Natural catastrophes are becoming a common phenomenon in India. These include cyclones, floods, landslides and earthquakes. The economic losses in each of the incident is far higher than the insured losses, giving a clear indication of the inadequate protection for life and property.

For instance, the Mumbai floods of 2005 was one of the largest cases of insurance loss events. A Swiss Re sigma report said that in the event of torrential rainfall, rapid urbanisation reduces avenues for water discharge and can lead to heavy flooding. Such was the case in Mumbai in 2005, when flooding after heavy rains resulted in one of the largest insurance loss events ever experienced in India (USD 0.9 billion, according to sigma data).

A natural catastrophe (nat-cat) pool to pay-out insurance claims for incidents like floods, earthquakes and landslides has been in the making for almost five years now. However, due to a lack of consensus on the structure of the pool, it has not yet been set up.

In the last five years, losses due to catastrophes have led to insured losses of almost Rs 25,000 crore. This includes losses due to the Uttarakhand floods, cyclones Hudhud and Phailin, the Chennai floods, as well as the recent Kerala floods (initial estimates of Rs 1,000 crore insured loss).

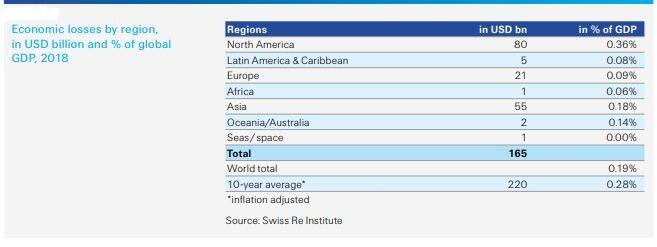

The share of uninsured catastrophe losses varies by region. A Swiss Re report said that it was typically higher in developing countries where infrastructure construction and implementation of catastrophe risk mitigation measures did not keep pace with economic growth. However, there are areas of underinsurance in advanced countries too, even in those with known medium to high exposure to certain hazards.

Individual products do offer protection to life and property. But, there is no special cover that offers comprehensive protection against natural catastrophes caused by climate change. A large event like the Kerala floods has the ability to escalate and wipe off the solvency of insurance companies.

The centre fully funding this initiative is not a feasible idea. Having a catastrophe bond to fund the claims from such incidents would be a good start. But, time is running out, and the stakeholders need to act fast.

With increasing population and rising risks from climate change, insurance companies need to respond to regular flows of small and medium-sized catastrophe events. The claim-paying capabilities of the companies will depend on how early they recognise the risks and maintain adequate reserves.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.