Indian markets jumped 2 percent on November 11 to hit near all-time-high, tracking gains in global equities after US consumer price inflation came softer than expected.

During the day, Sensex rose as much as 2 percent and hit a record high of 61,826.25 points while the Nifty gained 1.85 percent to touch 18,362.30 points. At closing, the Sensex settled at 61,795.04 points, up 1.95 percent while Nifty was at 18,349.70 points, up 1.78 percent.

The local equity rallied with support of banking and IT stocks. Meanwhile, BSE MidCap and SmallCap were trading marginally higher.

"The market rallied in the U.S. led by lower-than-expected inflation data. The Federal Reserve is likely to slow the pace of its interest-rate increases in the near term. India is likely to see a multi-year economic up-cycle led by strong macros, and various government initiatives", said Reliance Securities in its recent note.

All eyes are now on India's consumer price inflation which will be out on November 14. According to Bloomberg, CPI will likely cool to 6.7 percent in October from 7.41 percent a month ago.

Here are the top reasons with charts on why markets jumped:

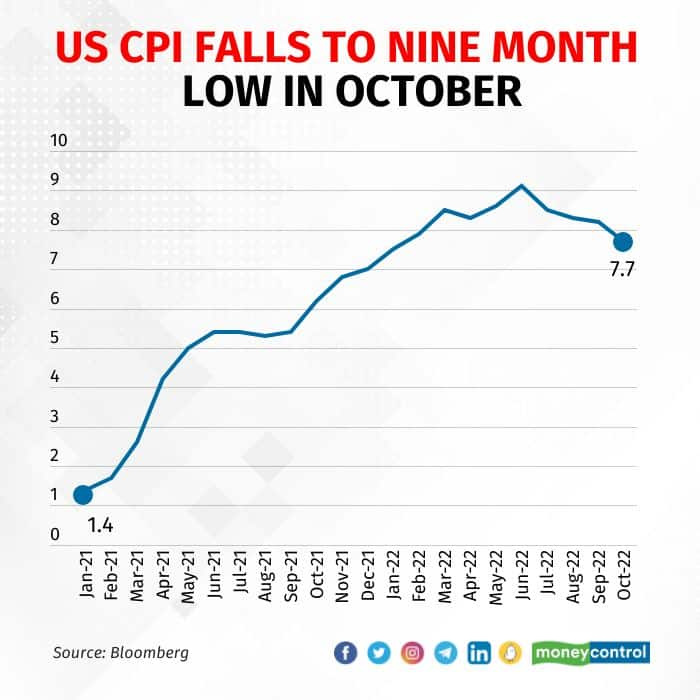

The rally started in the global equities with slower inflation that boosted the odds of a slower rate hike by the Federal Reserve. US headline CPI print came in at 7.7 percent year on year (0.4 percent MoM) against expectations of 7.9 percent yoy (0.6 percent MoM). The softer CPI print has resulted in markets paring back expectations of US Fed funds rate range to 4.75-5.00 percent from 5.00-5.25 percent. With inflation showing signs of cooling off, the expectation is that the Fed is likely to tone down its hawkishness, according to IFA Global Research Academy.

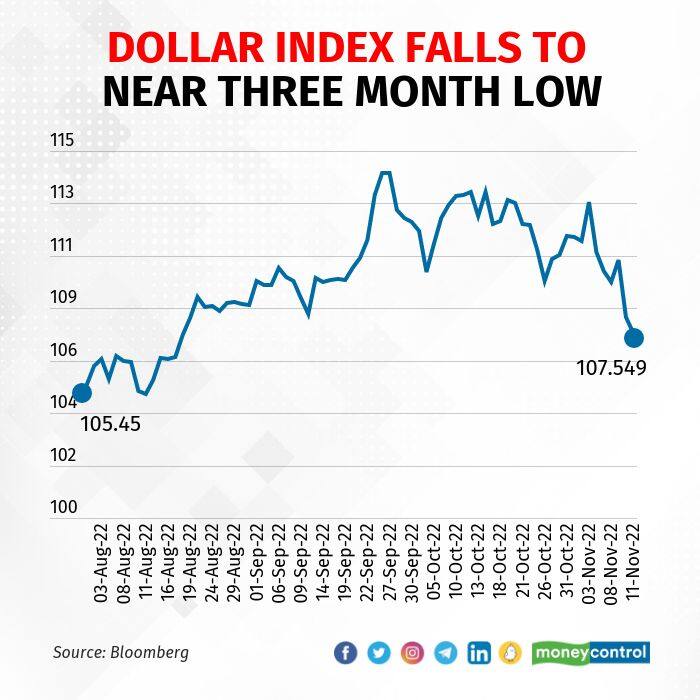

The dollar index’s sharp fall overnight has helped sentiment as well. Overnight, the dollar index saw its worst decline in 13 year. The index closed at 2 percent lower , its biggest fall since March 2009.

IT stocks, which were in correction mode, also surged. The stocks were under pressure amid expectation of recession in two of their largest markets – the US and Europe. Infosys rose 4.5 percent, Tech Mahindra 3.7 percent, HCL Technologies 3.6 percent, Tata Consultancy Services 3.4 percent, Wipro climbed 3 percent. The BSE IT Index jumped 3.7 percent.

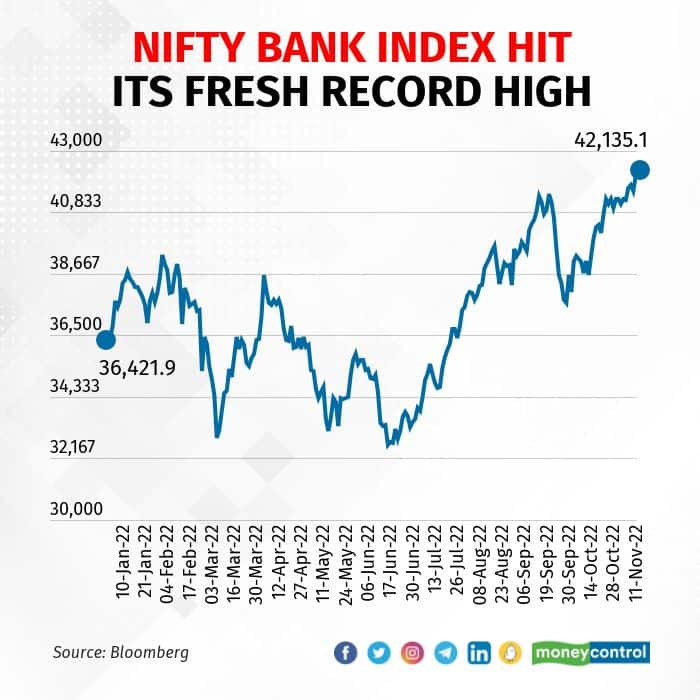

Nifty Bank advanced to its fresh all time high after today's rally. The rally was supported by gains in HDFC twins, which jumped over 6 percent intraday. According to a Macquarie report, after the completion of HDFC and HDFC Bank's union, the weight of the merged entity could be double the weight of HDFC Limited in MSCI currently.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.