Tata Motors, India’s largest electric vehicle manufacturer, is set to announce its second-quarter earnings for FY25 on November 8. Sales are anticipated to remain flat year-over-year, as weaker volumes across several divisions weigh on performance.

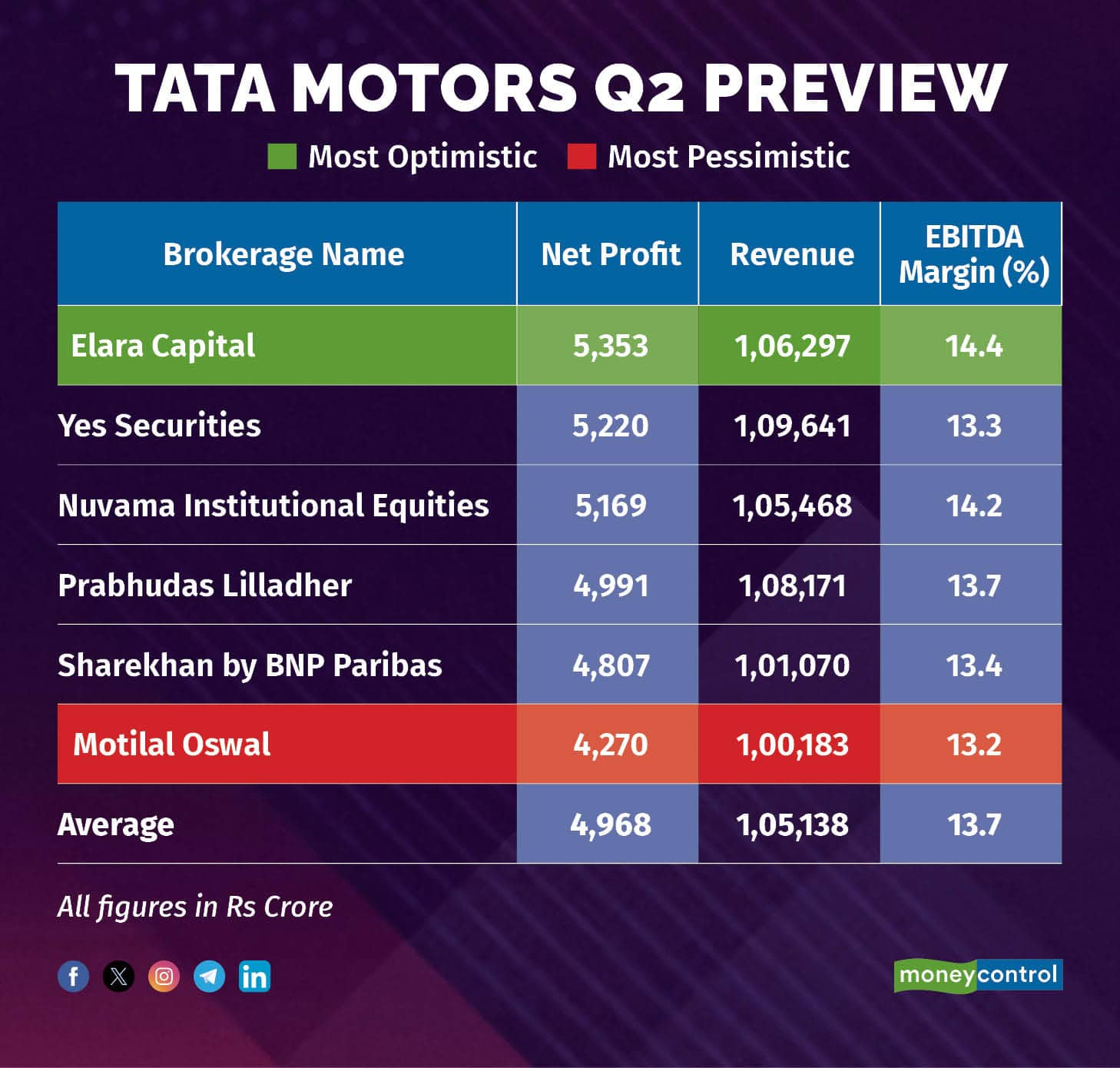

A Moneycontrol poll of six brokerage firms projects that Tata Motors, the maker of Nexon, will report flat year-on-year revenue at Rs 1.05 lakh crore. However, the company’s net profit is expected to jump 32 percent, reaching Rs 4,968 crore, up from Rs 3,764 crore in the same quarter last year.

Follow our LIVE blog for all the latest market updates

Earnings estimates from analysts polled by Moneycontrol are in a narrow range, indicating that any positive or negative surprises could trigger a sharp reaction in the stock price.

Steady EBITDA: Analysts from Nuvama Institutional Equities noted that the EBITDA margin could improve, driven by better profitability in Tata Motors' commercial vehicle and passenger vehicle businesses in India, as well as its British subsidiary, Jaguar Land Rover.

Volumes decline: As per Motilal Oswal, India’s business faced weak volumes, with PV and CV volumes down 5 percent and 19 percent year-over-year, respectively. JLR volumes are expected to decline 4 percent on the year.

Also read: Hopes of a Trump win sparks 3% rally in Nifty IT; Infosys, TCS lead gains

Supply chain challenges: JLR is expected to face supply chain obstacles during the quarter, resulting in a decline in volumes. However, Prabhudas Lilladher is of the view that a lower share of the Jaguar portfolio is likely to offset some impact.

The company reported a slight dip in both domestic and international sales, with total sales at 82,682 units in October, compared to 82,954 units in the same month last year. Domestic sales saw a marginal increase, rising to 80,839 units from 80,825 units in the year-ago period.

What should you look out for in the quarterly show?The key factors to watch out for are demand and margin outlook across divisions. As for the PV segment, there are various concerns regarding a demand slowdown due to a high base effect and high financing costs.

Tata Motors shares were trading at Rs 837, higher by 0.2 percent from the last close. The Tata Motors stock has tanked 10 percent in the past month.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.