The Narendra Modi-led Central government has selected Milliman Advisors India to work out the embedded value (EV) of Life Insurance Corporation (LIC) ahead of its initial public offering (IPO).

The embedded value will be a formal step towards analysing the life insurer’s valuation. Typically, the valuation is calculated as a multiple of the EV. This valuation is between 3.5-4.7 times the EV for large private life insurers.

Calculating the EV and consequently the valuation of LIC will be a mammoth task. It not only involves valuing the 64-year-old business of the country’s largest insurer but also its paintings, buildings and land parcels.

This will involve physical visits to the 2,048 LIC branch offices as also the 113 divisional offices and eight zonal offices.

Once the EV and valuation is declared, LIC’s exact fundraising plan through a stake sale will be made public.

Moneycontrol gives you a sneak peek into what will go into the valuation of LIC ahead of its listing:

What is EV?

The EV of a life insurance company comprises two key elements. First, it includes the net asset value or the net worth of the company, which represents the market value of the company’s assets attributable to the shareholders. Secondly, the EV also comprises the present value of the company’s future expected profits from its existing business portfolio on the date of valuation.

When it comes to LIC, which had a balance sheet of Rs 34 lakh crore in Q2FY21, this will include its cash and bank balances as well as funds in policyholder accounts and shareholder accounts.

What will be valued?

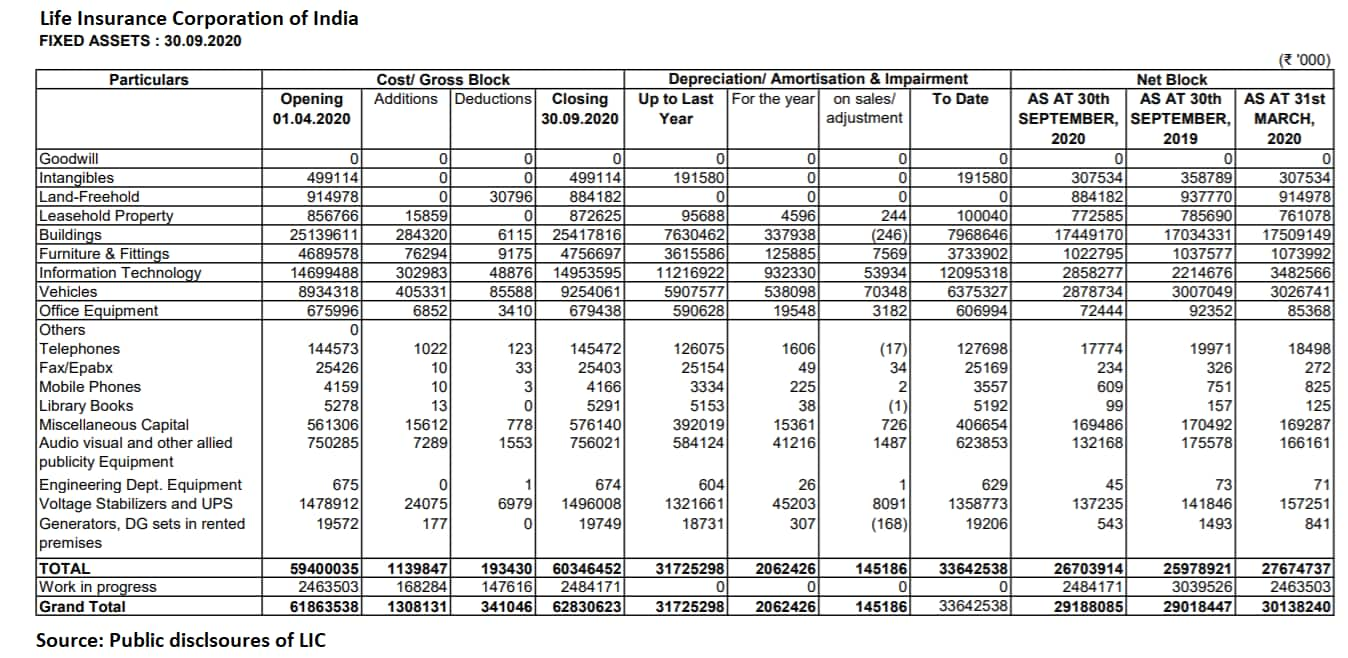

The first process that will be undertaken is to value the physical assets of LIC across India. This includes office equipment, land, buildings and properties given on lease.

As per LIC’s public disclosures, as of Q2FY21 it had Rs 6,283 crore worth assets on its books. This included buildings worth Rs 2,541.7 crore and leasehold property worth Rs 87.26 crore.

LIC also has Information Technology worth Rs 1,495.3 crore, which includes company equipment such as servers, WiFi connectors, computers and laptops.

Once all these assets are valued after taking into account any depreciation/sale, the premium related data will be collected for valuation of the business.

The required data for valuation in respect of each policy is extracted branch-wise from data maintained at each divisional office. The data extracted in respect of individual policies is checked for consistency and validated by software developed for this purpose.

The validated data is consolidated at the divisional office level itself and further consolidated at the zonal office level for offices under their jurisdiction. All such files are sent to the corporate office for further processing. Milliman Advisors will be involved in collating this data from the corporate office and arriving at the EV and valuation.

What about investments?

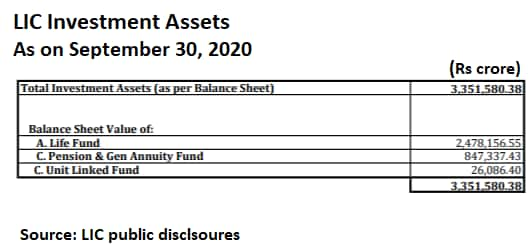

The investment book will undergo a deep scrutiny to look into each book, including linked (Ulips), non-linked and pension policies.

As of September 30, 2020, LIC had investment assets of Rs 33.5 lakh crore. Here, Rs 24.78 lakh crore was for the life fund (traditional business), Rs 8.47 lakh for pension/annuity fund and the remaining Rs 26,086 crore for the linked fund.

The consultant will be involved in valuing each of these funds to arrive at the embedded value. Once the insurer is closer to the IPO, the investment book will be rejigged to clearly demarcate the debt and equity investments in the book, especially in the Ulip portfolio, where investment in both equity and debt are made.

What about the non-performing assets or NPAs?

Gross NPAs in LIC’s debt portfolio stood at 7.96 percent at the end of September 30 (FY21) as against 6.1 percent in the year-ago period. Net NPAs stood at 0.27 percent in H1FY21 compared to 0.33 percent in the year-ago period.

While the insurer had clarified earlier that it has adequate assets to deal with doubtful and non-performing assets, during the EV calculation this figure will also be taken into account.

Also Read: Why is LIC's IPO is the most-awaited listing in India?

Rating downgrades of the investments disclosed by LIC on a quarterly basis will also be looked at during the EV calculation process. This will include downgrades in its life, linked and pension funds.

Will there be a COVID-19 factor?

Since LIC’s valuation process is being conducted amidst the Coronavirus outbreak, it is likely that COVID-19 related disruptions on the business will also be taken into account. This includes the impact on premium collection, drop in business in the first quarter of FY21 and also additional provisions made for the death claims.

The exact number of death claims received and paid due to Covid-19 will be analysed and future projections in this area will be taken into account.

Considering the several lakh crores of investments and assets that will be analysed across the 2,000 plus LIC offices in India, it is likely that the complete valuation process could take between five to seven months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.