For the Indian economy, July 2022 was a crucial month – the rupee's exchange rate crossed the 80-per-dollar mark for the first time as the surge in global commodity prices following Russia's invasion of Ukraine in February 2022 exerted severe pressure on the Indian currency.

While the Reserve Bank of India (RBI) staunchly defended the rupee – it sold foreign currency worth a record $39 billion in July 2022 and an eye-watering $213 billion on a gross basis in 2022-23 as a whole – a more long-term solution was clearly needed. And so, the central bank announced a series of measures – including the settlement of international trade in rupees – to boost sentiment and foreign inflows as well as reduce India's dollar dependence.

But the settlement of international trade in Indian rupees has not taken off in a big way even though the RBI has given its approval to open 92 Special Rupee Vostro Accounts of banks from as many as 22 countries. Given that rupee trade with the economically-embattled Russia is floundering, Indian authorities have pinned their hopes on bilateral trade agreements that involve not just the rupee but the other country's currency too.

"Bilateral (trade agreements) is a step towards rupee internationalisation," a government official told Moneycontrol on condition of anonymity.

"It is promoting the local currencies of both nations. This is a way we can slowly move towards internationalising the rupee, which is a long process," the official added.

The first steps have already been taken. Earlier this month in July – almost exactly one year after the RBI announced its framework for the settlement of international trade in Rupees – India and the United Arab Emirates (UAE) signed a Memorandum of Understanding to use the Indian rupee and the UAE dirham to settle bilateral transactions.

Treading carefully

While India has been aggressive in establishing links between its domestic fast payments system, the Unified Payments Interface, with those of other countries, the approach has been far more careful in setting up bilateral Local Currency Settlement Systems (LCSS).

"We have to go about this very cautiously and carefully," a source aware of developments said.

"On UPI, we are much more open and we would like to push it as much as possible because it can become a model for cross-border payments. But with local currency trade we have to be very careful because of any impact on our current and capital accounts and foreign capital flows. And any risks must be assessed and evaluated," the source added.

India's rupee trade with Russia to purchase discounted oil did create some concerns for Indian banks due to the sanctions the warring nation is under. However, the aforementioned source rejected claims that India was resorting to bilateral agreements to settle trade in local currencies and bypass economic sanctions of any sort.

"This has nothing to do with FATF (Financial Action Task Force). A lot of countries trade with the UAE. Local currency trade with the UAE has nothing to do with FATF," the second source said.

"India as a country, its businesses, have not violated any sanctions. We are very sensitive to sanctions. Nor do we intend violating them in future," the source added.

The Financial Action Task Force (FATF) is a global organisation focussed on tackling money laundering and terrorist financing. The UAE falls under the FATF's so-called 'grey list' and is subject to increased monitoring by the task force as it actively works to address certain weaknesses to counter money laundering, terrorist financing, and proliferation financing.

The FATF suspended membership of Russia on February 24, 2023. India is scheduled for a possible onsite assessment in November 2023.

Partner Choices

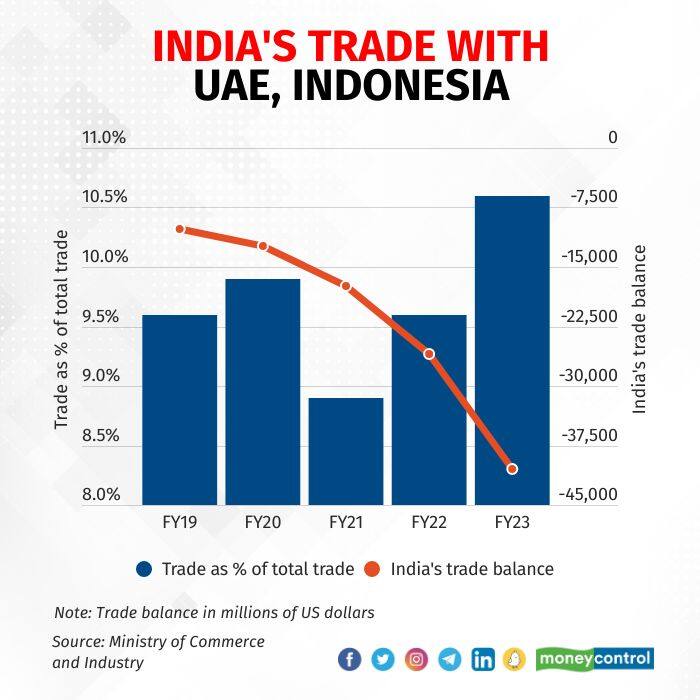

After the UAE, India already has its next partner seemingly lined up in the form of Indonesia, with the issue being discussed during the bilateral talks held on the side-lines of the meeting of G20 Finance Ministers and Central Bank Governors in Gandhinagar in mid-July. What is common to both UAE and Indonesia is a fairly stable trade relationship – over the last five years, India's combined trade with the two countries has ranged from 8.9 percent to 10.6 percent of its total trade. However, the trade deficit has recently widened in absolute terms due to higher energy prices. Nonetheless, there is potential to expand dealings beyond oil-based products.

"When it comes to bilateral currency trade, we will have to look at exchange rate risks and the potential to balance the trade gap, among other issues. In the case of UAE and Indonesia, there is potential for more trade. We import a lot of edible oil from Indonesia, so they are a good candidate," the first source said.

"Bangladesh and Sri Lanka are facing currency risks. Therefore, they are also good candidates for rupee trade. A bilateral trade agreement with them should not be of any risk. We have to look at desperate countries first if we have to push the rupee," the source added.

While India has merchandise trade deficits with the UAE and Indonesia, it has enjoyed a combined annual trade surplus of $10 billion-20 billion with Bangladesh and Sri Lanka over the last five years.

The RBI, or at least some of its staff, are in favour of establishing a standard template for bilateral and multilateral trade agreements for invoicing and payment in local currencies.

"The objective of this standardised approach is to primarily identify the terms of trade with the counterpart country/ies (to understand which country will accumulate balances in the other's currency, and how the surplus could be gainfully deployed to the mutual benefit of participating countries)," an inter-departmental report of the RBI on internationalisation of the rupee, released on July 5, said.

Also Read: RBI group says gains from including govt bonds in global indices outweigh risks

The RBI has said the group's recommendations do not reflect the central bank's official position.

The utilisation of surplus currency of another country – apart from the US and other major nations –represents a key problem, as India's short-lived rupee-trade arrangement with Russia showed. While the RBI's framework to settle trade in rupees provided options to use the surplus rupees held in Special Vostro Accounts – including investment in India government securities – they were clearly not an attractive proposition. According to a third source aware of developments, the facility to invest surplus rupees in Indian government securities has so far not been used at all.

But the Local Currency Settlement System gets the work done. The objective, after all, is to ensure the availability of multiple ways to settle trade and not for the rupee to substitute the US dollar as the world's reserve currency.

"It's not that countries have an agenda to de-dollarise themselves. But it's always better that the international financial system is not dependent on just one currency. Personally, I expect the dollar dominance to remain for quite some time," the second source said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.