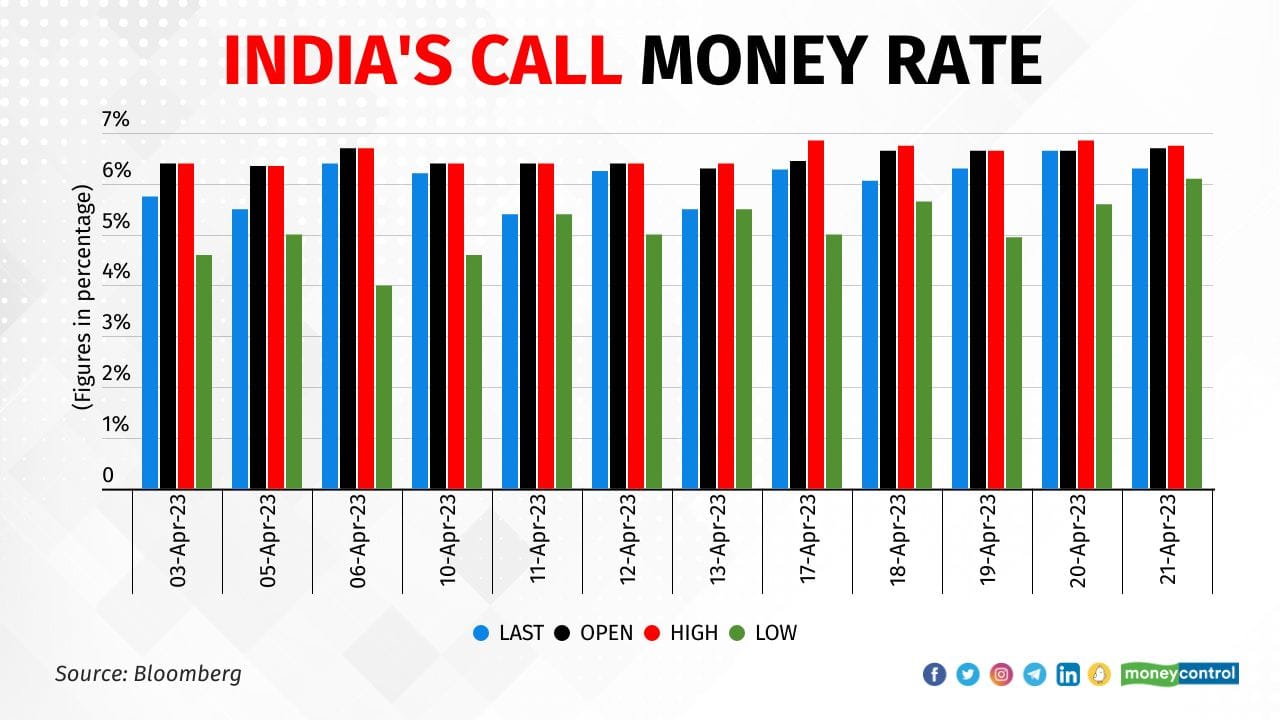

The intraday high of India’s call money rate remained above the repo rate of the Reserve Bank of India (RBI) in the last few days due to high demand for funds from a few banks. This was despite liquidity in the banking system remaining surplus.

According to Bloomberg data, between April 17 and April 21, the intraday high of India’s call money rate remained at 6.75-85 percent. But later in the day in all cases it fell to normal levels, which typically is below the repo rate.

As per data, there were a few deals where participants quoted rates higher than the repo rate and the rates remained close to the marginal standing facility rate of 6.75 percent. The repo rate of the RBI is currently set at 6.50 percent.

“Overnight rates over the last few days have been elevated probably due to skewed liquidity distribution in the 15-day VRRR (variable rate reverse repo) window, which has matured on April 21. Moreover, the liquidity surplus could have been concentrated with select banks,” said Upasna Bhardwaj, senior economist at Kotak Mahindra Bank.

Ritesh Bhusari, joint general manager, South Indian Bank, said those market participants who do not have surplus statutory liquidity ratio (SLR) on their books are availing funds from the call money market as funds in this market are collateral-free.

The call money rate is the rate at which banks lend or borrow short-term funds to and from each other in the money markets. This rates usually remains below the repo rate when liquidity in the banking system is in surplus, whereas pressure on rates is witnessed when there is deficit liquidity in the banking system. Currently, liquidity in the banking system is estimated to be in surplus by around Rs 1.35 lakh crore.

To remove excess liquidity from the banking system, the RBI conducted a 13-day VRRR auction on April 21 for a notified amount of Rs 50,000 crore, through which the central bank absorbed surplus liquidity worth Rs 20,480 crore.

According to the liquidity forecast of Kotak Mahindra Bank, inflows worth Rs 93,764 crore and Rs 2.58 lakh crore of outflows were expected in the week ending April 21. The outflows included Rs 1.70 lakh crore goods and services tax outflows, the report said.

Dealers are of the view that the current liquidity status will likely remain at the same levels till the end of the month.

Going forward, rates on call money are likely to remain at elevated levels due to liquidity stress, dealers added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.