With Tata Consultancy Services and Infosys set to kickstart Q3 FY2024 earnings on January 11, analysts note the persisting selling pressure in IT stocks at higher levels, and weakness in TCS, Infosys and Wipro, while strength in HCL Tech, L&T Tech and Persistent Systems.

Experts have expressed uncertainty about the IT results outlook due to an uptick in furloughs and subdued demand for discretionary services in a seasonally weak quarter. While the December quarter is generally considered weak due to the holiday season, the seasonality this time appears higher than usual.

Ahead of the results, here's how technical analysts and traders are positioning themselves:

"The Nifty IT index is grappling to overcome the selling pressure emerging around the 36,000 mark. This hurdle must be surpassed to enter the next leg of upside, said Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox. However, the IT index has a strong support at 34,000. “The current bias ahead of Q3 results remains formidable over the key support of 34,000," he said.

"If the index fails to adhere to this support, the downside may trigger bearish sentiment for the sector. The index may then drift towards 32,000 and may enter medium-term bearishness," Bagkar added.

The Nifty IT index was nearly flat at 2.30 pm on January 10, trading at 34,688.

Among IT stocks, HCL Technologies, L&T Technology Services, and Persistent Systems remain optimistic, according to Bagkar, as the upside bias continues to gain bullish momentum. He believes any weakness in these stocks could be viewed for accumulation and may see the price potentially heading into uncharted territories.

"Weak IT stocks include Infosys, LTIMindtree, Mphasis, Tata Consultancy Services, and Wipro, which, if they fall beneath their respective 50-simple moving averages, may see further downside," he further added.

Infosys is expected to remain subdued, while TCS may see positive movement with a decisive breach above Rs 3,835: Shiju Koothupalakkal, Technical Research Analyst at Prabhudas Lilladher.

According to Shiju Koothupalakkal, Technical Research Analyst at Prabhudas Lilladher, ahead of the results, IT stocks such as Infosys are expected to remain subdued and would need a decisive breach above Rs 1,580 to establish some conviction for further upward movement. "At the same time, a break below the crucial support zone of Rs 1,460 shall weaken the bias to anticipate further slide,” said Koothupalakkal.

“On the other hand, TCS can witness some positive move with support maintained near the important Rs 3,635 levels and on the upside, a decisive breach above the Rs 3,835 zone shall further strengthen the trend to anticipate further rise in the coming days," he added.

HCLTech and Birlasoft show strength with a fresh breakout on the daily charts: Arun Kumar Mantri, Founder of Mantri Finmart

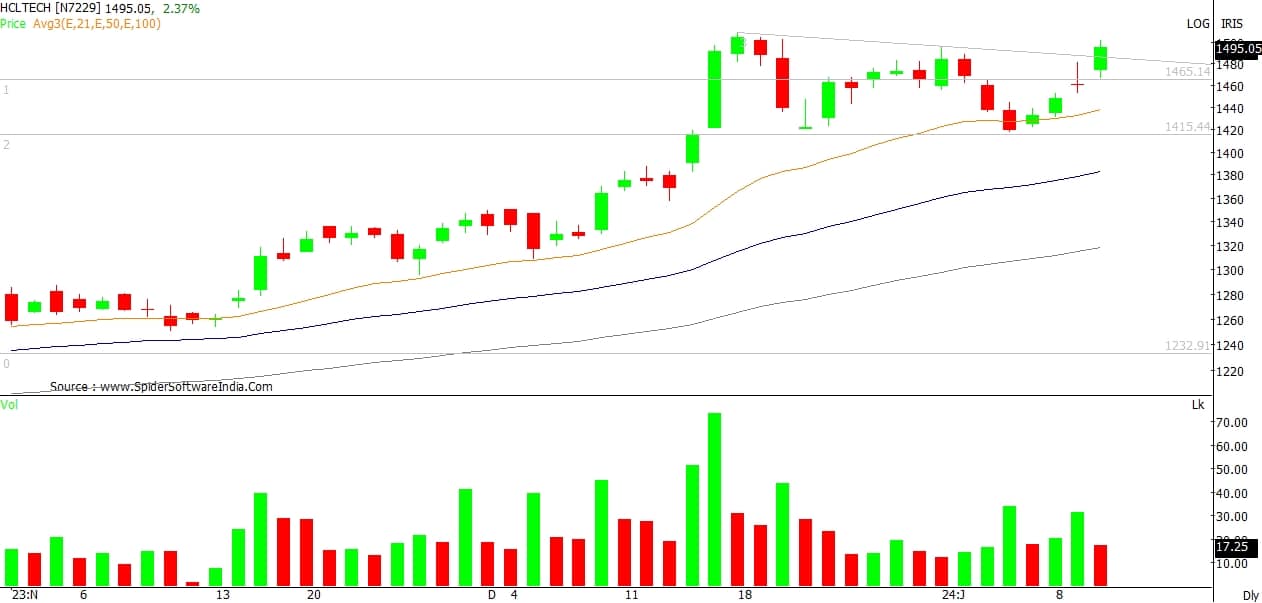

Arun Kumar Mantri from Mantri Finmart is positive on the IT sector, stating, "IT stocks are looking stable and consolidating ahead of TCS and Infosys results tomorrow. On the technical front, HCLTech and Birlasoft look extremely strong, with a fresh breakout on the daily charts. For the short term, HCLTech may be looked upon on the long side, keeping today’s low as SL, which is around Rs 1,466 for the targets of Rs 1,540 plus zones."

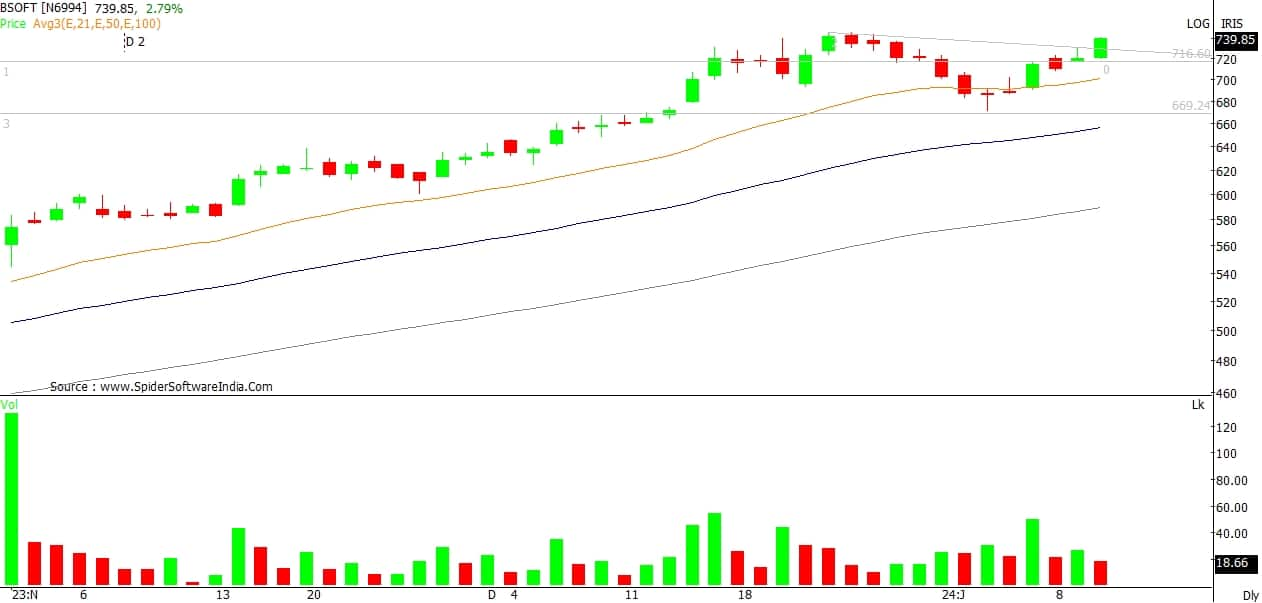

Birlasoft chart showing strong counter set to test fresh highs in the coming sessions: Arun Kumar Mantri

Birlasoft chart showing strong counter set to test fresh highs in the coming sessions: Arun Kumar Mantri

HCLTech technical chart showing breakout from the sloping trend line with good traction in volumes; Poised to test 1500 plus levels: Arun Kumar Mantri

HCLTech technical chart showing breakout from the sloping trend line with good traction in volumes; Poised to test 1500 plus levels: Arun Kumar Mantri

Bearish on IT stocks before results; No anticipated strong quarterly performance: Amit Saraf, Derivatives trader

Amit Saraf, a derivatives trader, has a contrarian view, stating, "I am bearish on IT stocks. I do not think that IT stocks in general will have any strong quarterly performance. I am short OTM calls on IT stocks ahead of results."

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.