State-run Power Grid Corporation (PGCIL) will announce its fourth-quarter earnings on May 19, and a poll of earnings estimates has pegged a modest profit growth on robust summer demand.

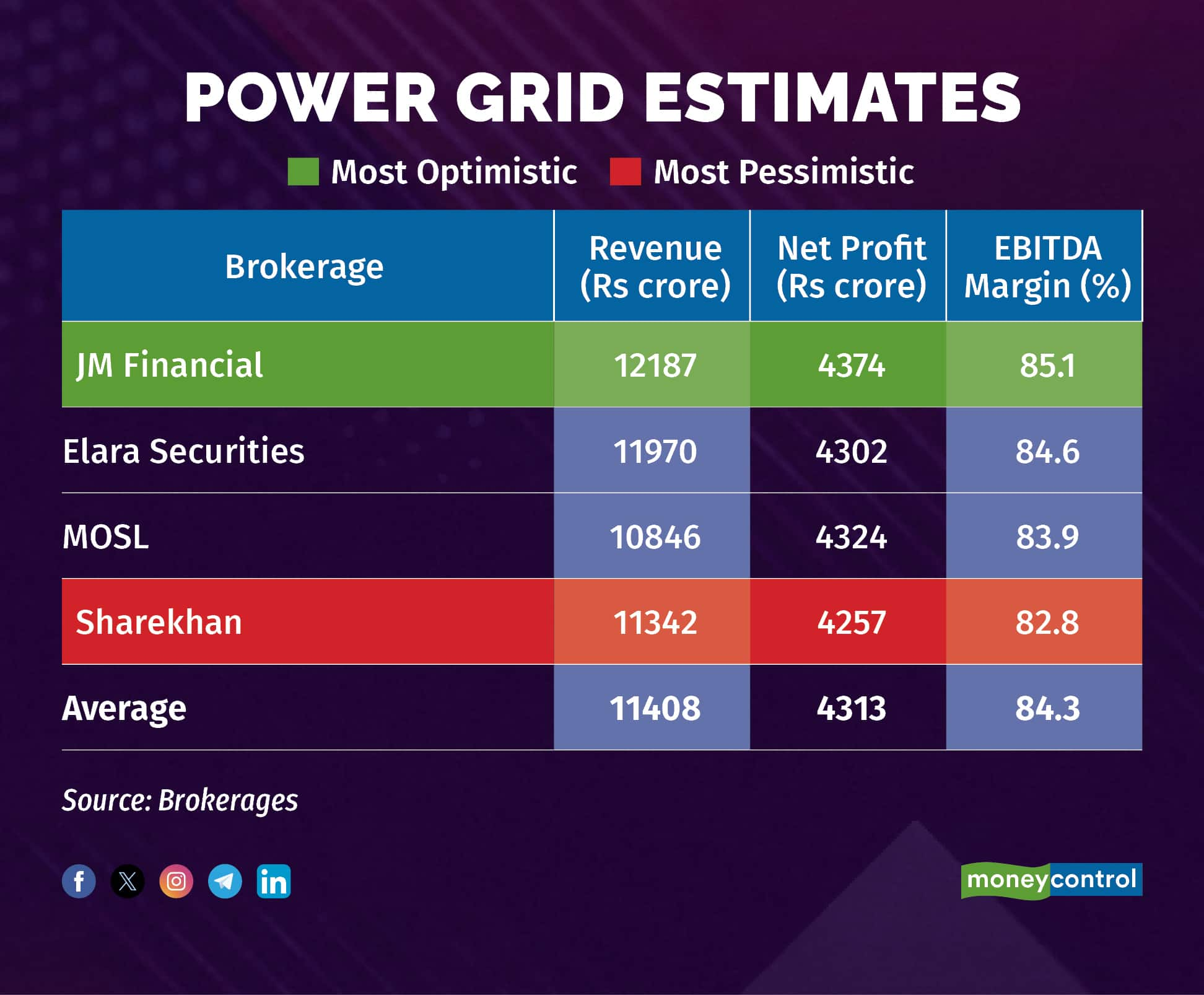

The poll on earnings estimates based on four brokerages said the government-owned company is expected to report a 4.5 percent on-year profit growth at Rs 4,313 crore due to steady demand for power transmission. The net revenue is expected to fall 4 percent year-on-year on an annualised basis to around Rs 11,408 crore.

This number is slightly skewed due to estimates from Motilal Oswal which expects a 1.8 percent YoY decline, while other brokerages estimate a 2-3 percent YoY increase in revenue. Earnings before interest, taxes, depreciation and amortisation or EBITDA margin for the three-month period is estimated to be muted at around 84.3 percent.

The most optimistic of the brokerage note – from JM Financial - estimates the net profit to rise by 3.2 percent on-year to Rs 4,302 crore, while the most pessimistic assessment by Sharekhan estimates a net profit growth of 3% increase from a year ago to Rs 4,257 crore.

The stock price of PGCIL has fallen around 4 percent in the last one year and by around 230 percent over the last five years. PGCIL is a central public sector undertaking (CPSU) under the Ministry of Power, dealing in power transmission as well as telecom and consultancy.

What Could Drive the Earnings?JM Financial estimates that power generation companies may deliver a modest performance in Q4FY25, owing to subdued energy and peak demand, impacted by the projection of a prolonged monsoon this year. Meanwhile, coal production and prices have remained soft, both in India and globally.

Transmission DemandAnalysts at Elara expect PGCIL to benefit significantly from the ongoing renewable energy (RE) capacity additions, as it continues to be the government’s preferred partner for large and strategic transmission projects. such as the Leh transmission project.

Elara Securities said that PGCIL’s regulated entity is expected to rise to Rs 89,600 crore in Q4FY25E, driven by the commissioning of new transmission lines and substations. Regulated equity is the portion of capital investment approved by regulators on which power utilities like Power Grid earn fixed returns. Under the Central Electricity Regulatory Commission’s (CERC) norms, 30% of the capital cost of a transmission project is treated as regulated equity while 70% is financed through debt.

Weak CapitalisationDespite a strong power demand, Sharekhan believes Power Grid is expected to report only a modest 3.1% YoY growth in PAT for Q4FY25, largely due to weak capitalisation. This indicates delays or lower-than-expected commissioning of new assets, which could impact the addition to regulated equity and earnings momentum.

Power DemandIndia’s power demand in Q4FY25 reached 41,800 crore units, marking a 4.2% YoY rise. According Sharekhan, the demand was sluggish in January and February, but it surged in March. Going ahead, given the forecast on the number of heatwave days, power demand is expected to remain robust in the coming months, supporting transmission volumes and future capex visibility for PGCIL.

Operating Expenses and ProfitabilityJM Financial noted that while overall revenue is likely to remain flat on a YoY basis, EBITDA is projected to increase by 3 percent YoY due to a 3–4 percent reduction in operating expenses. This improvement in operating efficiency, according to the brokerage should help cushion margins despite weak topline growth.

What to WatchAnalysts will be closely tracking for announcements on capex and demand estimates in the upcoming quarters.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.