After two successive quarters of bumper profits, net earnings of Indian companies are likely to be relatively muted in the January-March quarter of the fiscal year 2020-21, as businesses face headwinds from rising costs of commodities and supply disruptions. Many businesses have been complaining about the rising costs of commodities and inputs over the past few months.

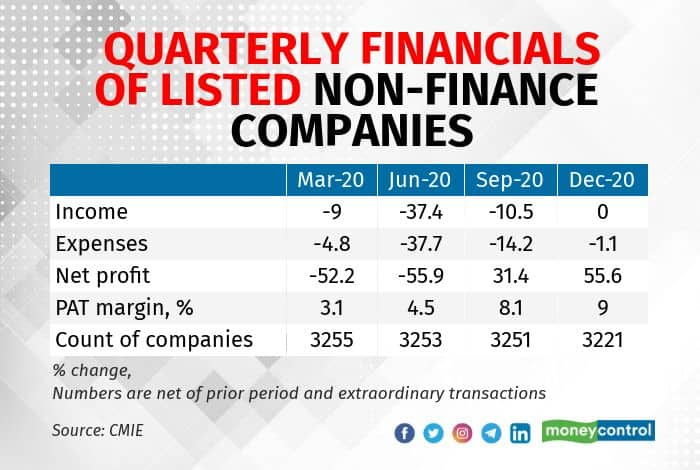

Listed non-finance companies had collectively reported a staggering 56 percent rise in their profit after tax (PAT) in the October-December quarter of 2020-21, from a year ago, after recording over 31 percent jump in the preceding quarter, according to an analysis by the business information company Centre for Monitoring of Indian Economy (CMIE). Profits climbed even as sales fell or stagnated at the levels reported in the corresponding period of the previous year. Such growth in profits (net of prior period and extraordinary transactions) was an outcome of lower costs—of inputs, wages and capital.

The fall in costs was greater than the fall in total incomes in the two quarters when the economic activity was gradually gaining pace after the harsh lockdown imposed a year ago. The PAT margin of some 3,200 listed non-finance companies tracked by CMIE rose steadily through the fiscal year, from 4.5 percent in the April-June quarter to 8.1 percent in the next and 9 percent in the third.

What Mattered: Slump In Costs

In comparison, the net sales of these companies fell 10 percent in the July-September quarter from a year ago, and remained almost stagnant at the previous year’s level in the October-December quarter. During those quarters, the expenses of these companies fell by 14 percent and 1 percent.

The growth in incomes, expenses and PAT, however, varied across industries due to the nature of their business. The third-quarter financial results of a small sample of companies are illustrative of this variation in income and profits growth. Companies such as Larsen and Toubro, NTPC, and Sun Pharma reported a stunning jump in their PAT despite a modest rise in their total incomes while Reliance Industries saw profits jump even as incomes contracted. Companies such as Hindustan Unilever, Infosys, Maruti Suzuki and Bajaj Auto benefitted as their expenses grew at a slower pace than their total incomes, resulting in 20-30 percent growth in their PAT.

Given the elevated prices of commodities, producers of minerals and metals can expect to report good profit growth in the current quarter. The rollout of the vaccine against COVID-19 will quicken the pace of economic recovery in the larger economies and that might keep commodity prices strong for several quarters.

Ferrous and base metal prices began their climb in mid-2020 when economic activity gathered momentum in China and its government announced plans to spend billions of dollars on building new infrastructure. Many analysts expect the Chinese demand to remain stable in 2021. Continuing Chinese demand for Indian iron ore and steel products will benefit the exporters.

Indian metal and mining companies had gained from the rising demand from China in the past quarters. Indian companies exported iron and steel worth $2.34 billion to China in April-January of 2020-21, up from $0.47 billion in the same period of 2019-20, data published by the Directorate General of Commercial Intelligence and Statistics (DGCI&S) of the department of commerce show.

During the same period of 2020-21 and 2019-20, the export of iron ore to China was $3.19 billion in 2020-21 and $1.76 billion.

Nearly 25 percent of iron and steel and 86 percent of iron ores exported in the current year went to China.

India Ratings and Research estimates that steelmakers may focus on the domestic market in the coming months given the strong pick-up in demand and robust realisations. Demand for steel from user industries such as automobile and consumer durable goods makers have been robust.

Crisil has estimated double-digit growth for the automobile sector in the next fiscal year. It estimates passenger vehicle sales will climb 23-25% and commercial vehicles by 34-36% in 2021-22. Equirus Securities in a mid-February note expected China’s steel demand to continue to grow and iron ore prices to stay elevated for the next 9-12 months.

The Union government’s plans to step up infrastructure spending, if executed expeditiously, will boost sales and profit growth of metal and mining companies for several quarters.

The elevated prices of iron and steel and other base metals can put a squeeze on the margins of user industries. Many are already absorbing a proportion of the increased costs of inputs instead of passing it on to consumers for the fear of hurting demand.

The inability to pass on higher costs to consumers will slow the profit growth of manufacturers of automobiles and consumer goods. Some easing of prices of some steel products seen in recent weeks will give user industries some respite, as would successful price negotiations.

A rise in prices of precious metals such as platinum and rhodium during the current quarter will also put pressure on the margin of automobile companies. Metals such as platinum, palladium and rhodium are used in catalytic converters.

Public spending on infrastructure and speeding up of ongoing development work can also boost demand for cement, steel, heavy equipment and machinery. A pickup in real estate activity, with emphasis on completing delayed projects, will help the sales growth of cement companies. In its sectoral note, CARE Ratings estimates that rural demand will be a major driver for cement in the near term.

However, rising costs of fuel – petroleum coke and coal – have pushed up expenditure for cement companies. Recent increases in cement prices will prevent further erosion of margins of the manufacturers. More price increases might become necessary if fuel and raw material costs continue to rise. For the moment, factories are operating below capacity due to manpower shortages.

Talking Of Worry Lines

The rise in petroleum product prices is another cause for concern for businesses. Higher prices for petroleum products raises the cost of transportation for all businesses. Transportation accounts for a sizeable part of expenses that all businesses incur, as inputs have to be brought to factories and output moved to warehouses and customers.

Elevated prices of crude make various kinds of plastics that are used in making parts of machinery, automobiles and gadgets as well as plastic packaging more expensive. If the plastic packaging makers are unable to pass on the rise in input costs to user industries, they could see margin compressions in the coming quarters. Plastics such as polyethylene and polypropylene are derived from crude oil.

The decision of the Organisation of the Petroleum Exporting Countries (OPEC) to hold production steady and even cut supplies will only serve to keep oil prices elevated. Given that, commercial and retail consumers of petroleum products can get some relief if the Union and state governments decide to lower the high tax component on petrol and diesel.

A global shortage of semiconductors has upset the plans of makers of automobiles, consumer goods and gadgets to normalise production. The shortage rose due to a rapid and unforeseen jump in the demand for microchips that power everything from computers and mobile phones to automobiles during the pandemic and after.

As the pandemic forced people to work from home and students to attend classes online, the demand for laptops, electronic devices and appliances jumped across the world. Stoppage of work in semiconductor factories during the early days of the pandemic and disruptions to transportation have also contributed to the current shortage.

The situation is unlikely to ease anytime soon, as there are only a handful of semiconductor chip manufacturers across the world and all of them are operating at full capacity to meet the robust global demand. Intel, Samsung and Taiwan Semiconductor Manufacturing Company are among the top semiconductor makers. The strong demand for products powered by semiconductors allows manufacturers of these goods an opportunity to raise prices to recoup some lost revenues.

Shortage Issues

Adding to the woes of businesses is a global shortage of containers to move parts, finished goods and perishables from one port to another. Shortage of hands at various ports and a shortage of drivers to move the cargo to their destination are only part of the reason. Other reasons include a change in the flow of goods traded, many containers have no cargo to move from ports where they had dropped off goods earlier. Moving empty containers is expensive.

Container shipping rates are surging on many routes due to the non-availability of these large boxes, increasing the freight costs for both exporters and importers. It is estimated that freight rates have doubled and tripled on some routes over the past few months. A decline in the number of vessels in operation is also hurting container cargo movement. The global container capacity might be normalised only sometime next quarter at the earliest.

Lastly, the wage costs of businesses are rising. The cuts made in compensation packages when businesses were brought to a halt by the national lockdown have been mostly restored. Many industries have started hiring more employees. Wage costs are a relatively small component of expenditure for large companies and therefore a rise in payout will have a minor impact on the margins.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.