The government may consider offloading only 3.5 percent of its 29.5 percent stake in Hindustan Zinc Limited (HZL) via the offer for sale (OFS) route in the initial tranche, as investor interest remains grim and retaining 26 percent will enable the continuation of some rights as a shareholder, a government official said.

“In this (HZL) case, investors want the government to remain a shareholder. The government will structure the OFS as per investor demand. Till 26 percent, some rights remain with the shareholder. Below 26 percent the government will have to forego many rights. So the government may look at offloading 3.5 percent. Prudence says that it is not advisable to forego many rights as a shareholder by offloading an additional 1-2 percent,” the official told Moneycontrol. It includes the authority to block any financial resolution proposed by the company board.

Officials had earlier told Moneycontrol that the government is likely to go for a small 5-6 percent stake sale in Hindustan Zinc Limited (HZL) due to tepid investor demand.

“In HZL the interests of institutional investors have been found lacking. The investors are not interested in HZL with Vedanta Ltd as the promoter,” another senior government official told Moneycontrol.

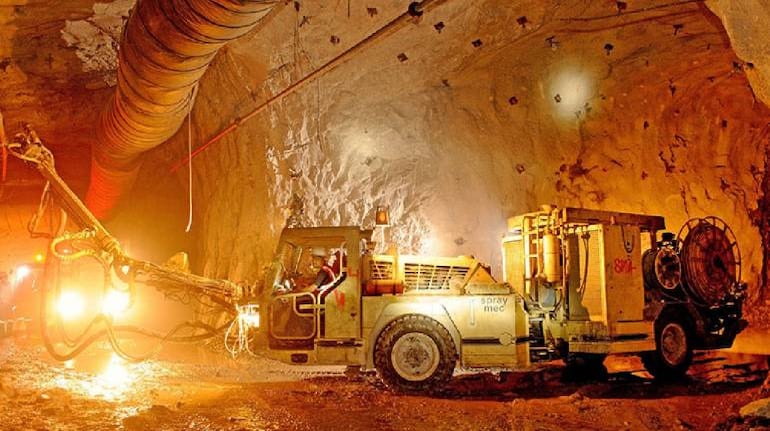

HZL is an Indian integrated mining and resources producer of zinc, lead, silver and cadmium. It is a subsidiary of Vedanta Limited. Vedanta holds a 64.92 percent stake in Hindustan Zinc.

"In HZL, if the government's stake drops below 26 percent, it may lose critical veto rights, especially in special resolutions which require a 75 percent majority. These rights provide the government with a significant say in major decisions and alterations pertaining to the company. Given that investor interest in HZL is currently tepid, it is conceivable that the government would offload just enough shares to maintain its 26 percent stake, ensuring it retains these critical rights while still capitalising on some liquidity," Sonam Chandwani, Managing Partner KS Legal & Associates, told Moneycontrol.

The Union Cabinet had given approval in 2022 to sell the government’s entire stake. The government will get approximately Rs 40,000 crore on sale of its entire 29.5 percent residual stake.

Vedanta had filed arbitration in 2009 after the government rejected its second call option to buy a 29.5 percent share in Hindustan Zinc. The Supreme Court in 2021 allowed the government to disinvest its residual stake in Hindustan Zinc in the open market. The government has been aiming to sell its HZL stake after Vedanta withdrew its arbitration in 2022.

Sebi allows non-promoter shareholders holding more than 10 percent to use the OFS route. Since the government holds more than 10 percent it has decided to opt for the OFS route to sell its stake in Hindustan Zinc.

A query to the finance ministry and Vedanta Limited were unanswered till the publishing of the article.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.