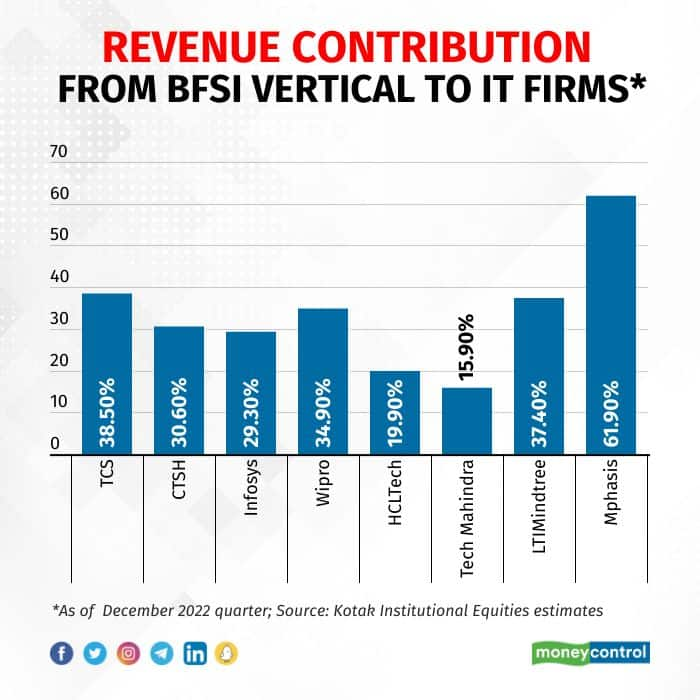

The series of events in the banking sector in the US and Europe in the last few days can impact the Indian IT services companies as clients are spooked currently, experts said. At roughly 40 percent, the Banking, Financial Services, and Insurance (BFSI) vertical makes up a significant portion of the revenue of Indian IT companies, according to NASSCOM’s 2023 Strategic Review report. The current crisis is an additional cause for concern for companies, which are already under stress in a harsh demand environment and macroeconomic climate.

There will be a slowdown in deals and decision-making delays in the near term, at least for the next six months, experts said. But they remain cautious as the situation continues to develop.

According to Phil Fersht, CEO and founder of HFS Research, there is a situation of panic among many clients. “The volatility and uncertainty are going to slow down decisions on deals as banks observe how the current crisis period shapes out. This may lead to short-term engagements in critical areas that cannot be put away, such as cybersecurity compliance and finalising app modernisation projects,” he told Moneycontrol.

Banks in the news recently such as Silicon Valley Bank, Silvergate, Credit Suisse, and UBS are all clients of various IT companies.

Fersht said that he expects spending to stay relatively strong with the large banks, particularly in the present situation as HSBC takes over SVB UK and UBS takes over Credit Suisse. “There will be a lot more consolidation which will lead to a lot of IT services needs. The mid-tier will be soft as many banks struggle with high interest rates and trust issues with customers,” he said.

Limited exposure to problem banks

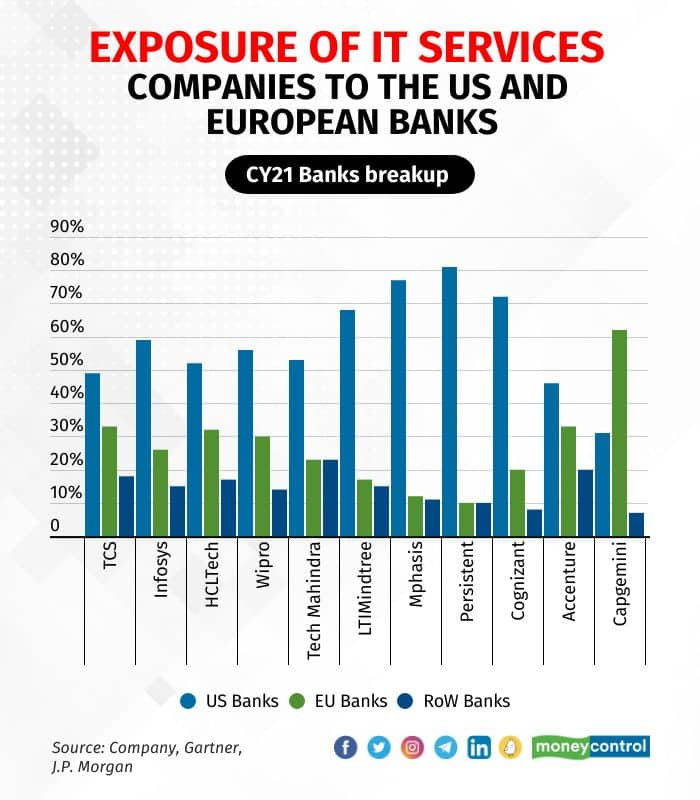

Mukul Garg, an IT analyst at Motilal Oswal Financial Services, said the Indian IT sector doesn’t have high exposure to Credit Suisse. “There might be some exposure to large-cap ones like Infosys, HCLTech but I don’t think it is large enough for them,” he says.

The current situation, he said, is likely to cause near-term pressure on spending by US and European banks if it exacerbates.

“We are still viewing how this scenario is developing, it is very recent. The impact will mostly be limited till March for IT services companies. There will be some impact on their revenue in Q4, but beyond that, we don’t have a lot of visibility in terms of whether the impact will persist. There is some concern but it will not structurally impact IT companies unless contagion spreads further,” he told Moneycontrol.

As per a recent note by JP Morgan, US regional bank exposure is the most at TCS and Infosys at less than 2-3 percent of revenue. It also estimated that the exposure to Silicon Valley Bank is 10-20 bps for TCS, Infosys, and LTIMindtree.

A LTIMindtree spokesperson told Moneycontrol that company's exposure to the impacted banks is immaterial. The company overall gets 37.4 percent of its revenue from the BFSI vertical.

“We wish to share that despite the volatility in the global financial markets following the banking crisis, LTIMindtree’s exposure to impacted institutions is immaterial. We do not foresee any impact on our financials. We continue to work closely with our clients and monitor the developments on the ground,” the spokesperson said.

Softening of tech spends

According to the JPMorgan note, the collapse of Silicon Valley Bank and concerns about liquidity across the US and the European Union can soften tech spends by banks in the short term. According to the note, it can lead to delays in ramp-ups, which can impact revenue conversion in the next 1-2 quarters and delays in deal closures that will impact revenues over the next 3-4 quarters. “We have already heard about slowing revenue conversion in 4Q and slowing deal signing before the events that kicked off SVB’s collapse,” the note said.

Fersht said that several Indian companies have “deep business footprints in BFS”.

“For example, TCS and Infosys are exposed to US regional banks. Wipro’s acquisition of Capco, a BFS specialist, could cause some issues. Other Indian-heritage providers such as HCL, Mphasis, UST, Hexaware, and Virtusa are heavily dependent on the BFS sector and will be watching closely. Cognizant’s dependence on BFS has lessened in recent years, which may be a blessing in disguise,” he said.

Nomura said in a note last week that SVB is a small customer of TCS, and the company works with most of the large regional and central banks. Softening of spending and decision-making in US BFSI was already there, even before SVB’s problems surfaced, it said. Infosys, on the other hand, said it works with 8 of the 10 largest US banks, has “no meaningful exposure to US regional banks”, and expects client spends for CY23 to be impacted. Wipro, according to the note, “thinks the larger impact from the recent volatility in the global BFSI sector would emerge only with a lag."

According to Kotak Institutional Equities, caution among BFS firms in developed markets, following Silvergate, SVB, Signature Bank and the acquisition of Credit Suisse by UBS is expected to lead to further curtailing of discretionary tech spends in the near term. Kotak said that there can be a pause in the pace of digital or cloud programs due to a cut in discretionary spending in the near term.

Slowdown?

Fersht said that the next six months are going to be tough, with many decisions put off.

“However, once trust in the financial systems is restored, 2024 should see strong growth as many BFS firms cannot afford to keep delaying IT projects. Many BFS firms have no choice but to modernise their legacy cores to survive in the digital environment,” he said.

Kotak expects a growth slowdown in FY24, with sequential growth expected to be impacted by 1-2 percent in Q1.

Kotak noted that post the global financial crisis in 2008, Indian IT players benefited from captive takeover deals and that similar opportunities might come up in the second half of FY24. This could benefit service providers with strong capabilities across services and mandates.

The note added that on a pro forma basis, UBS and Credit Suisse spend roughly $7 billion on technology, and would look for “upfront cost saves by eliminating redundancies in tech stack as part of their plan to rationalise the over CHF 8 billion annual cost run-rate by CY2027.”

The company indicated that cost savings of CHF 2 billion would be from the integration of IT systems. “M&A of such scale provides significant opportunities for service providers to sign deals with long-term annuity revenue streams, while also consolidating out the long tail of vendors,” Kotak said.

Wait and watch

A note by Nirmal Bang Institutional Equities said that it is unclear how things will play out, and going by the actions of the DM central banks, it looks like the damage has been contained for now. “If US regional bank problems are not sorted out quickly there is going to be a spillover effect on the US economy that would then have a direct impact on the IT spend by large US corporations,” the note said, adding that the BFSI sector will likely be an area of stress in FY24.

Gaurav Vasu, founder and CEO of IT market intelligence firm UnearthInsight, told Moneycontrol that the challenge for IT services companies is primarily about the current situation spreading to other banks.

“In the short run, there will be delays in banking contracts, a lot of the short-term and mid-term automation, cloud optimisation and modernisation kind of contracts, cybersecurity projects etc will see a slowdown. In the short run, till Q2, there will be a 20-30 bps decline in revenue of the BFSI sector overall,” he said.

He added that the impact in Q4 will be seen in companies directly related to Credit Suisse and SVB.

Queries sent to TCS, Infosys, LTIMindtree and Tech Mahindra were unanswered at the time of publishing.

“Macroeconomic developments are visible across the US and Europe and we are closely monitoring the situation. The majority of our exposure is to large banks, which are well capitalised,” Wipro told Moneycontrol in a statement.

Where will the spending be?

According to Mrinal Rai, principal analyst at ISG, spending in the BFSI space was geared more towards business process outsourcing than in IT. He added that spending is likely to be higher in the Governance, Risk, and Compliance (GRC) space.

Rai added that the annual contract value (ACV) for IT was trending downwards in the BFSI space. “Spending is more on the strategic side of it and when clients — not just in BFSI — analyse how technology will help them sustain in the business and how it can help strategically improve, they do spend on technologies on the business side. You may not see the regular IT service providers, somebody managing only say cloud or networks or data centre kind of deals, those deals will reduce but work that involves core banking services or GRC, payment processing, etc., in those kinds of things, spending is likely to be more.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.