The Indian rupee, though under pressure in the last few months, is the least volatile currency against the US dollar among its Asian and global peers, according to Bloomberg data.

This was due to the timely intervention by the Reserve Bank of India (RBI) in the spot as well as the forward markets.

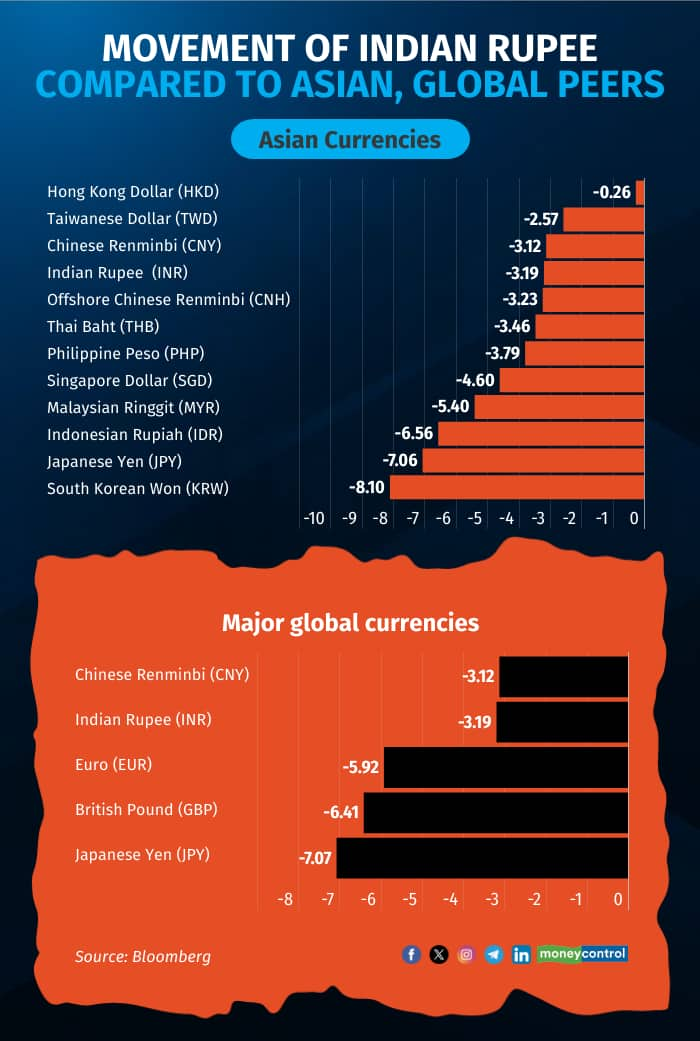

According to the data, the rupee is among the fourth-least volatile among Asian currencies. It is also among the second-least volatile currency against the Japanese Yen, British Pound, Euro, and the Chinese Yuan, during October to January.

The data showed that, among global peers, the rupee has depreciated 3.19 percent against the US dollar on January 30, compared to the 3.12 percent by the Chinese Yuan, 5.92 percent by the Euro, 6.41 percent by the British pound, and 7.07 percent by the Japanese Yuan, between October and December.

Further, it is the fourth volatile currency among Asian peers, after the Hong Kong Dollar (-0.26 percent), the Taiwanese Dollar (-2.57 percent) and the Chinese Renminbi (-3.12 percent) , Bloomberg data showed.

The rupee depreciated to 86.5900 against the US dollar on January 30, from 83.8213 against the greenback on October 1, 2024. In the last three months, it has depreciated around 3.19 percent against the US dollar.

The rupee has been on the depreciation path in the last few months due to various factors such as widening trade deficit, rising crude oil prices, and a surge in the dollar index after the US Federal Reserve hinted at fewer rate cuts in 2025. India's sluggish growth in Q2FY25, and foreign investor outflows from equities also contributed.

To top it, rising Brent crude oil prices played a major role in the depreciation of the rupee.

This has led to the rupee depreciating sharply in the last few months and hitting record lows almost every day against the US dollar.

The RBI intervention in the forex market by selling dollar in the spot market has impacted the domestic liquidity in the banking system. Usually, when the central bank intervenes in the forex market, it sells dollars and buys rupee, which removes liquidity from the banking system. The intervention is done through banks, leading to a strain on liquidity in the banking system.

The RBI has spent $77 billion from its foreign exchange reserves to defend the rupee from falling sharply in the spot market, taking India's foreign exchange reserves down to $623.983 billion as on January 17, 2024, from $701.176 billion on October 4, 2024 - down 12 percent in about three months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.