The three-day meeting of the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) began today, August 8. Chaired by Governor Shaktikanta Das, the committee's decision is scheduled to be announced at 10 am on August 10.

The MPC is widely expected to leave the policy repo rate unchanged at 6.5 percent for the third consecutive meeting, even though headline retail inflation may have rocketed past the upper limit of its 2-6 percent tolerance band in July, data for which will be released on August 14.

While the MPC's target is spelt out in terms of Consumer Price Index (CPI) inflation, the committee's members examine a range of data to assess the economy's situation when it comes to interest rate decisions. Here, Moneycontrol takes a close look at the movement of key economic indicators since the MPC met on June 6-8. It goes without saying that, while this list of indicators is not exhaustive, they are crucial in representing the state of the Indian economy.

Inflation

After cooling appreciably in the first half of 2023 – and returning to the RBI's 2-6 percent tolerance band – thanks to a favourable base effect – CPI inflation is set to take a turn for the worse in the upcoming months, especially in July.

Economists see headline retail inflation rising to 6.5 percent and beyond in July, data for which will be released just days after the MPC announces its interest rate decision. As such, even though the committee is seen as retaining the policy rate at 6.5 percent on August 10, it will not be plain sailing.

"We expect an acknowledgement of the heightened food inflation risks in the current quarter, which MPC would explain as weather-related and likely transient," Duncan Tan, a rates strategist at DBS Bank, said in a note on August 8.

"We estimate 80-100 basis points of upside risks to the official forecast of 5.2 percent for current-quarter headline CPI inflation. As a result, we could get revisions to the CPI forecast for both the forward trajectory and for the full financial year," Tan added.

Under the hood

While the RBI's target is spelt out in terms of the headline inflation rate, it is important to look under the hood too and examine the underlying developments; and they are mixed.

Also Read: FinMin says rise in food inflation warrants guarded approach by govt, RBI

A huge rise in food prices, especially tomatoes, is expected to drive headline inflation higher in July. In fact, the early signs were already visible in June, with CPI food inflation increasing to 4.49 percent from 2.96 percent in May.

"A wider sample of vegetables, with a total weight of 4.4 percent (double of tomato, onion, and potato, and accounting for more than two-thirds of all vegetables in CPI), suggests that the price index of all vegetables may have increased 50 percent year-on-year (and around 50 percent month-on-month) in July," said Nikhil Gupta and Tanisha Ladha of Motilal Oswal Financial Services.

At the same time, core inflation – or inflation excluding food and fuel – has eased significantly to just over 5 percent. Seen as an indicator of underlying demand, a weakening of core inflation amid temporary food price shocks could allay the MPC's concerns.

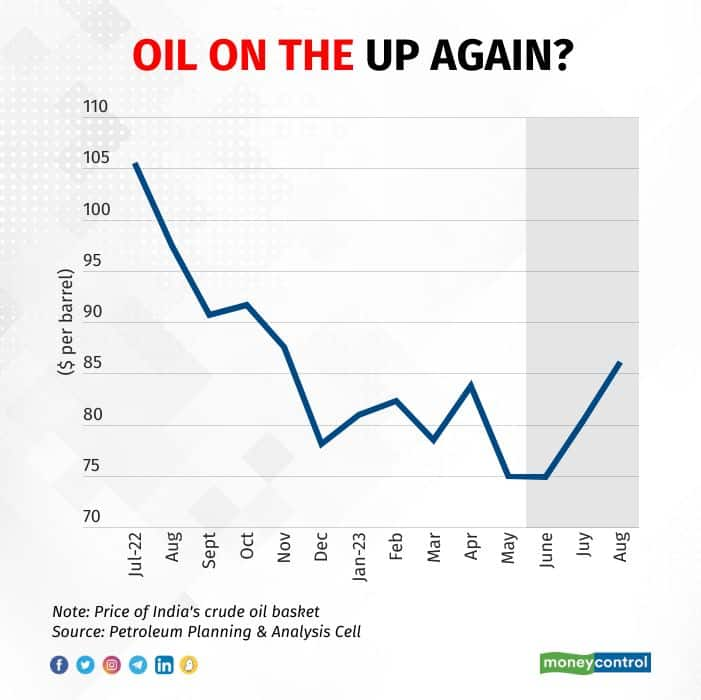

Returning to non-core matters, global crude oil prices are on the rise. Despite India heavily purchasing discounted oil from Russia, the price of India's crude oil basket has risen from less than $75 per barrel in May and June to over $86 per barrel so far in August.

It is worth noting that the RBI's inflation forecasts assume $85 per barrel as the price of India's crude oil basket.

External balance

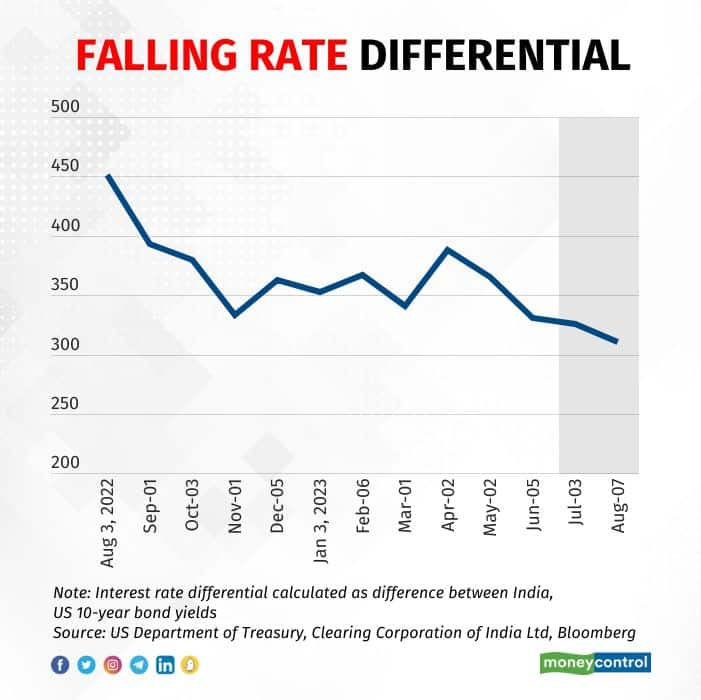

While the RBI has made no change to the policy rate in nearly six months, interest rates have been rising in other parts of the world. This reduces the difference between India and global interest rates – or the interest rate differential.

Take the US, for example, which hiked the federal funds rate target range in July by another 25 basis points to 5.25-5.5 percent – the highest in more than 20 years. This has led to the US-India policy rate differential narrowing to just over 100 bps.

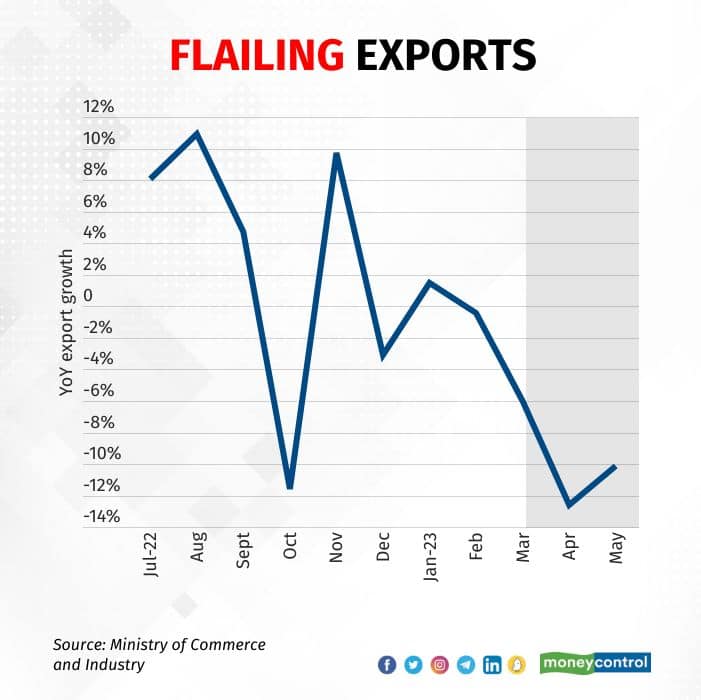

While narrowing of the interest rate differential can hurt India's capital inflows and adversely impact the external balance, it would compound matters at a time when the export performance is weakening.

India's merchandise exports have contracted on a year-on-year basis in six of the last eight months. In three of these six months, exports have contracted by more than 10 percent.

It is not just the global growth slowdown that is reflected in India's export numbers; the weakness in the domestic economy is also showing up in the form of falling merchandise imports. In April-June, India's merchandise imports stood at $160.28 billion, down 12.7 percent from the first quarter of 2022-23.

Growth

Despite the concerns about inflation and weakening external demand, India's authorities remain rather bullish about the domestic growth outlook.

The blowout January-March GDP growth number of 6.1 percent forced economists to reassess their growth forecast for 2023-24. And while they remain below the government's and the RBI’s forecast of 6.5 percent, the difference has narrowed.

Also Read: India cynosure of all eyes as Morgan Stanley, S&P turn bullish on economy

Although the vestiges of a favourable base effect mean the GDP growth for April-June is seen rising even further to 8 percent as per the RBI's forecast, economists are unconvinced by the ongoing growth recovery.

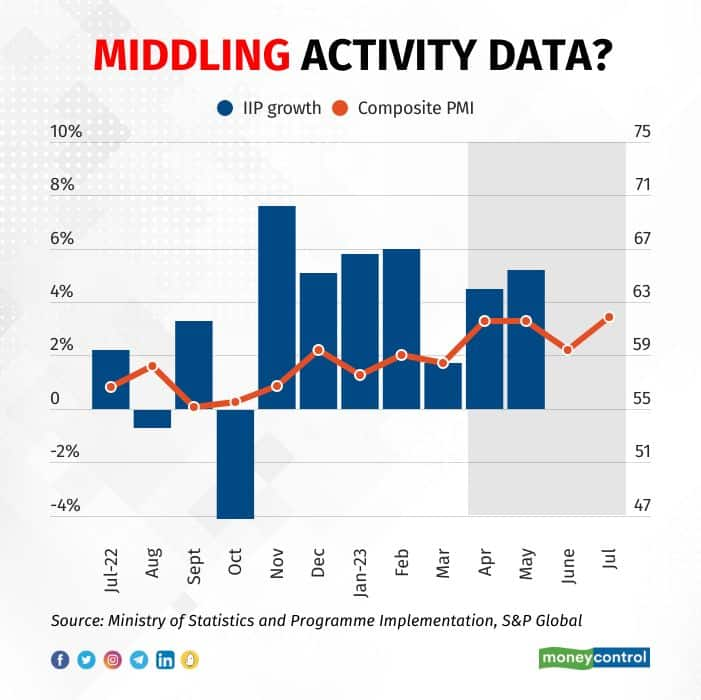

While sentiment-based surveys such as the Purchasing Managers' Index show the manufacturing and services sectors improving at a breakneck pace, official high-frequency data is indicative of a more middling and uneven performance.

"India's economic landscape remains a mixed picture. While high-end consumption and government capex are running quite strong, lower-end domestic demand and exports remain subdued," Nuvama Research analysts said in a note.

"Moreover, the cumulative effect of past monetary tightening is yet to fully reflect in the economy while the global economy continues to remain weak. Thus, an economic slowdown could spread to pockets which have been strong so far," they added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.