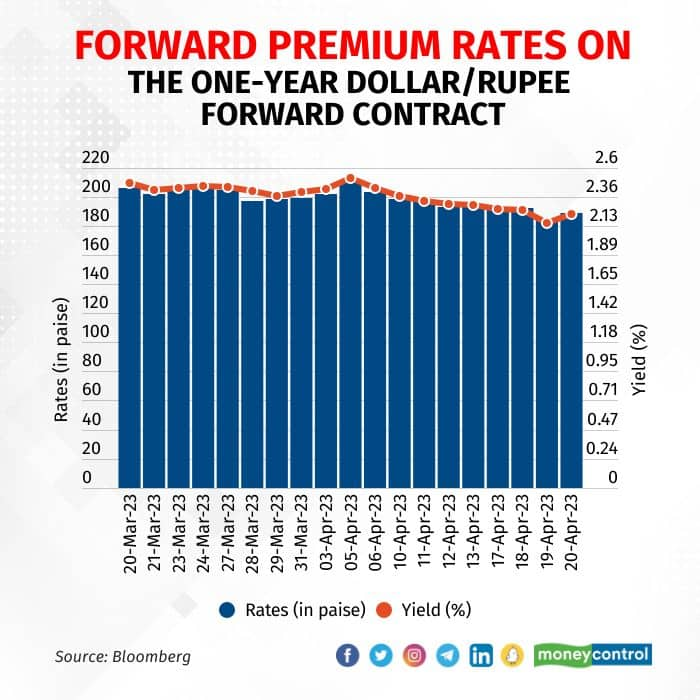

The forward premium rates on the one-year dollar/rupee forward contract has trended lower so far in April compared to March as the interest rate differential between the US and India have narrowed, dealer said.

Premiums on forwards of a currency pair are reflective of the interest rate differential between the two countries, dealers added.

The premium on the one-year dollar/rupee contract was 183.97 paise or 2.1527 percent on annual basis on April 19, compared to 206.54 paise or 2.4814 percent on annual basis, as per Bloomberg data.

“The key reason is the interest rate differential. This differential is getting reduced as the US Federal Reserve (US Fed) is still hawkish while the Reserve Bank of India (RBI), after the last policy meet, has been dovish. Also, with the premium being lower, the interest from carry traders gets reduced,” said Vikrant Sharma, Founder and Fund Manager of Kushak Capital Management.

According to Kunal Sodhani, Vice President at Shinhan Bank (Global Trading Centre, FX and Rates Treasury), with Consumer Price Index (CPI)-based inflation expectations remaining below 6 percent, the market is not expecting any further rate hike by RBI. On the contrary, the US Fed is expected to hike the policy rate by 25 basis points (bps) in its May 2-3 policy meet.

Further, he said, Fed Fund Futures are pricing in the same with 85 percent probability. This scenario suggests the interest rate differential between the US and India to narrow further, pushing forward premiums lower.

Interest rate differential

According to the CareEdge report, the differential between the India-US 10-year benchmark bond narrowed to 381 bps from as much as 400 bps over the last one month. This follows an unexpected pause in the rate-hike cycle by RBI, resulting in the yield on India’s 10-year benchmark bond to ease to a four-month low of 7.21 percent.

The forward point is the interest rate differential between two countries. These points are added to or subtracted from the spot rate. A spot rate is the price quoted for immediate settlement of a currency trade. An addition of forward points to the spot rate is called a forward premium, and a subtraction of forward points is called a forward discount.

For instance, if the one-year treasury bill (T-bill) in India is at 6.97 percent and the one-year US treasury yield is 4.84 percent, the difference between the two is 2.13 percentage points, and the one-year forward premium should be around that level.

Also read: Zee begins settlement talks with creditors for Sony merger

Impact on rupee

Sodhani said that when forward premium rates are low, it makes carry trade less viable and reduces the willingness of exporters to hedge, which reduces the supply of dollars in the forward market. It also poses risks to existing carry trades, as traders may look forward to unwind the same.

On the other hand, it remains beneficial for importers as due to lower forward premium, their hedging cost goes down.

The higher premiums will attract carry traders, while the lower premiums will lead to an unwinding of carry trades. A carry trade is a trading strategy in which investors borrow at a low interest rate and invest in an asset that provides a higher rate of return.

Forward premium rates trend lower so far in April as interest rate differential narrows

Forward premium rates trend lower so far in April as interest rate differential narrows

When premiums are low, the incentive to take on such trades is low. In such a situation, investors will prefer to unwind these positions. Thus, the demand for dollars will increase, leading to a shortage of the greenback. This, in turn, will further weaken the rupee.

“Rupee tends to underperform as its loses its attractiveness as a higher yielding currency. This keeps carry traders away from the market. And since forward premiums are less, importers tend to hedge longer-term payables as they are cheaper to buy and hedge,” Sharma said.

Also read: ITC becomes 11th Indian firm to cross Rs 5-trillion market value

Outlook

Forex dealers are of the view that till the time the US Fed continues its rate hike cycle, there will be pressure on the forward premium, thanks to expectations of a rate pause by the RBI.

However, the pressure is unlikely to remain unchanged, as there is also the expectation that the US Fed may hike for the last time in the May policy, and then pause, forex dealers said.

“Going forward, the rate hike trajectory may pause, and possible by next year beginning may start to reverse as well. Considering that, we don't see one-year forwards falling below 1.78 percent,” Sodhani added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.