Among the biggest surprises of Union Budget 2020 was the proposed Initial Public Offering (IPO) of Life Insurance Corporation of India (LIC). With a Rs 30.5 lakh crore balance sheet as of FY19, even a 25 percent stake sale by the government will mean a bumper listing.

“Listing of companies on stock exchanges discipline a company and provides access to financial markets and unlocks its value. It also gives an opportunity for retail investors to participate in the wealth so created. The government now proposes to sell a part of its holding in LIC by way of Initial Public Offer,” said finance minister Nirmala Sitharaman in her budget speech.

This will now need a Parliamentary nod, as well as an approval by the insurance regulator. And, that is because LIC is a state-owned entity which is guided by the LIC Act 1956.

The disinvestment and subsequent IPO will need an approval from the Parliament. This will then go to the LIC Board and the insurance regulator which approves all IPOs in the sector. A final clearing will be required from market regulator, Securities and Exchange Board of India (SEBI).

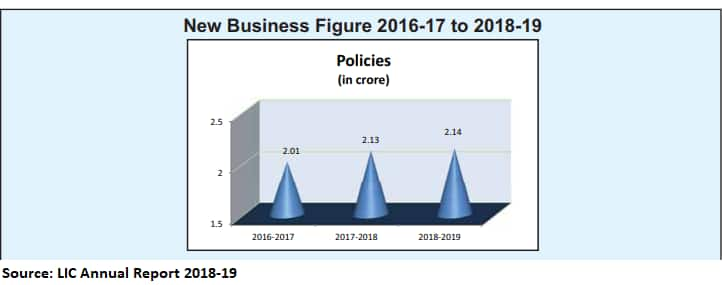

Market leader in insuranceThe country’s largest institutional investor and the largest insurer, LIC, is the market leader in the life insurance industry both by premium collected, as well as the number of policies sold.

For the April to December 2019 period, LIC collected new premiums of Rs 1.37 lakh crore, showing a 45.5 percent year-on-year (YoY) rise. In fact in one month (December 2019), LIC wrote Rs 16,861.98 crore.

Despite the insurance industry having been privatised in 2000, LIC still remains the largest life insurer with 70.52 percent market share (by premiums as of December 2019). It is the only insurer offering sovereign guarantee meaning that the policyholders funds are completely secure. This is the reason that LIC policy premiums are higher than private sector counterparts.

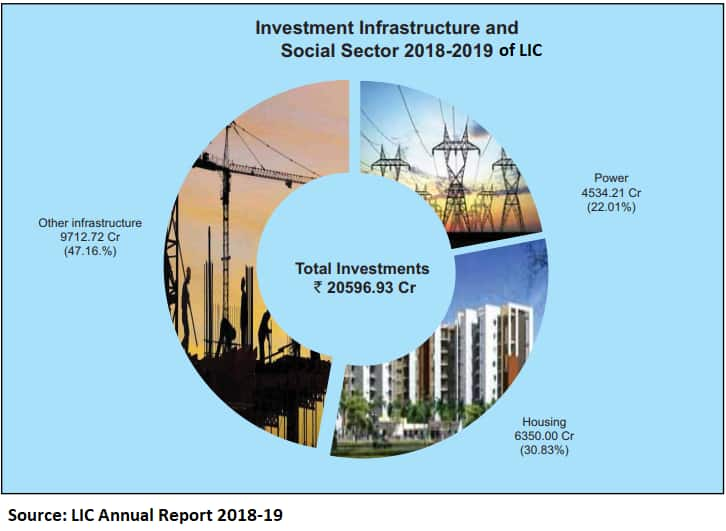

The higher the premiums collected, the more is the amount that goes into investments. These include both debt and equity investments.

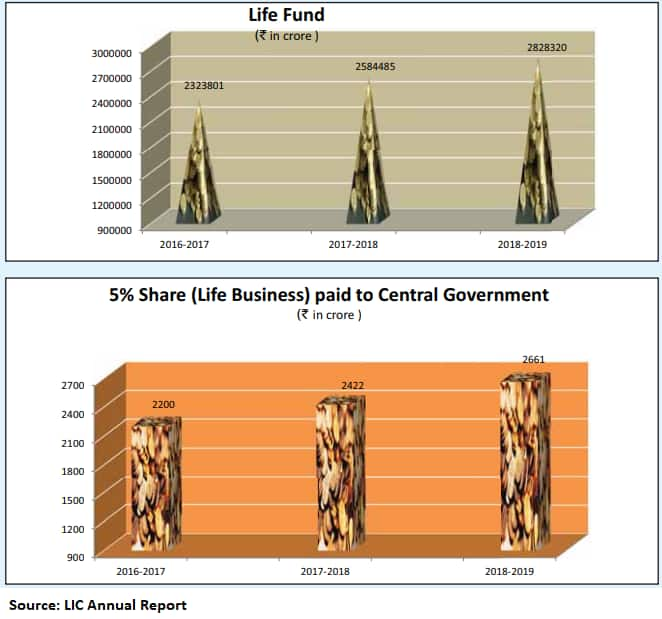

LIC saw a 291 percent jump in its income from investment in a 10-year period between FY09 and FY19. Data from the LIC Annual Report 2018-19 released last week showed that the income from investments stood at Rs 2,21,573.72 crore at the end of FY19.

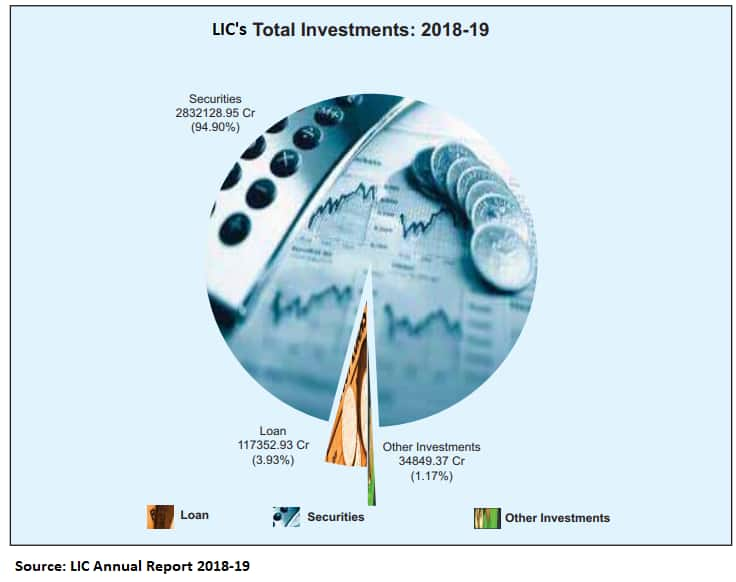

At the end of FY19, LIC's investments stood at Rs 29.84 lakh crore. Of this, Rs 28.3 lakh crore went into securities while Rs 1.17 lakh crore went into loans including policy loans and mortgage loans. The rest Rs 34,849.4 crore went into other investments.

Putting the premium income and investment income together, the net total income stood at Rs 5.61 lakh crore in FY19 compared to Rs 2 lakh crore in FY09. Here, the premium income stood at Rs 3.37 lakh crore.

Despite the tough market conditions, the investment income rose from Rs 2.08 lakh crore a year ago.

Similarly, LIC’s rental income from the estate portfolio rose to Rs 388.18 crore in FY19 compared to Rs 341.43 crore a year ago. The life insurer said that this was 90.18 percent of the yearly target. Ten years ago in FY09, gross revenue from estates stood at Rs 193.21 crore.

Equity market moverLIC is likely to end FY20 with an all-time high equity investment (gross) of around up to 72,000 crore, an all-time high, sources said. In FY19, LIC invested around Rs 68,620 crore into the equity market.

While the YoY growth will be 3.5 percent, LIC’s equity investments hold significance because it is the largest domestic institutional investor in the country. In 2019, LIC is looking to invest Rs 3.49 lakh crore into debt and equities.

In the first half of FY20 itself, LIC has invested around Rs 33,500 crore in the equity markets. The second half (H2) is better in terms of investments since individuals start buying life insurance for tax saving purposes from October onward. The policyholder funds are used for investment purposes.

While investing in the equity markets, LIC follows a ‘contrarian’ investment strategy, which is ‘sell’ when the sentiment is bullish and ‘buy’ when the mood is bearish.

Every year, the life insurer books a profit of Rs 18,000 crore to Rs 25,000 crore in equity profits alone. In FY19, LIC had an equity profit booking of around Rs 23,600 crore which was lower than the Rs 25,650 crore of the year ago.

Any concerns?The rising exposure of LIC to companies facing liquidity crisis has been a cause of concern. While the insurer has adequate assets to manage the bad debt, a rise in provisions could also affect the overall balance sheet.

In FY19, provisions for doubtful debt stood at Rs 3,439.3 crore (rise from Rs 2,744.5 crore in FY18) for participating portfolio while for non-participating (FY19) it stood at Rs 32.2 crore rising from Rs 2.37 crore in FY18.

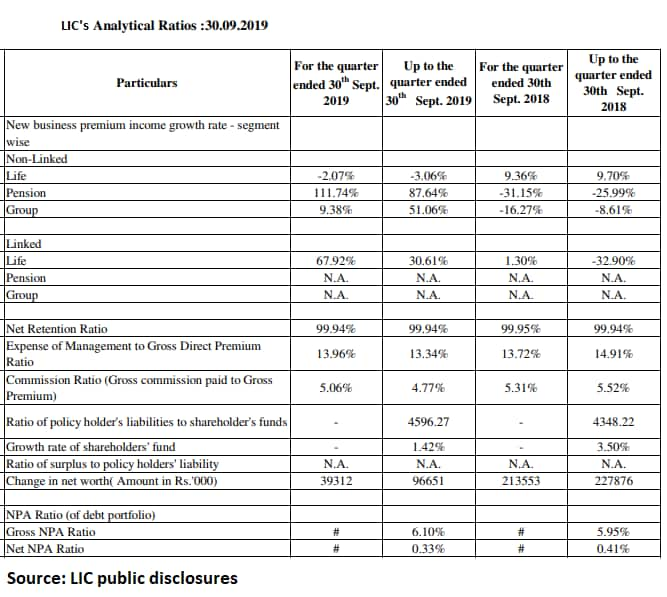

For H1FY20, the gross non-performing assets (NPA) ratio stood at 6.1 percent compared to 5.95 percent in the year-ago period. This is similar to the levels of the country's largest lender State Bank of India that had a gross NPA ratio of 6.94 percent in Q3FY20.

Market experts are of the view that an LIC IPO will mean that all the financial decisions of the insurer related to investments, as well as participation in disinvestment programmes of the government, will be subject to greater scrutiny.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.