The trend in tax mop-up shows that the various policy decisions taken by the government over recent years to widen the base seem to be bearing fruit, as gross tax revenue has gone up in recent years, albeit with some hiccups along the way.

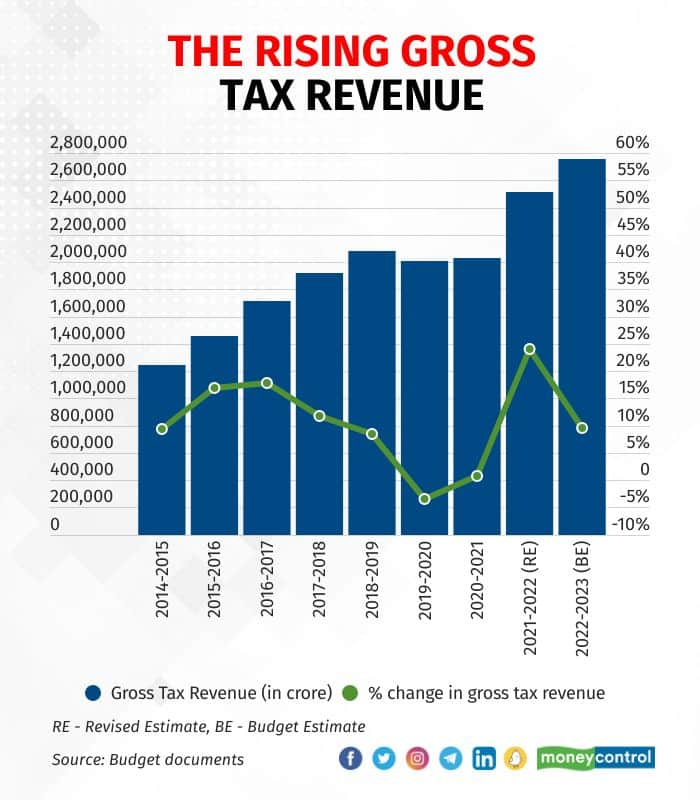

Gross tax revenue went up from Rs 12.44 lakh crore in FY15 to a budgetary estimate of Rs 27.57 lakh crore in FY23, an increase of 121.53 percent over the nine-year period. The FY23 estimate is also 9.61 percent higher than the FY22 figure.

On average, tax collection increased by 10.62 percent year-on-year during the FY15-FY23 period. FY22 marked the largest jump in collections, as the pent-up demand post-pandemic resulted in the gross tax revenue growing by 24.12 percent over the previous year to reach Rs 25.16 lakh crore.

Also read: In Graphic Detail | How government's capex got a boost in recent years

During this period, FY20, which was marred by the Covid-19 pandemic, was the only year in which tax revenue contracted. The gross tax revenue for the year was Rs 20.1 lakh crore, a decline of 3.38 percent from the year before.

However, even before the pandemic-induced slump, the growth in tax revenue was showing signs of slowing down. Both FY18, which was the year after the Goods and Service Tax (GST) was introduced, and FY19 recorded smaller percentage growth in gross tax revenue than the years before.

Though the first two years post its introduction saw an overall slowdown in the growth of gross tax revenue, the collection of GST has grown significantly since. GST collection grew by 76.25 percent from Rs 4.42 lakh crore in FY18 to a budgetary estimate of Rs 7.8 lakh crore in FY23.

A disruptive tax reform such as GST is bound to affect revenues in the initial stage, which explains the slowdown in the first two years.

GST collections are now a comfortably high base but the trend hinges on the growth in nominal gross domestic product. If the economic activity quickens, tax collections tend to rise. The government will have a tough time keeping up the momentum of tax collections in FY24 and economists expect tax revenue estimates to reflect modest growth in the Budget 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.