Bond traders pricing in a RBI rate cut this year may be disappointed, with local growth good and the US unlikely to go through a recession, according to a top official at Bank of America Corp.

“In the last quarter, the swaps market is pricing a cut in India, which I find very hard to believe,” said Jayesh Mehta, India country treasurer at the US bank said in an interview last week. “Our domestic demand is good, backed up by equally good local growth.”

While the country’s current account deficit may be one factor which might push officials toward one rate cut, “we are not going to pivot back to cutting rates that quickly this year,” he said.

Expectations for interest rate cuts are rising across many countries, with traders already pricing in a moderation in tightening followed by cuts in economies like the US and England. But according to Mehta, inflation is sticky and a US slowdown will only happen if large companies start slashing jobs in a big way.

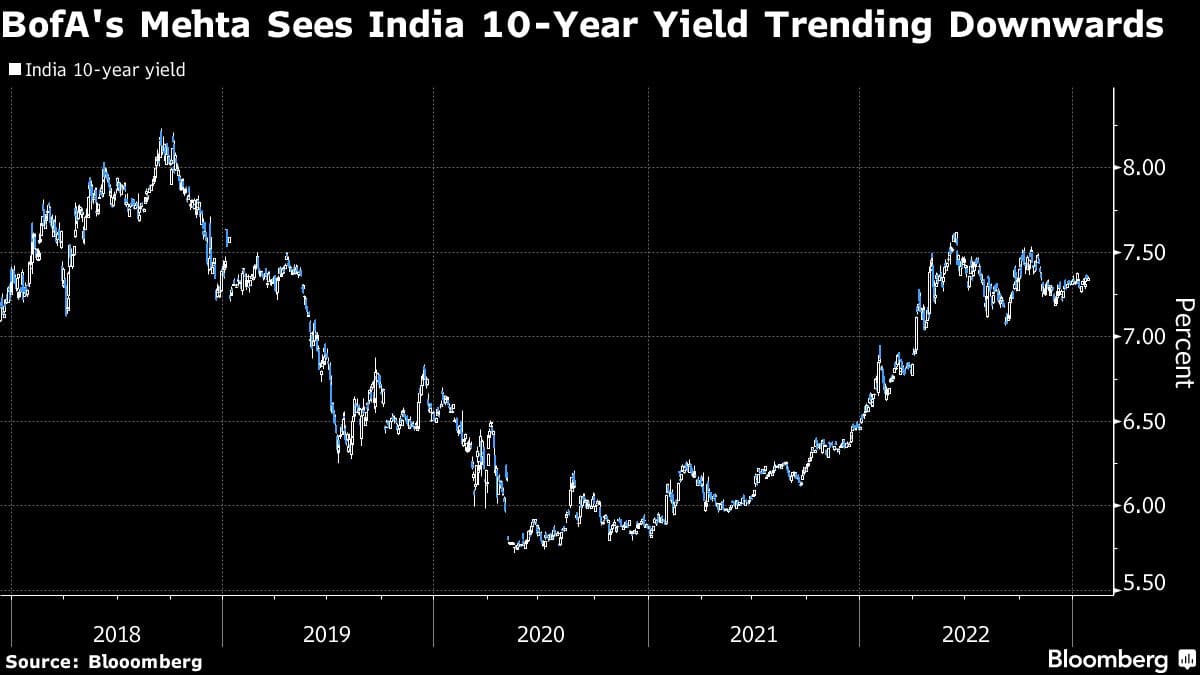

Still, the 35-year bond veteran sees India’s benchmark yield trending downwards, a view in line with market consensus estimating a fall to 7.18% by the end of the year from around 7.35% on Wednesday.

“Can it go to 7.50%, 7.60%? Yes, it can go. But will it stay there? The answer is no,” he said. While India’s borrowing requirements grew in its latest fiscal year and market expectations are for it to increase further, Mehta sees demand meeting supply.

“Supply was there, which was absorbed with ease,” he said. “And I don’t see that changing next financial year too.”

Investors will get a sense of how much more debt India is planning to raise in it’s upcoming Feb. 1 budget. This will be the last full fledged budget before the nation, that already has one of the highest deficits in Asia, goes into elections in 2024.

Mehta also sees a shift in the ownership trends of government securities, where pension funds and insurance companies are becoming larger holders of sovereign bonds than banks, as the country’s economy formalizes.

“It may be still that banks are the largest investors but on an incremental basis, it is reducing,” he said. “That shift from banks to insurance companies, pension funds is already happening.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.