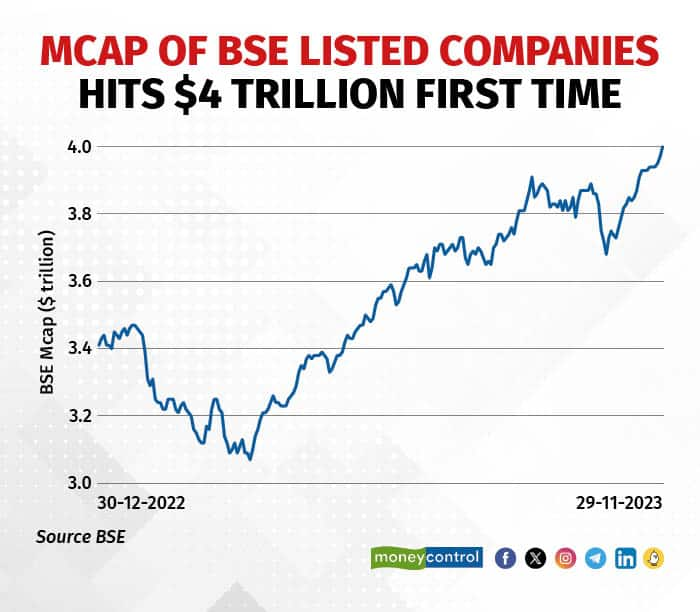

The market value of companies listed on the BSE crossed a record $4 trillion for the first time riding on the sustained rally in Indian equities.

As of November 29, the total market cap (MCap) of all BSE-listed companies hit $4.01 trillion or over Rs 333 trillion, climbing over $600 billion since the beginning of the year. However, the benchmark Sensex remains about 2 percent below its record high scaled on September 15.

The BSE-listed firms achieved a $1-trillion market cap milestone in May 2007. It took over 10 years to double that, despite numerous new companies joining the exchanges. The market cap surpassed $2 trillion in July 2017 and $3 trillion in May 2021.

Local equities surged following a significant drop in the US 10-year yields to 4.33 percent. The dollar index hit a three-month low after US Federal Reserve Governor Christopher Waller suggested possible interest rate cuts if inflation continued to ease.

India also received positive sentiment boosts from recent upgrades by global brokerages, strong earnings for the second quarter, and a fall in crude oil. Investors are awaiting India GDP for Q2 and election exit poll results for five states, voting of which completed recently, on November 30. The final election results will be declared on December 3.

Analysts note a sustained decline in the Consumer Price Index (CPI) inflation over four months, bringing it within the Reserve Bank of India's (RBI) acceptable range and pushing core CPI to a four-year low. This ongoing easing in inflation is seen as providing space for the central bank to devise a growth-oriented monetary policy in the near future.

They caution about potential risks from government policies related to elections, foreign institutional investor (FII) selling, and external volatility, likely prolonging a consolidation phase in the short term. However, with valuation comfort improving and forward P/E dropping below the 10-year mean level while maintaining EPS upgrade momentum, Brokerage InCred Equities upholds a Nifty target of 21103 and maintains an overweight stance.

JP Morgan, Morgan Stanley, CLSA, and Nomura recently upgraded India to an 'overweight' rating. JP Morgan's upgrade was due to positive seasonality linked to general elections, robust emerging markets (EM) nominal GDP growth, and a deeper bond market expected to lower risk premiums.

Morgan Stanley's upgrade was based on improving economic and earnings growth. CLSA raised its India portfolio allocation by 20 percent, while Nomura upgraded India to overweight in September, citing a compelling top-down narrative and potential benefits from the China+1 trend.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.