Tata Power Company's transition from fossil fuels to clean energy has been widely reported. But there is another transition at play at the company, which is pivoting from a utility to a consumer-focussed business with aggressive expansion into rooftop solar, electric vehicle (EV) charging, and energy management.

Managing Director and Chief Executive Praveer Sinha, who is spearheading these changes, says that the company is redefining its market presence and revenue mix and wants to position itself at the forefront of India’s energy transition.

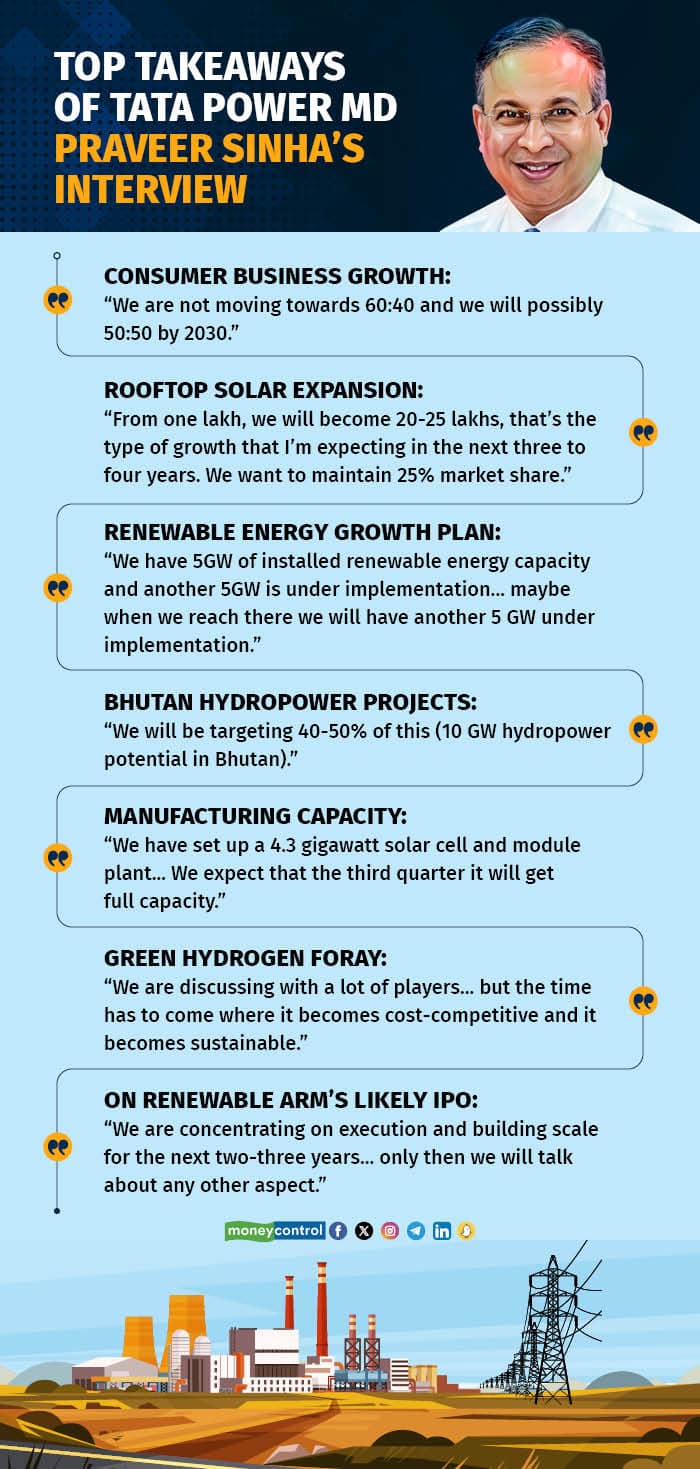

“At one point in time, 90 percent of our revenue was from B2B (business-to-business) and 10 per cent from B2C (business-to-consumer). We are now moving towards 60:40 and will possibly be 50:50 by 2030,” Sinha told Moneycontrol in an exclusive interview.

Tata Power has a diversified power generation portfolio of 14,453 MW, close to 40 percent of which is from renewable energy (RE). The company has diversified from its traditional business of power generation, transmission, and distribution, partly to secure the supply chain by foraying into storage solutions, solar cells and module manufacturing, and partly to tap the opportunity arising from the government’s push towards solar rooftop and EVs.

“We have been very understated and undervalued for many years. It's now that people have started realising that we have changed,” Sinha said, commenting on the rise in the company’s share prices.

Shares of Tata Power have run up close to 80 percent in the last year, while the benchmark Sensex gained around 21% in the same period.

“All of a sudden, the complexion of the company has become consumer-centric. In that regard, we still have to achieve the level of valuation that consumer companies get. I think there is huge inherent value in the company and what you are seeing is just an early indication. I feel that it will be much higher going forward,” Sinha said.

B2C strategyWhile Tata Power faced retail consumers in Delhi and Mumbai as a power distribution company, it is now investing in emerging consumer-facing sectors such as rooftop solar and EV charging. The company aims to increase its rooftop solar consumers to 20-25 lakh in the next three to four years, from one lakh now. The company now also has a total of 5,569 EV charging points across 553 cities.

“When we bring these products to the market, the acceptance is very high because of our credibility. They know that we’ve been doing this sort of thing for 25 years, we are not someone who has just set up shop and will go away. They have faith, we have credibility, and our product is very good. Consumers find that for any class of product, ours are much better in terms of operational efficiency and performance,” Sinha said.

But even as the company expands to new markets, it is keen to consolidate its presence in existing ones.

Betting on BhutanAfter nearly a decade of commissioning its first hydropower project in the landlocked Himalayan state, the company has announced plans to expand further. On August 6, the company announced it will be setting up the 600 MW Khorlochhu hydropower project, and is scouting for more opportunities.

“These are large investments that need long-term commitment because the power purchase agreements (PPAs) are for 30 years. We will be looking for opportunities wherever there is hydro potential, access, and (power) evacuation infrastructure. One has to do a deep study in all this, which takes about 12 to 24 months,” Sinha said.

Bhutan exports close to 70 percent of the power generated in the country to India. In 2008, when the then Prime Minister (PM) Dr Manmohan Singh visited the neighbouring country, the two nations agreed to develop 10 GW of hydropower capacity in Bhutan by 2020. The plan got a boost earlier this year when PM Narendra Modi visited the country. The two states issued a joint vision document on energy that focusses on exploring new hydropower projects, besides green and solar energy. Following this, in June, the Adani Group announced that it will be setting up a 570 MW hydropower project in Chukha province.

Sinha said that only 2.2 of the 10 GW is under implementation, and the company is eyeing more projects there. “We will be targeting 40-50 percent of this,” he said.

Pumped storage in IndiaCloser home, setting up large hydro projects remains challenging due to issues of resettlement, rehabilitation, and infrastructure, Sinha explained. Tata Power is focussing on setting up pumped storage hydro projects, in line with the government’s strategy to push these.

Unlike the large hydropower projects which generate electricity from river flow, pumped storage projects store energy by moving water between two reservoirs at different levels to generate power during peak demand. Tata Power plans to set up 2,800 MW by FY29.

“The plan is on and the focus is on execution. The first 1,000 MW will start in the later part of this calendar year, and the next 1,800 MW will come up mid-next year. Simultaneously, we will keep on examining other proposals, but it has to be ripe enough for us to take a call and talk about it,” Sinha said.

Strengthening the supply chainIn the past, to fortify its supply chain for thermal power generation, Tata Power bought stakes in coal mines and even acquired ships to transport imported coal, which it later sold. The company is replicating this model to support its ambitious clean energy expansion, with a manufacturing capacity of 4.3 GW each in solar cells and modules.

Top Takeaways of Tata Power MD Praveer Sinha's interview

Top Takeaways of Tata Power MD Praveer Sinha's interviewThe module unit is operational and running at full capacity, while the cell unit will commission the first 2 GW this month, and the next 2 GW in September. “We expect to get to full capacity by the third quarter… We have tied up the full manufacturing for at least the next two years. We may sell some modules in India and export the rest,” he said.

Balancing capex and debtTata Power’s net debt stood at Rs 42,467 crore at the end of Q1FY25, rising from Rs 38,125 crore in the previous quarter (Q4FY24) and Rs 37,749 crore in the same quarter a year ago (Q1FY24), due to higher capital expenditure (capex) and working capital requirements.

The company is carefully managing its capex to fuel its aggressive growth plans by maintaining a strategic mix of debt and equity to fund major projects, particularly in RE, to ensure it does not weigh on the balance sheet.

About the Bhutan project, Sinha said, “We are not incurring major capex, it will be funded by 70 percent debt and 30 percent equity. My equity contribution is only around Rs 800 crore over five years. That is the structure we will have for most of these projects, so it will not, to a very large extent, impact my equity.”

He said that the strategy is to march ahead with long-term expansion while maintaining strong key financial metrics. Tata Power increased its capex plan to Rs 20,000 crore for FY25, from Rs 12,000 crore spent in FY24.

“All our metrics are very good; our debt-equity, and debt-EBITDA ratios are very good. We must look at the metrics of an infrastructure company. If we have enough cash to pay for the debt, then we should be in a good position to go ahead and execute these projects,” he asserted.

Wait and watchTata Power is taking a cautious stance on green hydrogen, unlike peers rushing into the sector. While other RE firms see potential due to their access to clean energy, Tata Power is waiting for cost competitiveness before committing.

“We have our plate full with a lot of initiatives... we will subsequently come up with a proposal which we can implement,” Sinha said. “We are speaking to a lot of players, but it has to be cost-competitive and sustainable."

Another development that investors are closely watching is the potential IPO (initial public offer) of Tata Power’s RE arm. In 2022, the subsidiary, Tata Power Renewable Energy Limited (TPREL), raised Rs 4,000 crore by issuing shares to a consortium of Blackrock and Mubadala

“We have to have scale, only then we'll talk about any other aspect. In the current scheme of things, it (the IPO) is not there on the table,” he said. “We have 5 GW of installed RE capacity, and another 5 GW under implementation. Maybe when we get there we will have another 5 GW under implementation,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.