Minister Jyotiraditya Scindia told CNN-NEWS18 about Starlink's entry into the country. "India will be largest satcom market in the world. We have highest level of penetration and connectivity. Satcom not a competitor, it is a compliment. It enables you to reach where no technology can reach. It will be vital in natural disasters where normal communication is down. It is addition to bouquet of communication capabilities. This (Starlink) is the third license being given out in India, others also in queue. Spectrum to be given on a administratively assigned system, price to be determined by regulatory authority," said Scindia. (Read More)

-330

July 02, 2025· 12:08 IST

Crizac IPO Day 1 GMP Live: Canara Bank Securities recommends 'subscribe' to Crizac IPO for long-term gains

Canara Bank Securities has given a ‘subscribe’ rating to the Crizac Limited IPO, citing the company’s strong financial growth and strategic positioning in the global education sector. “Crizac has delivered a solid financial performance over the last three years, with revenue increasing at a CAGR of 76%—from Rs274 crore in FY23 to Rs849 crore in FY25. EBITDA has also seen a healthy CAGR of 43%, rising from Rs 104 crore to Rs212 crore in the same period,” the brokerage noted.

The issue is considered fairly priced at a P/E of 28x, comparable to its only listed Indian peer, though its P/B ratio of 9x is slightly higher than the peer's 7x. Analysts believe the company is well-placed to tap into the increasing global student migration trend, thanks to its wide university affiliations and agent network.

-330

July 02, 2025· 11:53 IST

Crizac IPO Day 1 GMP Live: Expert View: Crizac IPO valuation reasonable but not without risks

Gaurav Goel, Founder & Director at Fynocrat Technologies, recommends investors consider subscribing to Crizac Limited’s IPO, noting that the offer is priced at a P/E of around 28x FY25 earnings and a P/BV ratio of 8.52x, based on a net asset value of ₹28.76 per share. He pointed out that while the valuation is moderate—neither cheap nor overly aggressive—it reflects the company’s strong return on net worth (30.38%), asset-light and scalable business model, and consistent growth. However, Goel also cautioned that the lack of fresh capital inflow and the company’s heavy reliance on a concentrated revenue stream could limit immediate upside potential.

-330

July 02, 2025· 11:34 IST

Crizac IPO Day 1 GMP Live: Crizac IPO allotment likely on July 7 amid weekend delay

The share allotment for Crizac Limited’s IPO is expected to be finalised by July 5, 2025. However, since the date falls on a Saturday, there may be a delay. Investors can likely expect the allotment announcement on Monday, July 7, 2025.

-330

July 02, 2025· 11:23 IST

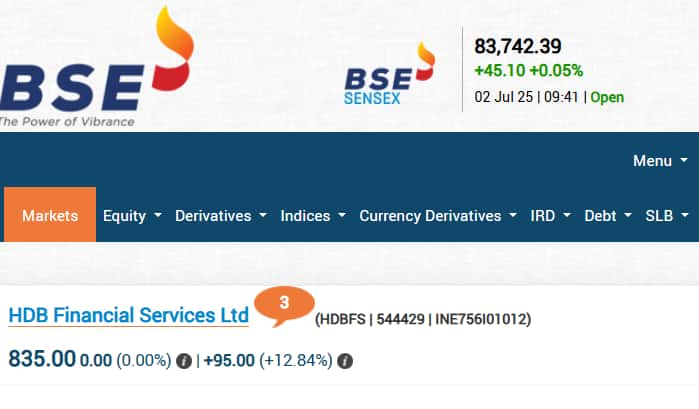

HDB Financial Services becomes eighth most valuable NBFC with nearly Rs 70,000-crore m-cap

HDB Financial Services Ltd has emerged as the eighth most valuable non-banking financial company (NBFC) in India following its market debut, with shares listing at a 13 percent premium over the issue price. On July 2, the stock opened at Rs 840 per share, taking the company’s market capitalisation to Rs 69,625.50 crore. Bajaj Finance remains the most valuable NBFC with a market capitalisation exceeding Rs 5.81 lakh crore, followed by Jio Financial Services and Cholamandalam Investment and Finance Company Ltd, valued at Rs 2.08 lakh crore and Rs 1.37 lakh crore respectively. (Read More)

-330

July 02, 2025· 11:13 IST

Crizac IPO Day 1 GMP Live: Crizac IPO commands Rs 21 GMP in grey market

As per market sources, Crizac shares are currently trading at a grey market premium (GMP) of Rs 21. This suggests early interest from investors ahead of the listing, although grey market trends should be viewed with caution.

-330

July 02, 2025· 10:59 IST

Crizac IPO Day 1 GMP Live: Rs 860 crore issue through OFS; No fresh capital for Crizac

The Crizac IPO is a complete Offer for Sale (OFS), with the company targeting to raise Rs 860 crore. Since it is an OFS, the entire proceeds will go to existing shareholders, and no new capital will be infused into the company’s balance sheet.

-330

July 02, 2025· 10:51 IST

Crizac IPO Day 1 GMP Live: Crizac sets IPO price band at Rs 233–Rs 245 per share

Crizac Limited has announced a price band of Rs 233 to Rs 245 per equity share for its IPO. Investors can subscribe within this range during the offer period. The company operates in the education sector and is based in Kolkata.

-330

July 02, 2025· 10:45 IST

Crizac IPO Day 1 GMP Live: Crizac IPO opens today, subscription window closes on July 4

The initial public offering (IPO) of Crizac Limited has opened for public subscription starting today and will remain open until July 4, 2025. The Kolkata-based education company is aiming to tap into market interest with its public debut.

-330

July 02, 2025· 10:38 IST

Adcounty Media Allotment Live Updates: Where to check Adcounty Media allotment status

- You can check the allotment status of Adcounty Media IPO through the following official portals:

- BSE Website:

Visit BSE IPO Allotment Status - Skyline Financial Services (Registrar):

Go to Skyline IPO Allotment Page - Simply enter your application number or PAN to view the status.

-330

July 02, 2025· 10:35 IST

Adcounty Media Allotment Live Updates: Adcounty Media IPO subscribed 251x; allotment likely today

The allotment of shares for Adcounty Media India Ltd., a digital marketing solutions provider, is expected to be finalized today, Wednesday, July 2, 2025. The company’s IPO, which closed for public subscription on Tuesday, July 1, witnessed a phenomenal response, being oversubscribed by 251.7 times. According to data from the BSE, investors placed bids for 1,076.48 million equity shares against the 4.27 million shares on offer, through a total of 3,06,037 applications.

-330

July 02, 2025· 10:27 IST

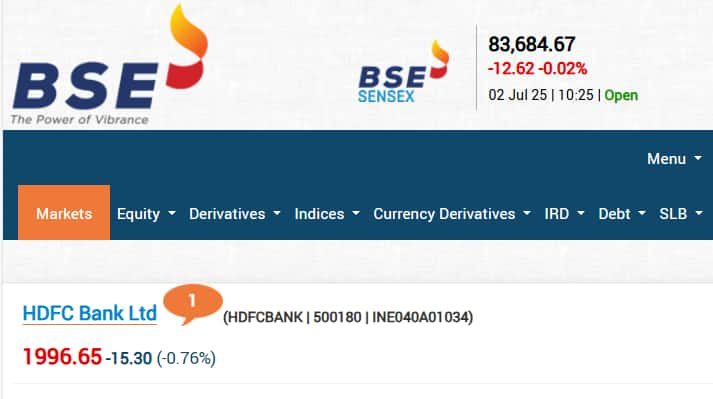

HDB Financial Services Share Price Live: Check current levels of HDFC Bank stocks

-330

July 02, 2025· 10:24 IST

HDB Financial Services Share Price Live: HDB debut shines, but parent HDFC Bank slips 0.81% to Rs 1,995.70

HDB Financial Services may be enjoying a strong market debut, but its parent company, HDFC Bank Ltd, is trading in the red. The stock is down 0.81% at Rs 1,995.70, even as its subsidiary shines on listing day.

-330

July 02, 2025· 10:21 IST

HDB Financial Services Share Price Live: What's happening after listing? Check current levels

-330

July 02, 2025· 10:17 IST

IPO News Live: Sambhv Steel Tubes shares debut at 34% premium to IPO price, beat grey market estimates

Sambhv Steel Tubes made an impressive debut on the stock exchanges on July 2, listing at Rs 110 per share on the NSE—reflecting a 34.15% premium over its IPO price of Rs 82. On the BSE, the stock opened at Rs 110.10, marking a 34.27% gain over the issue price. With this strong listing, the company began trading with a market capitalization of approximately Rs 2,948 crore. (Read More)

-330

July 02, 2025· 10:14 IST

LIC’s stake in NSE emerges as fifth most valuable holding for insurance behemoth

Life Insurance Corporation of India’s investment in the National Stock Exchange has become its fifth most valuable holding among listed entities, according to data analysed by Moneycontrol. As of March 2025 quarter, LIC holds a 10.7 percent stake, or 26.53 crore shares, in NSE, valued at over Rs 66,319 crore based on the latest unlisted market price of Rs 2,500 per share. (Read More)

-330

July 02, 2025· 10:05 IST

HDB Financial shares list at 13% premium over IPO price on NSE; should you buy, sell or hold?

HDB Financial shares listed at a decent premium of about 13 percent over its IPO price on the National Stock Exchange (NSE) on Wednesday, July 2. The listing of the shares of the subsidiary of HDFC Bank was better than the expectations in the grey market which had priced in a 8-10 percent gains on the listing day for the allotted investors. (Read More)

-330

July 02, 2025· 09:54 IST

HDB Financial Services Share Price Live: 'Too much josh,' says HDB CFO

HDB Financial Services Share Price: CFO Jaykumar Shah quipped, “Too much josh!” as he delivered a heartfelt vote of thanks, expressing deep gratitude to everyone involved for their support in making the public issue a success.

-330

July 02, 2025· 09:50 IST

HDB Financial Services Share Price Live: What about stock’s post-listing trajectory? See expert view

HDB Financial Services Share Price: Bhavik Joshi, Business Head at INVasset PMS, noted that the current grey market premium (GMP) for HDB Financial Services indicates a possible listing gain in the range of 9% to 11%. He added, “The stock’s post-listing trajectory will largely hinge on consistent earnings performance, effective management of credit costs, and the overall outlook for the NBFC sector amid a softening interest rate environment. Investors should approach the listing with cautious optimism, considering it a potential entry point for long-term exposure to India’s growing credit landscape.”

-330

July 02, 2025· 09:46 IST

HDB Financial Services Share Price Live: Who are the book running lead managers for HDB IPO?

- JM Financial Ltd

- BNP Paribas

- BofA Securities India Ltd

- Goldman Sachs (India) Securities Pvt Ltd

- HSBC Securities & Capital Markets (India) Pvt Ltd

- IIFL Capital Services Ltd

- Jefferies India Pvt Ltd

- Morgan Stanley India Co Pvt Ltd

- Motilal Oswal Investment Advisors Ltd

- Nomura Financial Advisory & Securities (India) Pvt Ltd

- Nuvama Wealth Management Ltd

- UBS Securities India Pvt Ltd

-330

July 02, 2025· 09:44 IST

HDB Financial Services Share Price Live: What's happening at the listing ceremony?

Well, after addresses by top HDB management and NSE boss Ashish Chauhan, mementos are being gifted to everyone involved in the IPO.

-330

July 02, 2025· 09:43 IST

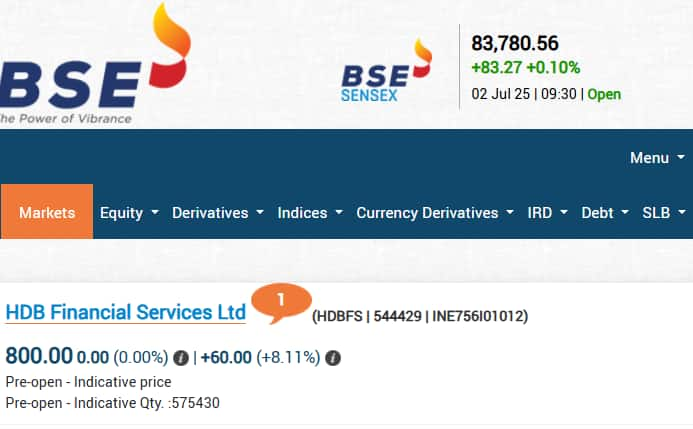

HDB Financial Services Share Price Live: HDB Financial trades at Rs 835 on BSE pre-open

-330

July 02, 2025· 09:39 IST

HDB Financial Services Stock Price: India's IPO pipeline swells: $26 billion in deals lined up, including LG, JSW Cement, and SMPP

HDB Financial Services Share Price: India's IPO market continues to gain momentum, with several major offerings in the pipeline. Among them are LG Electronics India's proposed $1.8 billion issue, along with upcoming IPOs from JSW Cement and defence equipment manufacturer SMPP, each estimated at around $470 million. According to one investment banker, JSW Cement’s public issue could hit the markets by late July or early August, while the timelines for LG Electronics India and SMPP remain uncertain. Data from PRIME Database reveals that a total of 143 IPOs are currently in the works in India, with an estimated combined value of $26 billion. Of these, 73 have already received regulatory approval.

-330

July 02, 2025· 09:36 IST

HDB Financial Services Stock Price: Yes Securities India says this for HDB stocks

HDB Financial Services Share Price: Rajiv Mehta, Analyst at Yes Securities India Ltd, told Bloomberg that HDB's “reasonable IPO valuation” presents a compelling opportunity for investors. He noted that the stock is priced at roughly 3.4 times its trailing 12-month book value—significantly lower than peer Cholamandalam Investment and Finance Co., which trades at 5.7 times book value.

-330

July 02, 2025· 09:32 IST

HDB Financial Services Stock Price: Check HDB Financial Services stocks at pre-open levels

-330

July 02, 2025· 09:30 IST

HDB Financial Services Stock Price: Top management of HDB is addressing the listing ceremony

HDB Financial Services Share Price: G Ramesh, who is the MD and CEO of HDB Financial Services, is addressing the event right now. Calling it a once in a lifetime milestone, Ramesh spoke about how the company started and expressed gratitude to all employees and the company partners. 'Thank you for being part of this incredible journey, Jai Hind,' Ramesh said.

-330

July 02, 2025· 09:26 IST

HDB Financial Services Stock Price: has IPO market made a comeback?

HDB Financial Services Share Price: “The IPO market has made a strong comeback... It’s the disappearance of major headwinds that’s fueling the momentum more than anything else,” said Suraj Krishnaswamy, Managing Director of Investment Banking at Axis Capital, in an interview with Reuters. According to LSEG data, India has maintained its position as the world’s second-largest IPO market in 2025 so far, raising $5.86 billion and contributing 12% of global IPO proceeds.

-330

July 02, 2025· 09:23 IST

HDB Financial Services Stock Price: How was 2024 for the Indian IPO market? A look back

HDB Financial Services Share Price: India’s IPO market reached a record high in 2024, raising $20.5 billion—second only to the United States. The surge was fueled by strong inflows from domestic investors, who have gained wealth amid the country’s economic expansion. Buoyed by confidence in India’s growth trajectory as the world’s fifth-largest economy, investors remained optimistic about continued momentum.

-330

July 02, 2025· 09:19 IST

HDB Financial Services Stock Price: Why July is so important for Indian markets

HDB Financial Services Share Price: Indian companies are expected to raise around $2.4 billion through IPOs in July, according to investment bankers, signaling a possible sustained revival in the primary market. This resurgence comes after earlier demand was impacted by the U.S. trade war and broader global geopolitical uncertainties. If realised, July would mark the strongest month for IPO fundraising since December. This follows a solid $2 billion raised in June, the bulk of which came from a single major listing—HDB Financial Services.

-330

July 02, 2025· 09:18 IST

HDB Financial Services Stock Price: Listing ceremony begins at NSE

The listing ceremony of HDB Financial Services has begun at the National Stock Exchange. We will bring you all the updates. In case you are interested in watching the ceremony live, here's the link

Listing ceremony of HDB Financial Services Limited will be starting soon at our exchange @nseindia. Watch the ceremony live!https://t.co/j2wCQ3x7tH#NSEIndia #listing #IPO #StockMarket #ShareMarket #HDBFinancialServicesLimited @ashishchauhan

— NSE India (@NSEIndia) July 2, 2025

-330

July 02, 2025· 09:10 IST

HDB Financial Services Stock Price: Investor Advisory: Caution on Grey Market Premiums (GMP)

HDB Financial Services Share Price: While the Grey Market Premium (GMP) can offer a rough indication of market sentiment ahead of a stock’s listing, it is not an official or regulated metric. GMP values are often speculative, driven by unofficial market participants, and may not accurately reflect actual listing performance. Investors are strongly advised to avoid making investment decisions based solely on GMP figures. These premiums can fluctuate significantly due to rumors, short-term hype, or market manipulation. Always evaluate IPOs based on fundamentals, business prospects, financials, and risk appetite, and consider guidance from SEBI-registered advisors.

Remember: GMP is not a guarantee of listing gains.

-330

July 02, 2025· 08:58 IST

HDB Financial Services Stock Price: Why there's so much interest in HDB IPO? Choice Equity Broking explains

HDB Financial Services Share Price: “There’s bound to be investor interest given HDB’s asset base and strong backing from its parent. It represents a solid brand-driven opportunity,” said Rajnath Yadav, Analyst at Choice Equity Broking Pvt told Bloomberg. He also noted that recent policy moves by the Reserve Bank of India have created a supportive environment for shadow banking firms.

-330

July 02, 2025· 08:19 IST

HDB Financial Services Stock Price: What BSE notice says about listing

HDB Financial Services Share Price: “Trading Members of the Exchange are hereby informed that effective from Wednesday, July 2, 2025, the equity shares of HDB FINANCIAL SERVICES LIMITED shall be listed and admitted to dealings on the Exchange in the list of ‘B’ Group of Securities,” a notice on the BSE said.

-330

July 02, 2025· 08:13 IST

HDB Financial Services Stock Price: HDB IPO subscription - category-wise breakup

HDB Financial Services Share Price: The IPO witnessed robust demand across investor categories, with the retail portion subscribed 5.72 times. The Qualified Institutional Buyers (QIB) segment saw the highest interest, getting subscribed 55.47 times, while the Non-Institutional Investors (NII) category recorded a 9.99 times subscription.

-330

July 02, 2025· 08:08 IST

HDB Financial Services Stock Price: An action recap - A look at investors' response

HDB Financial Services Share Price: HDB Financial Services' IPO saw an overall subscription of 16.69 times, with investors placing bids for 217.67 crore equity shares against the 13.04 crore shares available in the offer, according to subscription data published by the NSE.

-330

July 02, 2025· 08:06 IST

HDB Financial Services Stock Price: When did HDB IPO open for subscription?

HDB Financial Services Share Price: The Rs12,500 crore IPO was open for subscription from Wednesday, June 25, to Friday, June 27. The IPO was priced at a band with the upper cap set at Rs740 per share.

-330

July 02, 2025· 07:57 IST

HDB Financial Services Stock Price: Apart from HDB, here are other key listings today

Suntech Infra Solutions Limited on NSE Emerge and Sambhv Steel Tubes Limited

-330

July 02, 2025· 07:52 IST

HDB Financial Services Stock Price: Premium listing today? Check GMP trends

HDB Financial Services Share Price: According to data from Investorgain (as of July 2, 2025, 6:30 AM), the latest grey market premium (GMP) for HDB Financial’s IPO stands at Rs68. Based on the upper price band of Rs 740, the estimated listing price is around Rs808 per share, implying a potential gain of approximately 9.19%.

-330

July 02, 2025· 07:45 IST

HDB Financial Services Stock Price: Know the ownership structure of HDB Financial Services

HDB Financial Services Share Price: HDFC Bank presently owns a 94.36% stake in HDB Financial Services. The IPO stands as the second-largest in the past three years, trailing only Hyundai Motor India’s Rs 27,000 crore issue.

-330

July 02, 2025· 07:43 IST

Trade setup for July 2: Top 15 things to know before the opening bell

Technical indicators point to a potential consolidation phase persisting for the next few sessions, following the recent sharp upmove. The 25,650–25,700 range is expected to serve as a key resistance level on the upside. (Read More)

-330

July 02, 2025· 07:19 IST

HDB Financial Services Stock Price: Missed HDB IPO? Should you buy? Here's what Mehta Equities advices

- HDB Financial Services Share Price: Prashanth Tapse, Research Analyst at Mehta Equities, noted that the HDB Financial IPO garnered bids exceeding Rs 1.61 lakh crore, underscoring robust demand from both institutional and retail investors.

- “HDB’s IPO ranks as the second most subscribed among issues over ₹10,000 crore, just behind Tata Technologies. Its attractive valuation, diversified product offerings, and emphasis on SME lending position it as a strong long-term investment opportunity,” Tapse said.

- He further highlighted that the company’s strategic advantage—backed by parent HDFC Bank—provides ample growth potential, particularly in underserved retail and SME lending segments.

- As for post-listing strategy, Tapse recommended that investors who missed out on allotment look to buy during any price dips triggered by short-term volatility. “HDB Financial is well-aligned with India’s structural credit growth story and is a good fit for investors with a 3–5 year investment horizon,” he added.

-330

July 02, 2025· 07:16 IST

HDB Financial Services Stock Price: Who is India's biggest shadow lender?

HDB Financial Services Share Price: According to Bloomberg data, India’s leading shadow lender Bajaj Finance Ltd. is trading at six times its book value, while Sundaram Finance Ltd. holds a valuation of over four times its book.

-330

July 02, 2025· 07:10 IST

HDB Financial Services Stock Price: Stocks to Watch Today

HDB Financial Services Share Price: While the focus will remain on HDB, there are other stocks that will be on investors' radar today. These include Sambhv Steel, Hero MotoCorp, Lupin, Asian Paints, JSW Energy, RITES, Maruti Suzuki and Paras Defence. (Read More)

-330

July 02, 2025· 06:58 IST

HDB Financial Services Stock Price: What Hensex Securities says about HDB Financial Services IPO

HDB Financial Services Share Price: Mahesh M. Ojha, AVP – Research & Business Development at Hensex Securities Pvt Ltd., highlighted that HDB Financial has maintained consistent asset quality, with gross NPAs averaging approximately 2.3% over FY23 to FY25. He also noted that during this timeframe, the company’s assets under management (AUM) grew at a compound annual growth rate (CAGR) of 24%, while its profit after tax (PAT) registered a CAGR of 5.4%.

-330

July 02, 2025· 06:50 IST

HDB Financial Services Stock Price: Take a look at the scale of operations

HDB Financial Services Share Price: The IPO documents of HDB Financial Services show that it has around 90,000 employees. In terms of the coverage, HDB has 1,700 branches with a loan book of nearly $12 billion. This makes the shadow lender the major player in this segment. HDB's parent company is HDFC Bank, which is India's largest private bank. Many will also see how the HDFC stocks are performing today when the market opens at 9:15 am

-330

July 02, 2025· 06:41 IST

HDB Financial Services Share Price: In the big league - How the numbers are stacked up for HDB Financial Services - Take a look at the biggest IPOs for Indian markets

| Company | Listing Date | Offer Size (Billion Rupees) |

| Hyundai Motor India Ltd | Oct-2024 | 278.7 |

| Life Insurance Corp of India | May-2022 | 205.6 |

| One 97 Communications Ltd | Nov-2021 | 183.0 |

| Coal India Ltd | Nov-2010 | 154.7 |

| HDB Financial Services Ltd | Jul-2025 | 125.0 |

| Reliance Power Ltd | Feb-2008 | 117.0 |

| General Insurance Corp of India | Oct-2017 | 113.7 |

Source: Bloomberg

-330

July 02, 2025· 06:31 IST

HDB Financial Services Share Price: 10 percent listing gains for investors of HDB Financial Services? Here's what expert says

- Market experts anticipate the stock to debut with gains in the range of 8–10%.

- “HDB Financial shares are expected to yield 8–9% listing gains. Investors who received allotments should consider holding the stock for the medium to long term,” said Mahesh M. Ojha, AVP – Research & Business Development at Hensex Securities Pvt Ltd.

-330

July 02, 2025· 06:30 IST

HDB Financial Services Share Price: Why strong listing of HDB Financial Services matters for India's IPO segment

A strong listing for HDB could set a positive tone for other high-profile IPOs lined up for later this year, such as Tata Capital Ltd. and the Indian arm of South Korea’s LG Electronics Inc.

-330

July 02, 2025· 06:29 IST

HDB Financial Services Share Price: What's the mood in market right now - Numbers speak

According to Bloomberg, India’s $5.4 trillion stock market is witnessing a renewed boom, driven by strong foreign inflows, with the benchmark index nearing an all-time high.

-330

July 02, 2025· 06:28 IST

HDB Financial Services Share Price: Looking beyond Hyundai listing - How are things placed since last mega IPO for Indian markets

The IPO marks the largest offering since Hyundai Motor India Ltd.’s record-breaking $3.3 billion issue in October. It also arrives at a time when institutional placements and market listings are regaining momentum after a slowdown following 2024’s blockbuster activity.

-330

July 02, 2025· 06:26 IST

HDB Financial Services Share Price: Rs 12,500 crore HDB Financial IPO to list on D-Street today

HDB Financial Services Share Price: The stage is set for HDB Financial Services’ much-anticipated stock market debut today. Touted as India’s largest IPO of 2025, HDB Financial Services is scheduled to be listed on both the NSE and BSE at 10 AM. Market participants are closely watching to see if the company can defy the so-called “mega IPO curse” and deliver a rewarding listing for investors. Although the grey market premium suggests modest listing gains, such signals are not always reliable and should be interpreted cautiously. The last IPO of comparable scale was Hyundai’s blockbuster listing in October last year. HDB Financial’s Rs 12,500 crore issue received strong demand, clocking in a subscription of 16.69 times, according to exchange data. What lies ahead? Stay tuned as we bring you live updates, expert insights, and real-time action on the HDB Financial Services listing.