Death claims worth a whopping Rs 1,134 crore were paid out in 2020-21 under the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), according to data from the department of financial services.

In 2020-21, 56,716 claims, worth Rs 2 lakh each, were paid out under PMJJBY. In the year-ago period, there were 42,977 claims, totalling Rs 859.54 crore.

“There has been a spike in term insurance claims due to the rise in COVID-19 deaths. In FY21 and even in FY22, there has been a big rise in claims. In fact, almost 50 percent claims paid out are due to COVID-19 deaths," said an official.

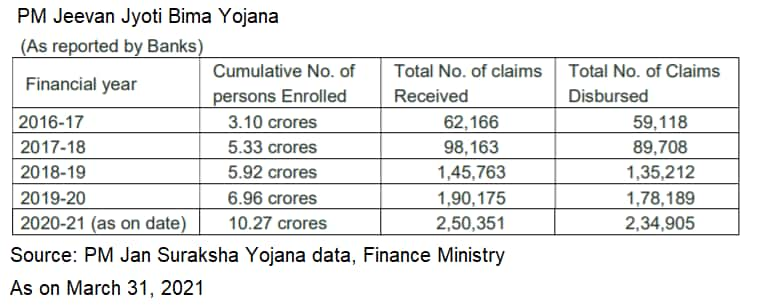

As of FY21, 102.7 million people are enrolled under the PMJJBY on a cumulative basis. Launched in May 2015, the PMJJBY is a pure term insurance policy, with an annual premium of Rs 330 for a cover of Rs 2 lakh.

Pure term insurance scheme is one in which the claim is paid only in the event of death of the policyholder during the policy term. Premiums are deducted through an auto debit facility at the banks on a yearly basis.

One factor attracting customers is that the annual premiums have stayed unchanged since inception.

“Your regular insurance policies have premiums going up every one to two years, depending on the past claims experience. But PMJJBY has the same premium, and, hence, it works to be way cheaper. The government stuck to Rs 330 since it wanted the product to be accessible,” added a government official.

As on 8 am on May 18, India had set a new record with 4,329 deaths in the past 24 hours. The total death tally from COVID-19 stood at 2,78,719.

The number of COVID-19 cases in the country stand at 25.2 million, with 2,63,533 new cases being registered as of May 18, 8am.

Government officials told Moneycontrol that the sudden spike in filing claims is also because a lot of families were not aware of the deceased having PMJJBY. Insurance companies handle the claims process and make payouts after verifying documents from the bank.

“Banks have been spreading awareness about this product. Hence, family members of those losing their lives due to COVID-19 and other reasons can check the bank passbook for 2020 to verify if the Rs 330 premium has been debited. Claims settlements are also done within," said a ministry official.

Under PMJJBY, an insured's kin need to approach their bank to get the claims settled since the premium amount is debited from their account. Once the death certificate and allied doctor's documents are submitted, the claims are passed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.